US producer prices climbed substantially higher in the first month of the year, further substantiating pressure on the Federal Reserve to promptly raise interest rates and end its asset buying program.

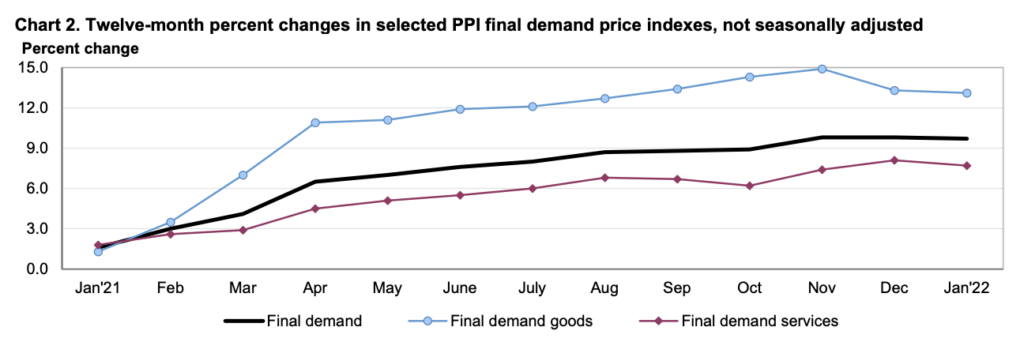

According to the latest data from the BLS, the producer price index — which gauges the prices US producers receive for their goods and services — was up 1% in January, double the forecasted figure and marking the 21st consecutive month of increases. Compared to the same period one year ago, the PPI was up by a whooping 9.7%, also surpassing an expected 9.1% rise and nearing the highest on records dating back to 2010.

Core PPI, which excludes volatile components such as food, energy, and trade services, also surpassed estimates last month, rising 0.9% between December and January and up 6.9% year-over-year. The latest gains come on the heels of red-hot inflation that is burning across nearly all sectors of the US economy, with consumer prices sitting at the highest in 40 years.

Again, US #inflation comes in higher than median forecasts:

— Mohamed A. El-Erian (@elerianm) February 15, 2022

January producer prices rose by 1.0% MoM, twice the median projection (core was 0.8% vs 0.5%).

The annual PPI increase was 9.7% (vs 9.1% expected).

Core inflation was 6.9%.

Bottom line: More CPI inflation in the pipeline pic.twitter.com/Plmho4xpBf

In the meantime, an increasing number of investors are pencilling in a more abrupt reaction from the Fed to tame inflation, with some even suggesting an emergency meeting could convene in order to make emergency monetary policy adjustments. However, FOMC members still remain undecided on how to react to the alarming inflation figures, with some still advocating for a more balanced approach.

Information for this briefing was found via the BLS and Dow Jones. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.