It appears that allegations of fraud are not just subject to major world banks – cryptocurrency exchanges have also been joining the list of turning a blind eye to extensive money laundering. According to a recent Reuters report, US prosecutors have officially charged the founders of cryptocurrency exchange BitMEX of purposely disregarding US laws surrounding money laundering.

BitMEX founders Samuel Reed, Arthur Hayes, Gregory Dwyer, and Benjamin Delo have all been charged by the Department of Justice for conspiring to, and violating the federal Bank Secrecy Act. According to a Manhattan federal court indictment, the defendants have allegedly deliberately failed to implement the “Know Your Customer” (KYC) process aimed at curbing money laundering through their cryptocurrency derivative exchange. Given that BitMEX was set up to serve US customers, it was required to exercise due diligence with its customer base.

Instead of complying with the mandated requirements, BitMEX founders incorporated their company in the Seychelles due to its apparently lenient regulations and easiness to bribe authorities. Due to BITMEX’s intentional lack of anti-fraud regulations, the company soon became an attraction for sanctions violators and money laundering, especially by suspicious individuals from Iran.

In addition, the Commodity Futures Trading Commission has also filed a separate civil lawsuit against the company in order to terminate its commodity derivatives business in the US. So far, only Reed has been arrested, meanwhile the other defendants still remain at large.

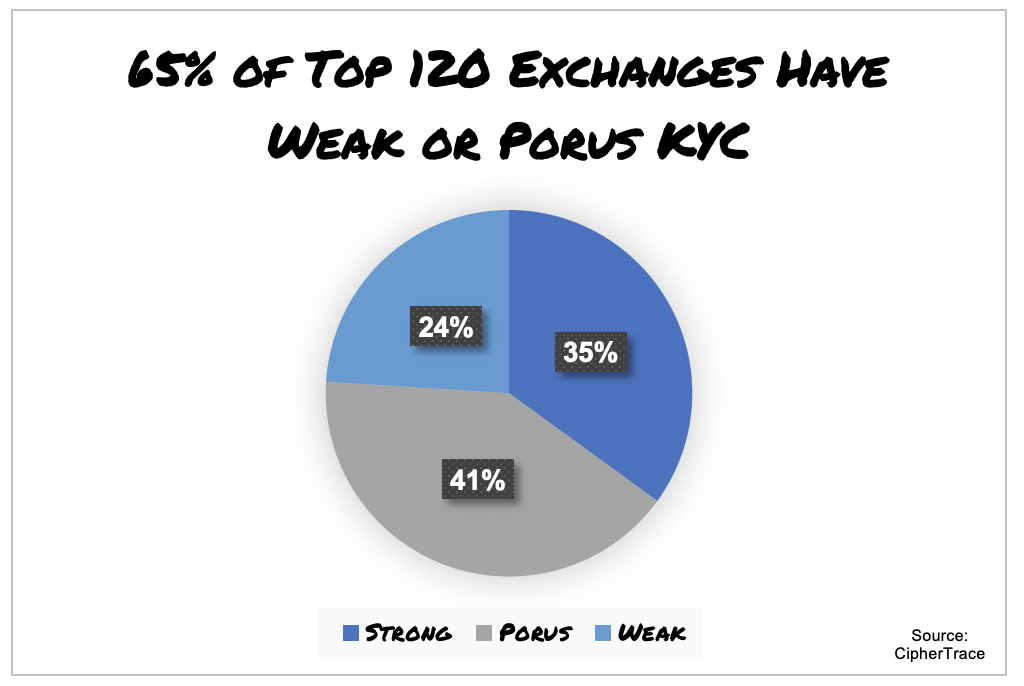

The Financial Action Task Force (FATF), the global terrorist financing and money laundering watching has recently acknowledged that virtual currencies are increasingly becoming the method of choice for financial crimes around the world. A large portion of FATF’s member countries have not imposed regulations or stringent KYCs on virtual currency providers regarding money laundering and financing of terrorism. In fact, only 35% of cryptocurrency exchanges have strenuous KYC processes in place aimed at curbing virtual currency crime.

Information for this briefing was found via Reuters, FATF, and CipherTrace. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.