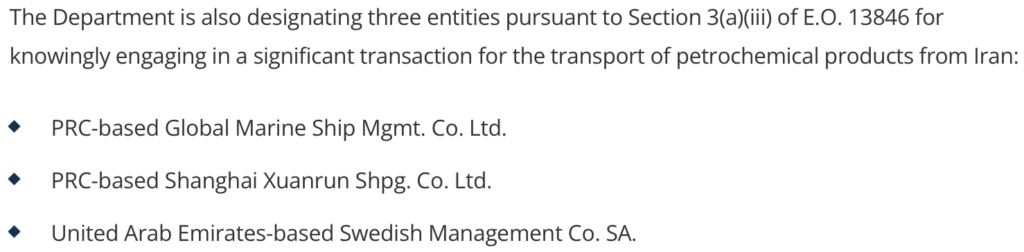

The US State Department named two China-based organizations – Global Marine Ship Management and Shanghai Xuanrun Shipping – as “Iran sanction evaders” and accused them of “knowingly engaging in a significant transaction for the transport of petroleum products from Iran”.

Today we designated six entities and identified 20 vessels as blocked property. This is the latest of numerous actions taken by the United States against sanctions evaders around the world. We will continue to enforce our sanctions against Iran.

— Secretary Antony Blinken (@SecBlinken) March 2, 2023

The sanctioned corporations’ assets in the United States are effectively frozen, and Americans are forbidden from engaging with them. Also included in the list is United Arab Emirates-based Swedish Management.

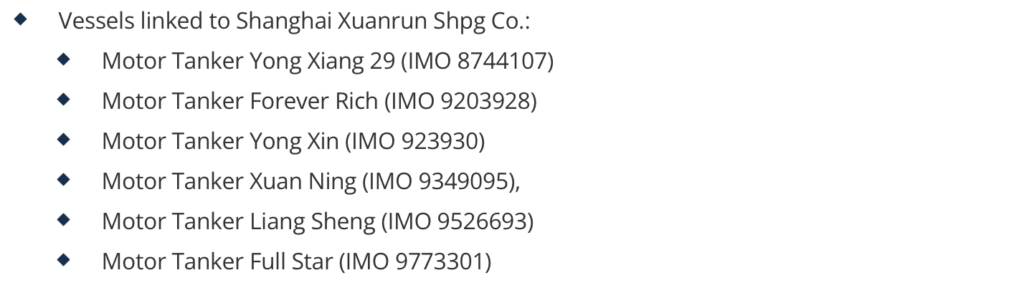

Six tankers associated to Shanghai Xuanrun were also designated as “blocked property” by the US.

For knowingly engaging in a “significant transaction for the transport of petroleum products from Iran,” the US is also designating Vietnam-based company Golden Lotus Oil Gas and Real Estate Joint Stock Company.

Further, two Iran-based entities were also added to the sanctioned list, namely Shiraz Petrochemical Company and Bushehr Petrochemical.

“These designations underscore our continued efforts to enforce our sanctions against Iran. We will not hesitate to take action against those who try to circumvent our sanctions,” the state department said in its statement.

The Treasury Department’s Office of Foreign Assets Control will issue licenses to facilitate the winding down of certain vessels until June 30, the statement added.

In November, the US imposed sanctions on 13 entities in mainland China, Hong Kong, and the UAE, alleging that they assisted in the sale of “hundreds of millions of dollars” of Iranian oil and petroleum products to East Asian consumers.

Here in Canada, the federal government made an official stand against Iran back in October when Prime Minister Justin Trudeau’s government said it plans to invest $76 million “to strengthen Canada’s capacity to implement sanctions and ensure we can move more quickly to freeze and seize sanctioned individuals’ assets.”

The sanctions on Iran, mainly driven by the Russia-Ukraine war, is heightened by the crackdown of the state government on demonstrators launching waves of protests following the death of Mahsa Amini while in police custody. Amini, 22, was arrested on September 13 for her “unsuitable attire”–showing her hair by not wearing a hijab–by the country’s morality police. She died three days later after falling into a coma.

China and the US have continued their Cold War through sanctions. Beijing announced in February that it had banned Lockheed Martin (NYSE: LMT) and a subsidiary of Raytheon Technologies (NYSE: RTX) due to their military sales to Taiwan.

However, the move was seen to be more of Beijing’s posturing and is expected to have a limited impact because US defense corporations are already generally prohibited from selling military equipment to China.

Information for this briefing was found via South China Morning Post and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.