Stagflation is officially here, and its signals are flashing red-hot. Service providers across the US expanded by the sharpest pace on record last month, and were not shy to pass along the subsequent cost increases onto customers.

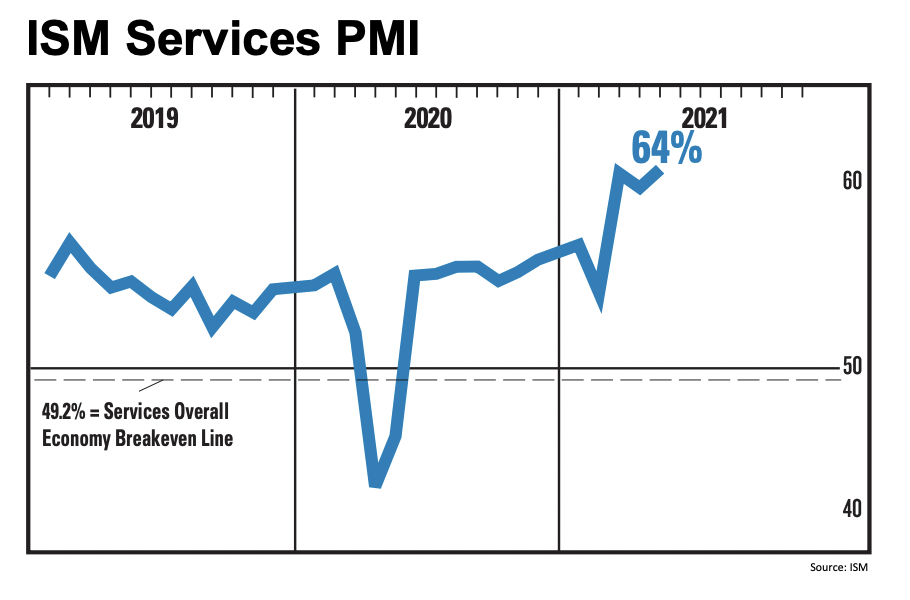

The latest ISM Services reading soared from 62.7 to 64 in May— the highest on records dating back to 1997. The figures suggest that demand for a variety of services— such as air travel, hotel stays, and meals— has been surging as governments lift Covid-19 restrictions and Americans’ desire to get out of the house picks up. Although pent-up consumer demand and ongoing business investment is expected to accelerate the recovery, a number of problems continue to persist.

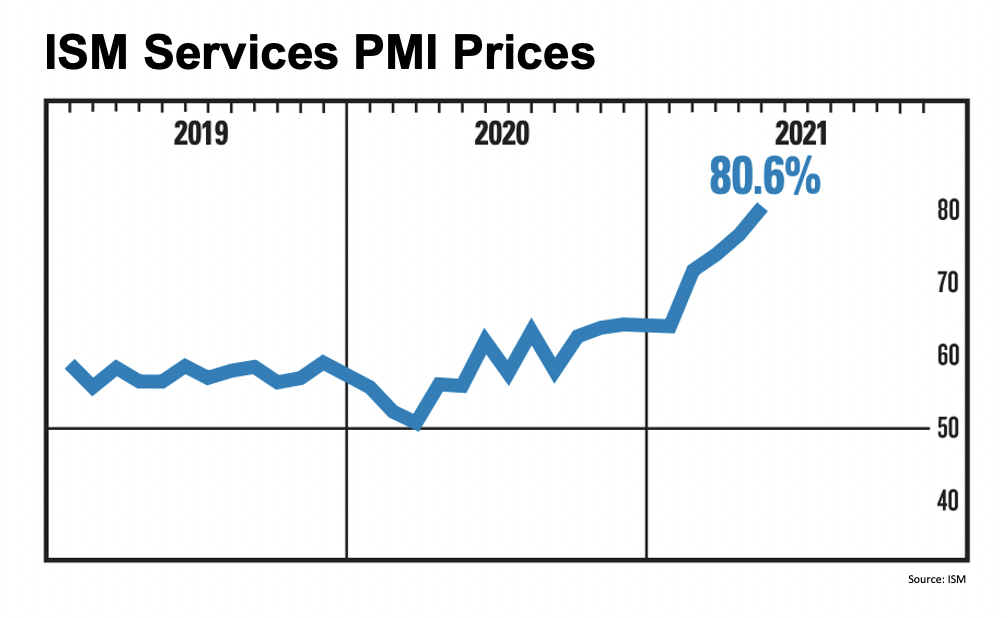

The ISM report also showed that price pressures are sharply increasing, labour shortages are becoming more widespread, and order backlogs are piling up. The limited availability of skilled workers, coupled with lack of input materials, add further strain on the pace of the US economic recovery. “The rate of expansion is very strong, as businesses have reopened and production capacity has increased,” said ISM Services Business Survey Committee chair Anthony Nieves. “However, some capacity constraints, material shortages, weather-related delays, and challenges in logistics and employment resources continue.”

The report noted that all 18 services industries experienced growth last month, particularly businesses in retail, wholesale, construction, and entertainment and recreation. The index of material costs jumped to the second-highest on record, prompting service providers to pass along any added costs onto consumers, with the pace of charge inflation rose by the most in the ISM survey’s history.

Information for this briefing was found via the ISM. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.