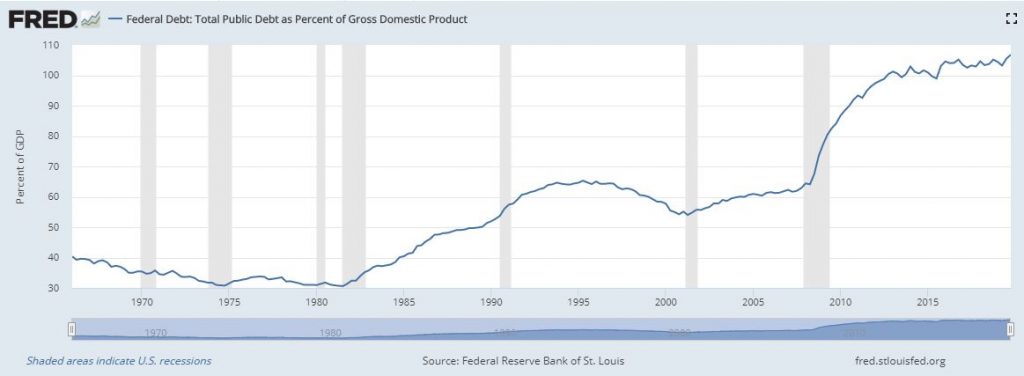

As the US economy is in the middle of fighting its invisible war against the coronavirus, the Federal Government’s spending continues to soar, surpassing historic stimulus borrowing with a record of $2.99 trillion by the second quarter.

In the second half of the fiscal year, the US Treasury Department is anticipating to issue an additional $3.7 trillion worth of marketable debt- thus bringing the full year’s total to $4.5 trillion. To put it into comparison, the government will have borrowed five times more amid the coronavirus pandemic than it had during the peak of the 2008 financial crisis.

Thus far, the US government has already spent $3.5 trillion to go towards mitigating the economic implications stemming from the coronavirus pandemic. The funds have since been allocated towards unemployment insurance, coronavirus testing, hospitals, direct stimulus checks to households, and emergency loans for small businesses. Although the government has been haphazardly going into debt, even before the pandemic, tax revenue may not be as readily available as it was before.

Prior to the coronavirus fiasco, the Treasury estimated that in the first quarter of 2020 it would borrow approximately $367 billion, and then repay $56 billion with tax revenue by the second quarter, however that is no longer the case. Incoming tax revenue is most likely going to decline significantly, given that unemployment numbers are upwards of 30 million, with widespread shutdowns of businesses and services.

According to the Congressional Budget Office, who’s primary responsibility is to provide economic and budget information to Congress, its predicted that the annual deficit will be 18% of the country’s GDP. If that turns out to be the case, the deficit will be highest share of GDP since the end of the Second World War.

Information for this briefing was found via The Wall Street Journal, Bloomberg, and the Congressional Budget Office. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.