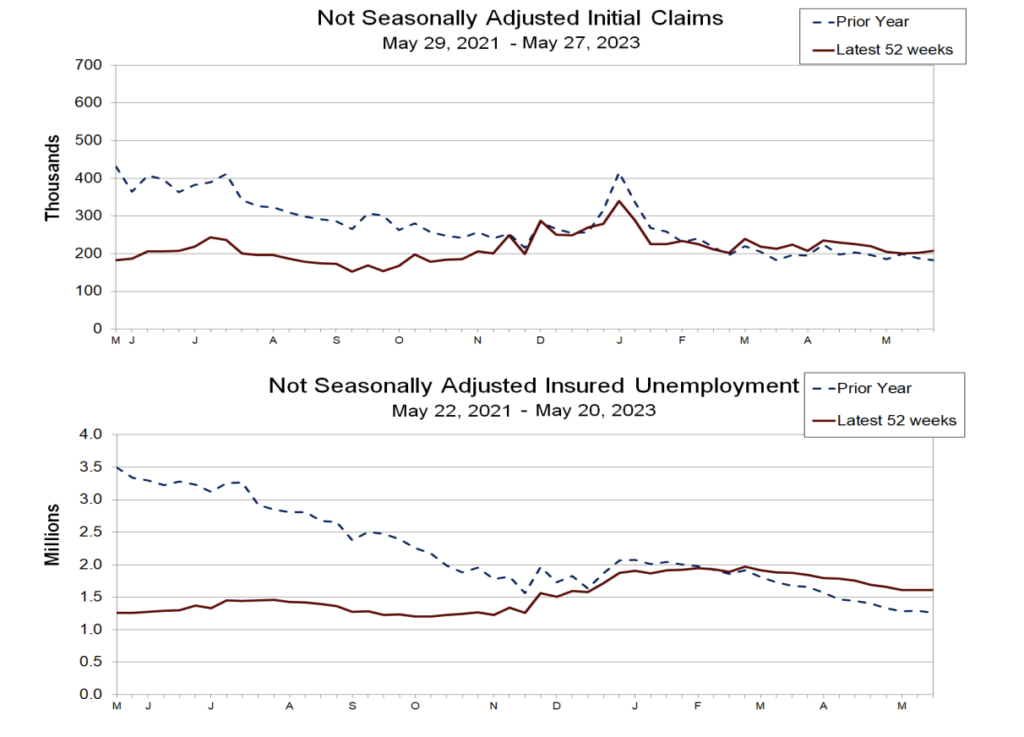

The number of jobless benefit applications jumped marginally by 2,000 to 232,000 for the week ending May 27. However, the four-week moving average, which is considered a better representative of labor market conditions, decreased to 229,500, marking a drop of 2,500 and demonstrating the continued strength of the labor market.

Despite a surge in job creation following the pandemic-induced loss of over 20 million jobs in 2020, there are indications of the labor market cooling. This is likely due to rising interest rates, concerns about a forthcoming recession, and the Federal Reserve’s monetary tightening efforts. Federal Reserve policy makers decided in May to increase interest rates for the 10th consecutive time to combat some of the highest inflation not seen in over 40 years.

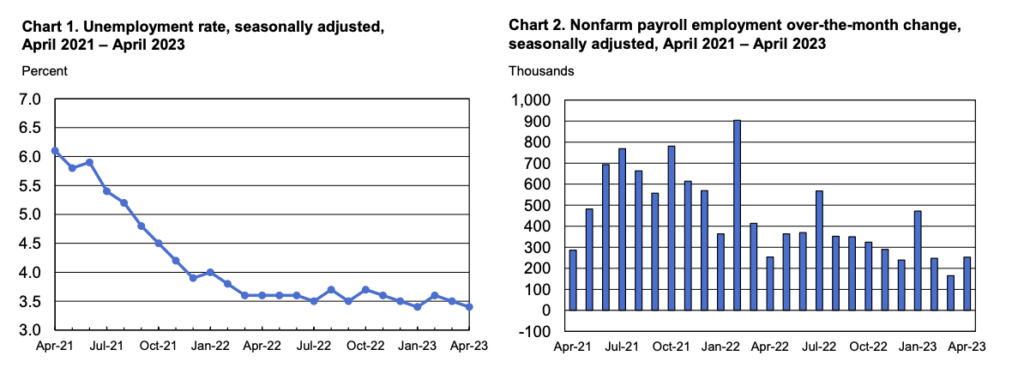

The unemployment rate decreased to 3.4% in April, equating to a 54-year low, with 253,000 jobs added. However, job figures for February and March were revised downwards by 149,000, suggesting the cooling effects of the Federal Reserve’s policy on the job market.

In an unexpected turn, April saw an increase in US job openings to 10.1 million, the highest since January. This data, combined with the upcoming jobs report for May and recent layoffs data, could influence the Fed’s decision on its next rate hike. Policy makers aim to achieve a “soft landing”, slowing economic growth just enough to control inflation without triggering a recession, a goal met with uncertainty by many economists.

Information for this briefing was found via the Department of Labour and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.