Not only is the Chinese province of Hubei now infamously known as where the deadly coronavirus originated from, but now it has yet a second unfavorable reputation to come to terms with: the epicentre of counterfeit gold bars.

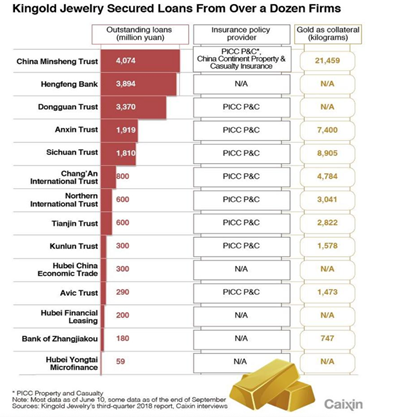

According to a recent expose by Caixin, over a dozen financial institutions in China, many of which are trust companies, lent approximately 20 billion yuan to Wuhan-based gold processor Kingold Jewelry Inc over a duration of 5 years. In exchange for the loans, which were to go towards business operations, enhancing cash holdings, and increase gold reserves, pure gold was designated as collateral in addition to insurance policies in the event that loses need to covered.

Back in February however, one of the lenders, Dongguan Trust Co. Ltd did not receive loan repayments from Kingold, and as a result decided to collect its collateral in exchange. Well, turns out, Dongguan was in for a jaw-dropping surprise: turns out, that out of 83 tons of gold bars designated as collateral, some turned out to be completely fake. What Dongguan thought were gold bars, to their astonishment, ended up being gilded copper alloy.

Luckily, insurance policies were able to cover approximately 30 billion yuan, but the remaining 16 billion yuan remains outstanding in wake of the counterfeit gold bars. In the meantime, authorities are investigating how such a scandal could have occurred, while Kingold’s chief Jia flatly denies the accusations stating that there is nothing wrong with the gold collateral.

Information for this briefing was found via Caixin. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.