The Valens Company (TSX: VLNS) experienced a pretty wild second half of January, and analysts have a lot to say about it. It began on January 19th, when Valens provided a financial update where they pre-announced fourth-quarter revenue at C$17 – $18.5 million and guided for first quarter 2021 revenues of C$19-$23 million.

They also announced that in the fourth quarter the company is expected to take a $9 – $10 million write-down as they liquidate most of their cannabis oil inventory. This includes a $2.9 million to $3.2 million loss from the sale of bulk cannabis oil, an inventory write-down of $4.7 million to $4.9 million, and a provision on previously entered biomass commitments of $1.4 million to $1.9 million.

At the same time, they also announced that they made a voluntary prepayment of $9.5 million to its creditors and renegotiated their covenants on that credit agreement, which is directly a result of the writedowns taken by the company.

This caused ATB Capital, Haywood, Canaccord, Raymond James, and Stifel-GMP to all downgrade their 12-month price targets on Valens.

Next, on January 25th, Valens announced an acquisition of LYF Food for C$24.9 million, which has a C$17.5 million milestone for meeting certain EBITDA thresholds. They also announced a bought deal of C$35 million on the same day.

Valens currently has eight analysts covering the company with a weighted 12-month price target of C$3.59. This is down from the average at the start of the year, which was C$4.34. One analyst has a strong buy rating. The majority, six analysts, have buy ratings and one analyst currently has a sell rating on the company.

First is Canaccord Genuity’s analyst Shann Mir’s note, in which he downgrades Valens’ 12-month price target to C$4.50 from C$6 and reiterates their speculative buy rating.

He headlines “Replacing bulk oil with edibles.” He believes that the acquisition of LYF will shore up production assets in edibles manufacturing, which he believes has been under-utilized by Valens. Mir writes, “the company has secured entry onto BC retailer shelves through white labeling agreements with LPs/brands that not only provide Valens with immediate exposure to the edibles market.”

Onto the financial update, Mir says that the charge shows a weaker demand for Valens toll services in 2021, “the company is now poised to see additional margin benefit as it works through oil balances with a ~50% reduced average cost.” He also expects top-line growth in the first quarter due to the K2 facility being operational.

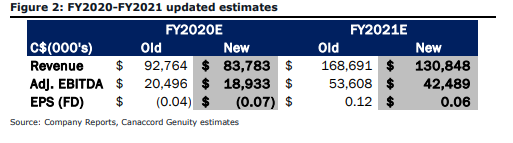

Mir adds that the main reason for the downgrade is primarily due to them factoring in 1) the new shares from the bought deal and 2) removing over 50% of Valens tolling revenue in 2021 with a more gradual ramp back. Below you can see Canaccord’s new full-year 2020 and 2021 estimates.

Onto Raymond James assessment of the news. The firm downgraded Valens to a sell from a hold rating while reducing their price target from C$3.50 to C$2.00. Rahul Sarugaser, Raymond James’ analyst writes, “we are resetting our opinion on VLNS, cutting our target price to $2.00, and downgrading our rating to Underperform.”

Sarugaser believes that management’s reasoning for the liquidation of all their oil is not correct. Management said that they liquidated the oil so it “can now rebuild its inventory with targeted strains of dried cannabis sourced at opportunistic, lower price points that are anticipated to grow product gross margins in 2021.” Sarugaser argues that everyone will have access to 2020’s outdoor-grown cannabis harvest, which is expected to have a cost basis of an estimated C$0.25 per gram. He writes, “we do not see this tactic giving VLNS any specific competitive advantage.”

When talking about Valens fourth-quarter revenue, he says that their channel checks show that Valens adult-use market share is sub 1% and writes, “we do not see how VLNS has any material competitive advantage in the market to grow its market share.”

Onto Stifel-GMP’s analysis of the last month. Analyst Andrew Partheniou downgraded Valens’ 12-month price target to C$3.35 from C$3.75 but left their buy rating unchanged. Partheniou says that the financial update is obviously negative as he writes, “we recognise this initiative came about as a result of a misstep by management in product and demand planning.” However he is happy that they decided to make this switch to purchasing via the spot market, as it provides the company flexibility to create inventory based on demand and lowers their input costs. It also gets rid of any supply risk.

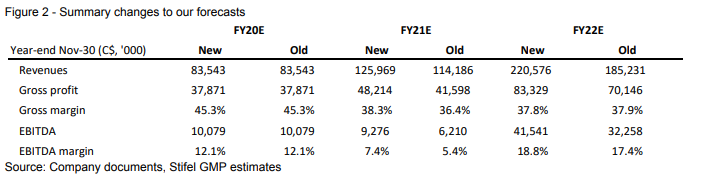

Onto the pre-announced fourth-quarter revenue and guided first-quarter revenue, Partheniou basically reiterates what the other analysts had to say, that both numbers are lower than even their lowest forecast. They have made changes to their full-year 2020, 2021, and 2022 estimates based on lower bulk sales/tolling revenues and are guiding for a slow ramp-up in revenues.

Parteniou sounds very optimistic about the LYF acquisition and bought deal. He says that the LYF acquisition helps accelerate Valens Canadian adult-use strategy, as he writes, “the increased portfolio of 100+ recipes could be a catalyst to expand the edible market share from the ~6% share currently to the ~20% share seen in mature US states, offering a robust opportunity for sales generation, in our view.”

He also believes that the bought deal adds U.S optionality, as he writes, “management has been pointing to an eventual US market penetration, which we believe could likely be strategically focused on CBD as those assets could be converted relatively quickly for THC opportunities under a regulatory reform scenario.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.