Last week, The Valens Company (TSX: VLNS) reported their fiscal third quarter financial results. The company reported net revenue of $20.99 million, up from the $18.76 million reported last quarter. Gross margins were 26.8% for the quarter compared to 22% last quarter, while adjusted EBITDA came in lower than last quarter at negative $6.18 million. The company reported a net loss of $12.8 million. Valens saw its SKU count go from 75 at the end of the first fiscal quarter to now 181 at the end of this quarter.

A number of analysts cut their 12-month price target on The Valens Company, bringing the 12-month price target to C$3.92 from C$4.22, which is a 90% upside. Out of the 9 analysts covering the stock, 1 has a strong buy rating, 7 have buys and 1 analyst has a hold rating. The street high sits at C$5.253 from Stifel-GMP, while the lowest comes in at C$2.50.

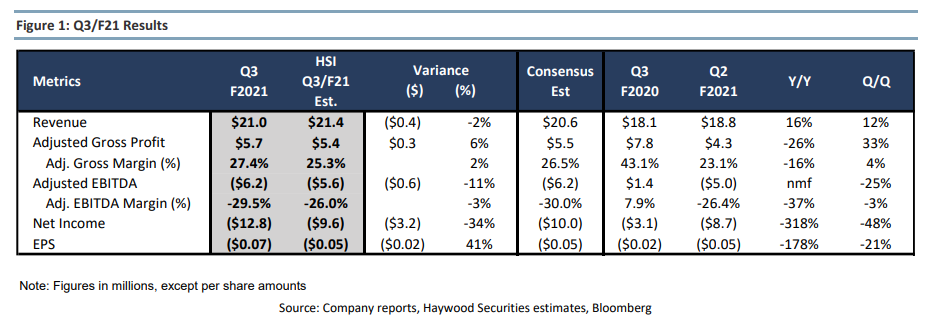

In Haywood Capital Markets note, they cut their 12-month price target to C$4.00 from C$4.50 and reiterated their buy rating on the name saying that Valens’s valuation remains compelling. They say that this quarter came basically in line with their estimates, their revenue estimate was $21.4 million. They say that this quarter benefited by a $4.7 million contribution from Green Roads while provincial sales increased 20%, but B2B sales were down almost 30% for this quarter.

Haywood notes that Valens formulated and manufactured 67 SKUs, up 10 from last quarter “as the company continues to optimize its product portfolio.” These new SKUs are not entirely new formulations but rather a mix of different formats such as pre-rolls.

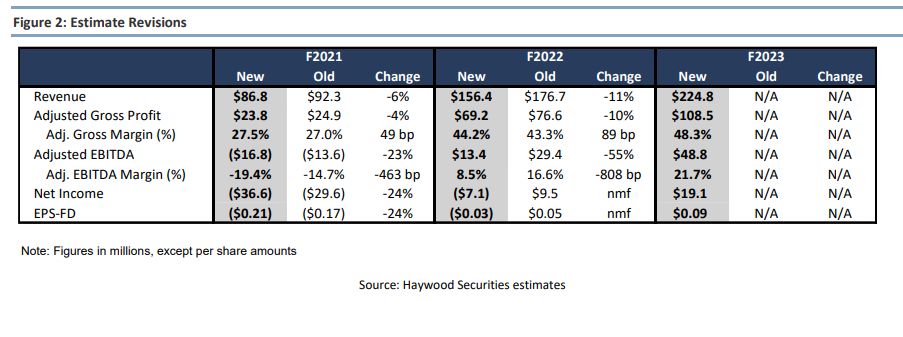

Below you can see Haywood’s updated 2021 and 2022 estimates as well as new 2023 estimates. They say they have lowered the companies future revenue growth “to reflect the competitive landscape in the Canadian recreational markets,” and they are expecting the company to take longer to ramp up new listings.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.