Village Farms (TSX: VFF) (NASDAQ: VFF) will be reporting their fourth quarter and year-end financials pre-market on March 16th.

Village Farms has a consensus C$26.06 12-month price target on the company, via a total of six analysts, with one analyst having a strong buy rating and the other five have buy ratings. The street high comes from Beacon Securities with a C$35 price target, and the lowest target comes from Stifel-GMP with a C$17.50 price target.

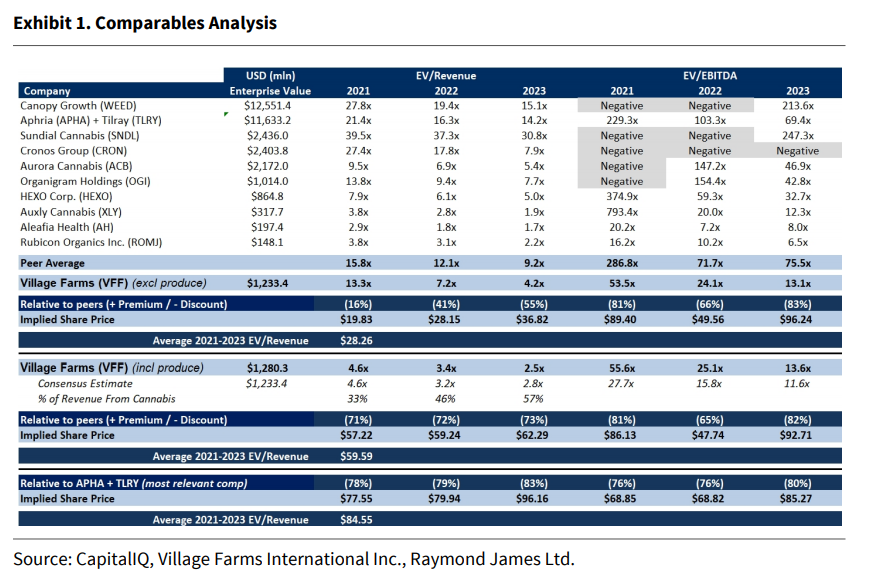

Early this morning, Raymond James came out with their fourth quarter and year-end estimates for the company. They also reiterated their C$26 12-month price target and strong buy rating. Raymond James analyst Rabul Sarugaser says that Village is currently trading 70-80% below its Canadian peers and expects that gap to close after the company reports its first-quarter 2021 earnings. He writes, “Come 1Q21, with fully consolidated revenues, we expect this asymmetry to correct, resulting in significant appreciation in VFF’s stock price.”

Below you can see the comparable analysis.

Sarugaser forecasts that Village will beat the consensus estimates by 6% for a total of U$55.4 million in revenues for the fourth quarter. They are saying that their channel checks report that Pure SunFarms did U$20.9 million in the fourth quarter.

Village will not fully consolidate their Pure SunFarms revenue this quarter. They will only consolidate roughly 83% of the U$20.9 million estimate this quarter. Below you can see Raymond James’ Pure SunFarms revenue estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.