In a move which appears unlikely to benefit the shareholders of either company, Golden Predator Mining Corp. (TSXV: GPY) and Viva Gold Corp. (TSXV: VAU) agreed to a friendly merger via a stock-for-stock exchange on March 3. Golden Predator will be the surviving company, and Viva shareholders will receive 1.6 shares of Golden Predator for each Viva Gold share they own.

Based on both companies’ March 2 close, that exchange ratio implied a Viva Gold takeover price of $0.32 per share. Viva Gold traded in the mid-40 cent range as recently as August 2020.

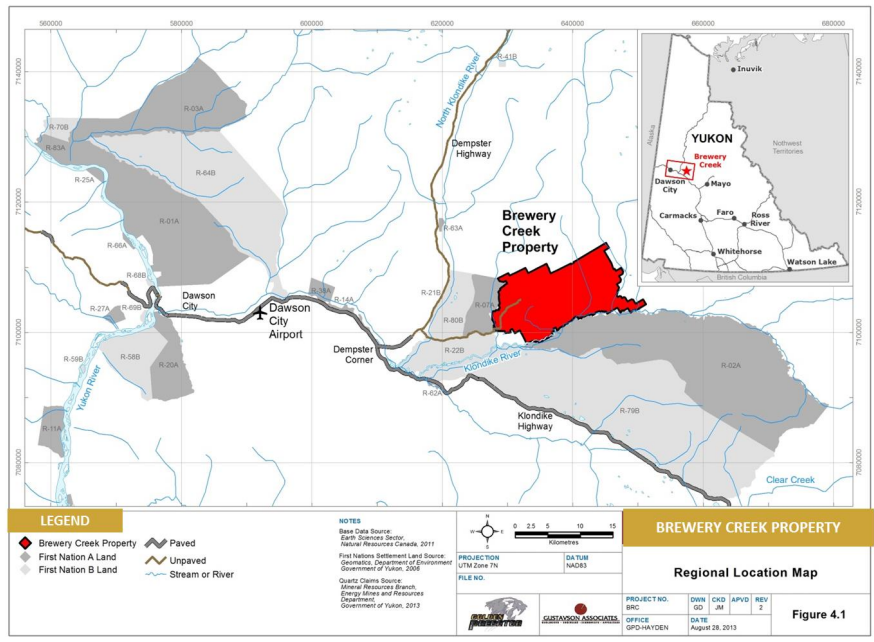

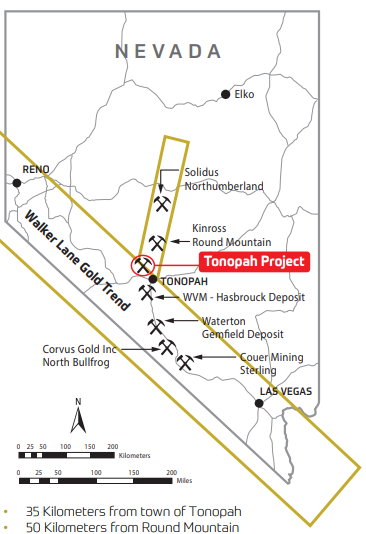

The synergies of the merger seem likely to be modest. Golden Predator is developing the past-producing Brewery Creek Gold Mine in the Yukon towards a possible resumption of production. Brewery Creek last operated in 2002. Two thousand miles away, Viva Gold is developing the Tonapah Gold Project in Nevada. Combining these projects is unlikely to result in any appreciable cost savings, and neither project should generate cash flow for some time.

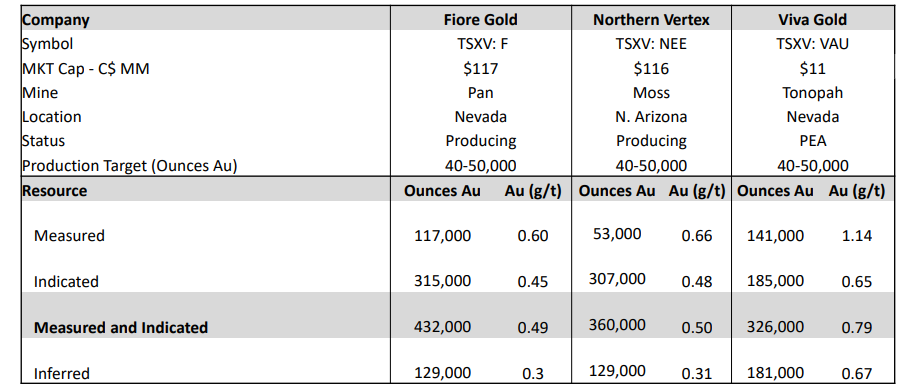

From Viva Gold’s perspective, it is difficult to grasp the merger rationale under these terms. In its February 2021 investor presentation, it detailed that its valuation was dramatically lower than other similarly positioned junior miners. Agreeing to be acquired for a small premium at this juncture means that if this value discrepancy does exist, it will be captured in the future mostly by Golden shareholders, as they will own 73% of the combined company.

One aspect of the deal is decidedly in Golden Predator’s favor and does not benefit existing Viva shareholders even though Viva was the merger target. Golden owns 8.62 million shares of C2C Gold Corp. (CSE: CTOC), a junior miner focused on projects in Newfoundland. That stake is worth about $1.55 million. Under the merger agreement, Golden will distribute these shares only to existing Golden shareholders as a return of capital just prior to the close of the Golden Predator – Viva Gold merger.

Golden Predator’s Financial Position

As of September 30, 2020, Golden Predator had nearly $9 million of cash and marketable securities (see comment above on its stake in C2C Gold) and virtually no debt. At July 31, 2020, Viva Gold had about $2 million of cash and negligible debt.

Golden Predator’s operating cash flow shortfall has averaged about $2.4 million per quarter over the last five reported quarters. Viva Gold’s operating cash flow deficit has been smaller, averaging about $400,000 per quarter over the last three reported quarters.

| (in thousands of US dollars, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($2,090) | ($1,443) | ($1,930) | ($3,951) | ($3,879) |

| Operating Cash Flow | ($1,576) | ($2,237) | ($1,071) | ($3,835) | ($3,368) |

| Cash and Marketable Securities | $8,921 | $8,155 | $885 | $1,322 | $5,243 |

| Debt – Period End | $95 | $113 | $131 | $181 | $248 |

| Shares Outstanding (Millions) | 172.3 | 168.1 | 156.9 | 156.9 | 156.9 |

The merging of two development-stage companies whose projects are thousands of miles apart in two different countries does not appear to create value. Any resultant cost savings seem likely to be small. From Viva Gold’s perspective, the company agreed to be acquired at a price far below its trading price of about six months ago. The benefit largely appears to be for Golden Predator’s shareholders, whom will now have a project that can have activities occur year round, that are not limited by winter conditions.

Golden Predator Mining Corp. and Viva Gold Corp. shares are trading at $0.19 and $0.26, respectively, on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.