Wallbridge Mining (TSX: WM) has released an updated preliminary economic assessment for its Fenelon Gold project in Quebec. The study has outlined an after-tax net present value of $706 million and IRR of 21% for the project, based on $2,200 an ounce gold and a 5% discount rate.

At $3,000 an ounce gold, that valuation figure is said to jump to $1.38 million, while the IRR moves to 34%.

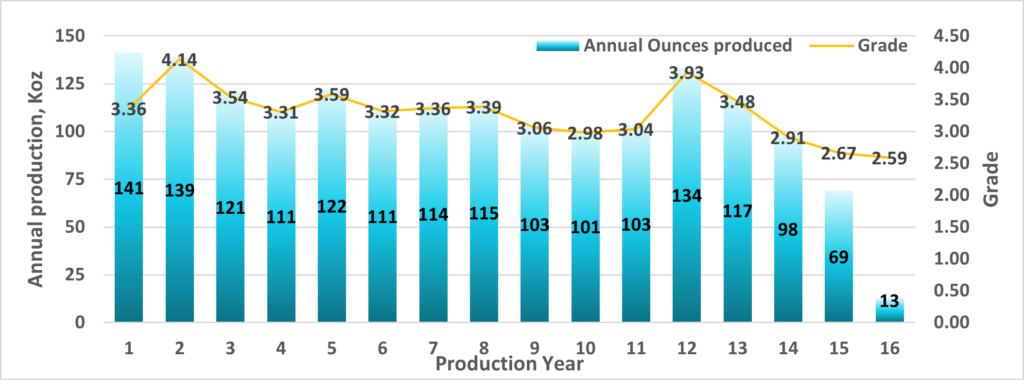

The study is based on a 16 year life of mine that would see average annual production of 107,000 ounces of gold, which bumps up to 127,000 ounces over the first five years. Total life of mine recovery is estimated at 1.7 million ounces of gold, with the mine to incorporate both open pit and underground mining methods.

The current mineral resource estimate comparatively estimated that the Fenelon project contains 1.8 million gold ounces at 3.62 g/t in the indicated category, and 1.6 million ounces in the inferred category at 3.41 g/t, across both open pit and underground models.

Initial capital costs are estimated at $579 million, while sustaining capital is pegged at $449 million. On a per ounce basis, cash costs are estimated at just $851 an ounce, while all in sustaining costs are expected to come in at $1,046 an ounce.

Average annual free cash flow from the operation is estimated at $120 million, while the project payback period is pegged at 4.0 years.

Comparatively, a preliminary economic assessment conducted in 2023 estimated an after tax net present value of $721 million based on a gold price of $1,750 an ounce. That estimate was based on a 12.3 year life of mine with average annual production of 212,000 ounces of gold.

Wallbridge Mining last traded at $0.0575 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.