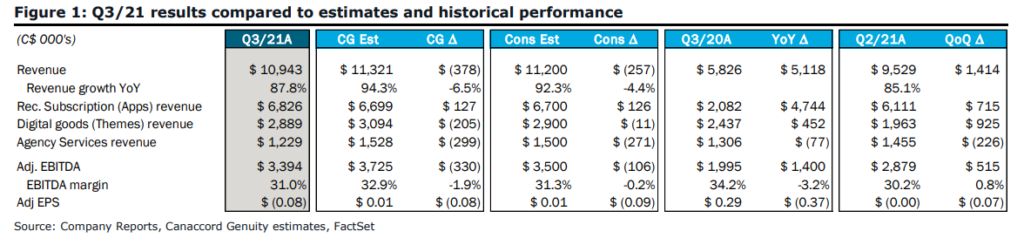

On November 22nd, WeCommerce (TSXV: WE) reported its third quarter financial results. The company reported total revenues of $10.94 million, up from $5.8 million last year. The company reported an operating loss of $0.34 million and a net loss of $2.98 million while adjusted EBITDA came in at $3.4 million, or a 31% margin.

WeCommerce currently only has 2 analysts covering the stock with an average 12-month price target of C$20, or a 54% upside to the current stock price. One analyst has a strong buy rating and the other has a buy rating. The street high sits at C$22 while the lowest comes in at C$18.

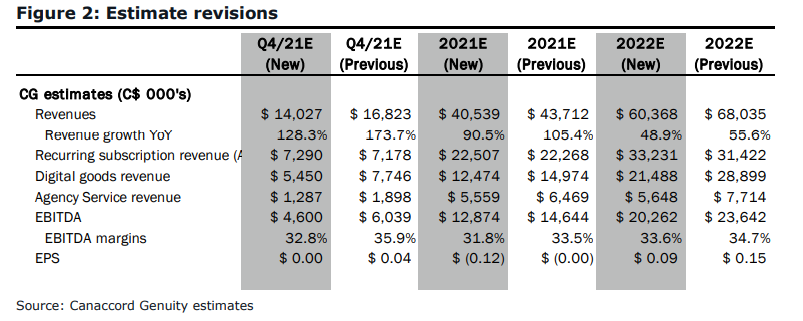

Canaccord Genuity lowered its 12-month price target to C$18 from C$20 but reiterated their buy rating as the company didn’t meet Canaccord’s expectations for the quarter.

For the quarterly results, Canaccord expected revenues to be $11.32 million, and adjusted EBITDA to be $3.72 million. The company missed on digital goods and agency revenue. Canaccord says that the agency revenue miss came from two canceled projects from a single client. While digital goods were missed due to Shopify’s new rules coming into force. Below you can see Canaccord’s estimates for this quarter.

Canaccord says that the company’s M&A pipeline still remains robust as management has noted that their conversations with companies have only grown and they have $100 million in revenue in the pipeline via M&A.

Part of the reason Canaccord has lowered its 12-month price target is that they have changed their Archetype revenue estimates. They have done so since Shopify customers have paused their purchases in the second quarter and only expect to rebound in the fourth quarter.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.