Yesterday morning, Canaccord Genuity initiated coverage on WeedMD Inc (TSXV: WMD) with a C$0.60 12-month price target and a speculative buy rating. Shaan Mir, Canaccord’s analyst headlines, “Don’t forget about the medicine.” He calls WeedMD a, “unique medical cannabis strategy that has secured preferred access to ~350,000 patients while sharing in the upside potential of the Canadian adult-use market.”

Mir says that he believes WeedMD is a potential takeout candidate, “for a potential buyer that has lagging or limited medical cannabis exposure today,” and says that their interim CEO, George Scorsis has been through many cannabis M&A, such as Mettrum Health to Canopy Growth and Liberty Health to AYR Wellness.

Mir believes that recreational sales will see explosive growth this year which will drive momentum through its adult-use offerings. For product, WeedMD has a top spot on the OCS for its Saturday vape pen within its first month of launching the product, while having an array of other SKU’s expected to release within the next 12-18 months. They expect WeedMD to grow its market share from its sub 1% position to a 3% position in the next few years. Mir writes, “we expect the company to begin accelerating its onboarding of LiUNA local union groups while continuing to layer other payer groups into its one-of-a-kind platform that should serve as a sticky-tailwind to top-line growth.”

He also adds that the company trades at a discount to other licensed producers, as WeedMD trades at 1.5x their 2020 EV/revenue estimate while other tier 3 names trade at a 4.7x multiple. On top of that, WeedMD has something many other names don’t currently: a strategic partner and a direct billing model. Mir writes, “we would expect the company to trade at a less pronounced discount to the mid-tier average.”

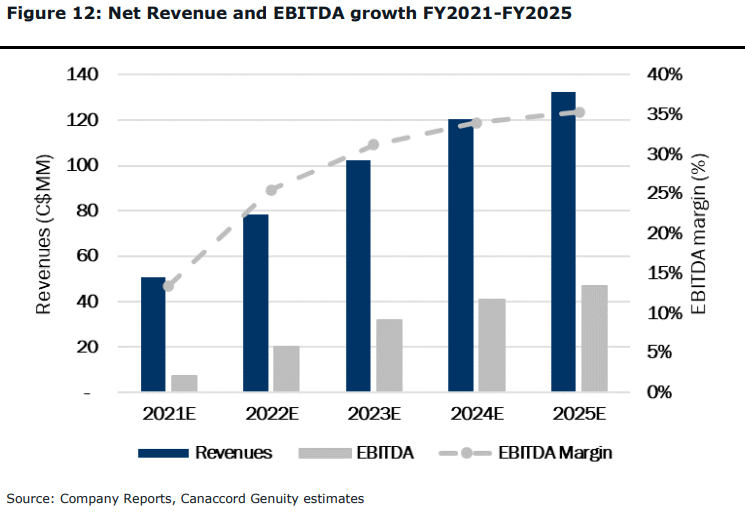

Below you can see Canaccord’s revenue and EBITDA estimates. Canaccord gives some financial highlights. They expect WeedMD to grow 27% compounded annually from $50.9 million to $132.4 million in 2025.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.