For continued long term success in the Canadian cannabis sector, companies need to develop an edge that sets themselves apart from the rest of the industry. WeedMD Inc (TSXV: WMD) has done just that.

Since it’s inception, WeedMD has been acutely aware of the need to establish itself within a niche of the industry. While other licensed producers have elected to focus on becoming the largest growing by square footage, or the grower with the lowest cost basis per gram, WeedMD has focused itself elsewhere. Instead, the firm has had its sights squarely set on the niche market of long term care and assisted living facilities.

It is believed that WeedMD is the only licensed producer focused on this niche market.

So what’s the draw to this niche market? We’re glad you asked. Join as as we Deep Dive into this weeks company in focus: WeedMD Inc.

WeedMD: The Niche Market Player

WeedMD’s Current Operations

Aylmer, Ontario Facility

WeedMD’s current primary facility is located in Aylmer, Ontario. The facility consists of 25,620 square feet, of which approximately 14,000 sq ft is utilized as canopy space. Formerly an Imperial Tobacco facility, the building was retrofitted several years ago for the production of cannabis. In its current format, the facility is capable of producing approximately 1,500 KG of dried cannabis flower per year. However, this production figure has varied from 1,200 to that of 1,500 throughout several separate news releases and investor documents.

The facility itself is located on 4 acres of land, which has been leased by the company for a period of five years commencing on May 1, 2014. For a monthly fee of $16,013, WeedMD receives access to the facility and the small amount of land surrounding it. A purchase option does exist for the property, enabling WeedMD to acquire it for $1,500,000 at any point during the term of the lease. Additionally, there is a further four acres available for lease to the company. Leasing this additional space would allow for the expansion of the current facility to that of up to 220,000 sq ft in size.

The company on at least one occasion has also noted that it owns 100 acres of nearby land. However, details on this property have proven to be scarce. It is not clear how close this land is to the current facility, or whether it is still owned by the company.

In total, WeedMD’s Aylmer facility is licensed to produce and sell dried cannabis flower, oils and extracts, and clones. Further to this, on March 1, 2018 the facility applied for a licensed dealer designation, which would enable the company to be able to export product in addition to perform certain research functions.

Lastly, on March 13, 2018, it was announced that WeedMD had exercised the option to purchase this facility in whole. The company has yet to decide if it wishes to purchase the adjacent four acres of land as well.

Strathroy, Ontario Facility

In November 2017, a major operational update was issued by WeedMD – they had secured a lease on a new greenhouse facility in Strathroy, Ontario. Just 60 km from it’s current facility, the Strathroy property is owned by Perfect Pick Farms. In total the property sits on 98 acres of land, with the current greenhouse facility comprising of 614,000 square feet.

However, the initial lease from Perfect Pick is not for the whole facility. Instead, WeedMD has elected to lease portions of the building in stages. The first of which is for 217,800 sq ft, or five acres which is leased for $60,000 per month. This space has since been converted to twenty two separate grow rooms. With each grow room being approximately 9,900 sq ft in size, it enables WeedMD to have a harvest occurring every 10-12 days. From an operations standpoint, this is an excellent process in regards to consistent revenue generation. It also limits the potential for supply gluts. It is expected that the first planting will commence within one months time, with the first harvest taking place in July 2018.

The facility itself is less than two years old. It has several benefits that will be realized by WeedMD, such as the “unlimited” supply of natural clean water on site. The site also features a modern fertigation system, which allows for the constant monitoring of key data points, such as nutrient levels and water conditions. Due to the greenhouse being remarkably new, the retrofit costs come in at a low $70 per square foot, one of the cheapest in the industry.

Upon completion of the retrofit, WeedMD estimates that they will be able to produce roughly 20,000 KG of dried cannabis per annum at the facility. It is expected that phase two of the expansion will commence shortly thereafter, consisting of the conversion of 175,000 square feet of space for an additional 12,000 KG of production capacity. Upon the conversion of the entire facility WeedMD’s estimated annual output is stated to be 50,000 KG.

WeedMD has the option to acquire the Strathroy Facility via a cash payment of $22.6 million. This is in addition to the three million shares and warrants the company previously issued to acquire the option.

Cannabis Beverages Inc

A recently announced joint venture partnership between WeedMD and Phivida, Cannabis Beverages Inc (CanBev) is the response to what two firms see as an emerging market trend in the cannabis sector. The venture aims to be one of the first cannabis-infused beverage production centers in the country.

To commence operations, WeedMD will allocate a portion of its Strathroy, Ontario for the purpose of the joint venture. This includes designating roughly 25,000 square feet of the facility for the purpose of production and cold storage. WeedMD’s role in the venture also includes being the exclusive supplier to the company for cannabis products.

Phivida’s role in the venture includes product innovation, research and development, as well as the provision of proprietary intellectual property. This IP will enable the bioavailability of the CBD infused beverages to be at a higher level than would otherwise be possible. Lastly, Phivida is responsible for all branding aspects of the firm.

WeedMD’s Niche Market

Often times in emerging sectors, the value of positioning a company within a specific niche is widely overlooked. Rather than posturing, firms are often more focused on being the first to market, or being the largest in the field. Think of the ‘big three’ in the cannabis world – Aphria, Canopy Growth, and Aurora Cannabis. Right now these three firms are arguably more focused on expanding square footage and patient acquisition numbers than anything else. Recent M&A activity performed by these companies support this claim as well. However, sheer size in an industry is not always where the best return lies.

In the case of WeedMD, they’ve elected to take a different approach from the start. Rather than focus on production numbers or the square footage of their facilities, they’ve chosen to focus elsewhere. That elsewhere consists of seniors, long term care centers, and assisted living facilities. Sounds rather unromantic, doesn’t it?

There is in fact excellent logic behind the focus on this niche market. For starters, several members of the current management team have vast experience and connections in this specialized market. A handful are also well versed in the China market, but that’s a different focus entirely. These connections exist in both private and public facilities, which greatly assists in getting WeedMD’s foot in the door when it comes to obtaining exclusive contracts. The market itself is also growing – by 2036, the number of seniors is expected to hit 25% of the total population of Canada.

There’s also the financial aspect to consider. It is estimated that seniors provide three times the lifetime return than that of the average consumer. This is due to regimented medicinal intake, which results in a high usage level and routine product ordering. Naturally, this allows for a steady income stream. Furthermore, there is also the aspect of extremely efficient patient acquisition. Via the exclusive partnership of these facilities with WeedMD, these patients are essentially lining up to utilize the companies product.

The strategy thus far has worked in favour of WeedMD as well. As of their latest report, they are currently the exclusive supplier of dried cannabis and cannabis oils to four separate chains of long term care homes and assisted living facilities. In total, this amounts to twenty nine separate facilities comprising of roughly 3,000 beds. WeedMD continues to execute on this niche market strategy.

In addition to focusing on this business to consumer niche, WeedMD is also focused on the emerging recreational market. Additionally, they have business to business agreements in place to supply Aurora Cannabis with dried cannabis flower.

WeedMD’s Financials

Price Per Gram & Inventory

When it comes to analyzing the revenues of a cannabis company, it is becoming increasingly difficult to peg appropriate figures to analysis. This is the result of the “gain on biological assets” line, which allows the company to add a positive adjustment to the revenue figure presented. This can occur without the sale of product actually occurring, and thus skewing the figures given.

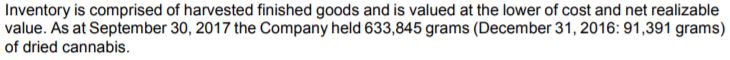

In an effort to combat this, we are increasingly looking elsewhere to identify the strength of a company. One item that we focus on, is current inventories. Across the market, it is claimed that there is a shortage of product available to the market. However, stated inventories come financial reporting time often discredit these claims. Instead, we are noticing an increasing level of inventories being on hand for companies in the sector. Take for instance, the figures reported by WeedMD in their last filing, as of September 30, 2017.

In this latest financial report, it was indicated that 634 KG of dried cannabis flower was sitting on company shelves. The severity of this is realized when one considers that the annual production figure for the current plant is estimate to be 1,500 KG annually. This means that 42% of the years anticipated harvest is still waiting to be sold, at the end of the third quarter.

Also seen right above in the interim financials, is this significant note. First and foremost, an additional 258 KG is expected to be harvested soon – which could put the total inventory figure at 891.4 KG. This would equate to a total 59% of the years produce sitting unsold on the shelves. Also of concern in the above quote, is the estimated sale price. While StatsCan indicates the average price per gram is roughly $7, WeedMD is anticipating getting anywhere from $3 – $6 per gram, resulting in a range of $772,806 and $1,545,612 just for what is soon to be harvested. With such a high level of volatility, it makes revenue estimates vary wildly.

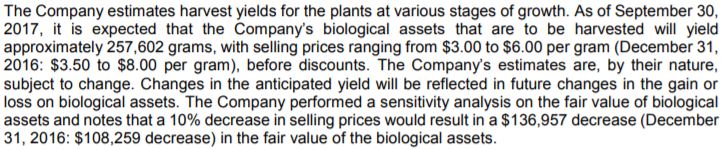

Share Structure

As always, the share structure of TSX Venture listed stocks is much harder to track than that of CSE listed stocks. As a result of this we leave a certain amount of margin of error room with respect to the totals – largely a result of not knowing when options are issued and warrants exercised. However, based on the latest investor presentation we got pretty darn close.

Once factoring in the convertible debentures conversion rate, we are only a few thousand off of what the company states. Not an easy feat considering the last financials are as of September 30, 2017. For our calculations however, we will use the figure issued by the company in their latest investor presentation. Our calculation is still excellent for knowing levels to watch for dilution.

As per the recently updated investor presentation, it is stated that the company currently has 96.6 million shares outstanding. With the closing price on March 16 of $1.97, this translates to a market cap of $190.30 million. Utilizing the fully diluted figure of 127.1 million shares, this gives the firm a fully diluted market cap of $250.39 million.

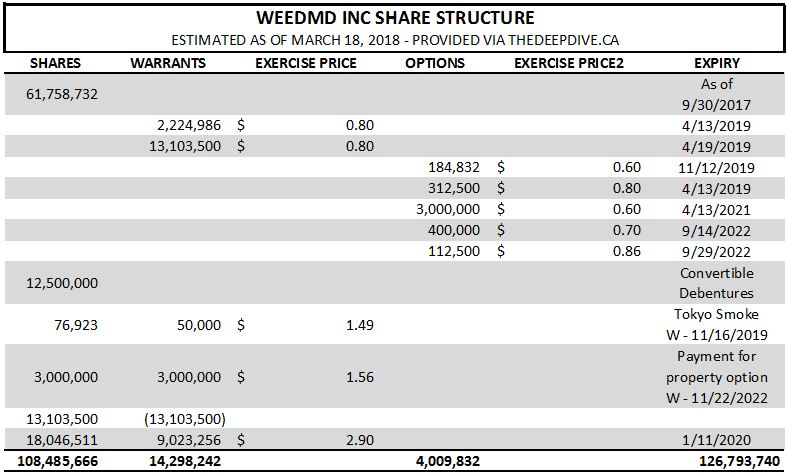

Insider Holdings

The insider holdings for that of WeedMD are not all that noteworthy. They’re at a level that appears to somewhat be the industry standard.

Overall, it is estimated that insiders are in control of roughly 10.3 million shares, which equates to 10.77% of the outstanding shares. On a fully diluted basis, this figure climbs to roughly 11.34% of the fully diluted share count. Again, nothing spectacular – just a middle of the road result.

Potential Valuation for WeedMD

All right, time for one of the most revered aspects of our full analysis – a potential valuation for the company. If you are new to our long form analysis, we typically do a short term as well as a long term estimate to give a baseline. This is solely due to the amount of items cannabis companies tend to have on the go.

With regards to WeedMD, we’ll look at it from a slightly different angle. For the vast majority of the valuations we guestimate, we use a price point of roughly $7 per gram. However, this is much too high for the figures WeedMD is reportedly receiving per gram. For our estimate, we will therefore use a baseline of $5 per gram.

On a short term basis, these are the factors that are in play. As of the last financials, the company had roughly $2 million in the bank. In the time frame since, two raises have been completed – one for $15 million, the other for $34.5 million. The first of these was utilized for the retrofit at the Strathroy facility, so we’ll rule out those funds. We’ll also rule out roughly $6 million for operational costs, and say it’s possible that the company has at least $30 million in the bank, especially once warrant exercising is factored in. In addition to that, they are currently capable of producing 1,500 KG per year. This adds to the valuation roughly $7.5 million in annual revenues. Utilizing a fairly standard multiple of five for revenues (Yes, it’s gross, not net. We get it.) would give us a rough total valuation of $80 million.

On a longer term basis, things get a little more complicated. For simplicity sake, we won’t factor in CanBev, as it’s not even off the ground yet. We’ll use the estimated 50,000 KG capacity, and a price per gram of $4 due to market saturation. This gives us annual revenues of roughly $200 million. Again utilizing the standard 5x multiple for revenues, and we land on a cool $1,000 million market valuation. This however assumes that everything goes to plan, and that market prices for cannabis stay relatively stable. By this point in time, a 5x multiple on revenues may be a bit lofty as well. However, we needed a baseline to utilize.

Closing Remarks

At the end of the day, WeedMD is another cannabis company in an increasingly saturated market. What has set it apart from its peers, is the fact that it has focused on a non-standard niche of the industry. For this, we commend them.

As much as we like the current market that the company is going after, there are still some concerns however. First and foremost, is why is there so many grams of cannabis currently going unsold? Is it a quality issue, a lack of distribution channel issue, or old fashioned market saturation? If obtaining patients is the issue, it reduces the favorability of the company over the long term. As more players enter the market, it will be significantly more difficult to obtain patients. If WeedMD struggles to acquire patients now, how is it going to perform in an overly saturated market?

Ask the tough questions. Be critical. Dive Deep.

Information for this analysis was found via Sedar, TMX Money, Sedi, and WeedMD Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.