Naturally Splendid Enterprises (TSXV: NSP) had an excellent trading session yesterday. It managed to gain some ground midday and continued to pick up momentum, ending the session up 31%. This is great news for long term investors of the stock, whom have watched similar companies take off in recent weeks.

The reasoning behind this run is likely related to that of the recent regulation announcements by the Government of Canada. Under this announcement, the growing requirements for that of hemp is to be greatly reduced. With the companies focus being that of hemp related health foods, it was only natural for this stock to post significant gains yesterday.

Stock gains aside, the company has one issue in this emerging sector. It’s revenues are declining at a rapid pace as a result of an increasingly crowded sector. With a crowded sector also comes the issue of margin slippage, which Naturally Splendid has certainly experienced. With the latest financials due out within the next week, will they continue to disappoint?

Naturally Splendid’s Most Recent Financials

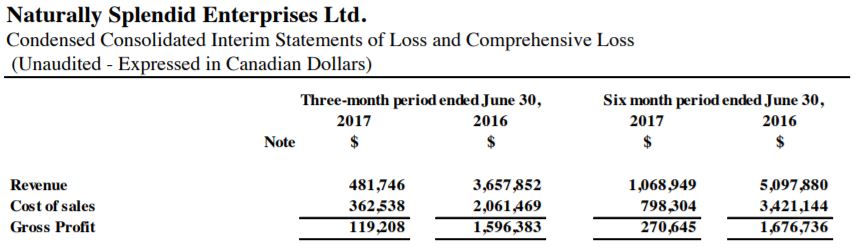

Gross Revenues & Margin

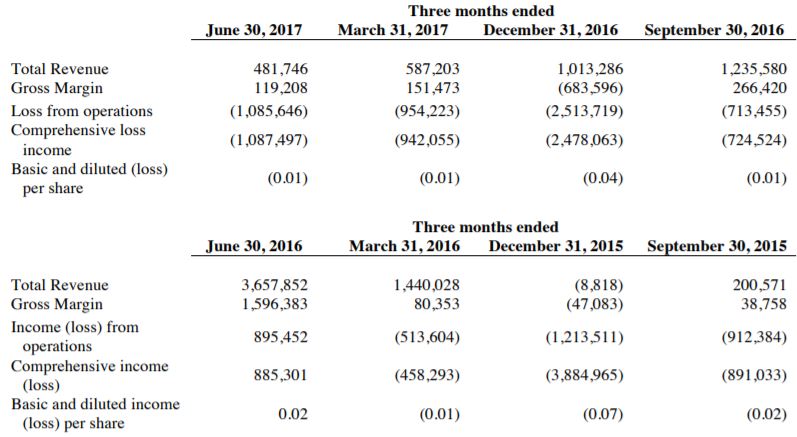

The most recent financials published by Naturally Splendid are for the quarter ended June 30, 2017. To summarize simply: it was a doozie. Naturally Splendid only made 13% in gross revenues in comparison to the figures posted for the same three month period last year. Thirteen percent. By any standard, that’s a failing grade. For the six month period, that number bumps up slightly to just under 21%. Still, a failing grade.

In addition to significantly reduced revenues, gross margin took a hard hit as well. In the most recent three month period, Naturally Splendid recorded margins of 24%. The six month period is slightly higher, at 25% margin overall. In comparison, the same periods earned 43% and 32% in the previous fiscal year respectively.

This decrease is due to the type of sale being made. In 2016, a significant portion of revenues came from that of bulk hemp seed sale to South Korea. With weakening demand, lower commodity prices, and higher competition, Naturally Splendid was slammed by numerous factors for its decrease in bulk sales. With the loss of bulk seed sales, came the loss of the high margins the company was accustomed to. Now, the bulk of its sales come from retail markets, where the margin is significantly reduced due to increased input costs.

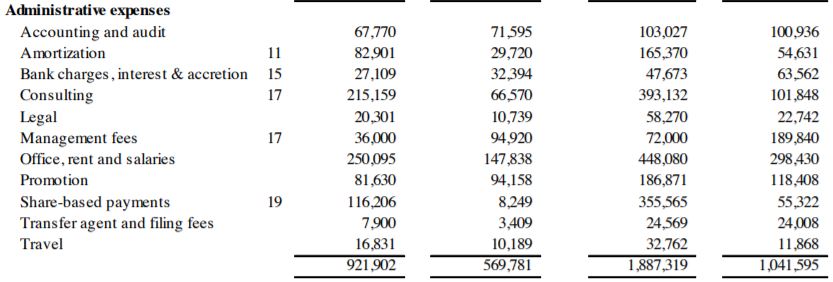

Expenses

While revenues and margins were down overall, the opposite is true for that of expenses. Of particular notice, is the cost of administrative expenses. The figures appear to be skyrocketing, especially when considered as a percentage of sales.

In particular, it is the change in consulting fees that most significantly impacts the companies expenses. These figures were almost four times higher than that of last years comparison period. Item 17 indicates that $154, 697 related to the three month period is due to key management for services rendered. For the six month period, this figure increases to $303,085. Given the significant decrease in revenues overall, it is questionable as to why these fees would increase so significantly.

Also of note, Office, Rent & Salaries has increased noticeably as well. However, this can be attributed to the fact that the company is currently focused on growth. As a result of this, the company may be slightly top heavy with regards to management and sales teams in order to further drive this growth.

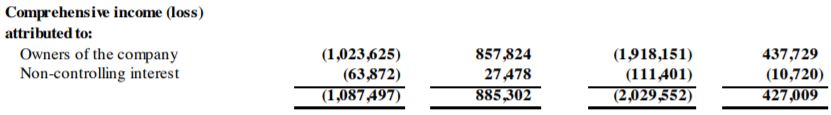

Operating Loss

Overall, Naturally Splendid recorded an operating loss for both the three and six month period reported as of June 30, 2017. This pales in comparison to the net gain filed for the same periods a year earlier. For the three month period, this loss totaled $1,087,497, compared to last years net gain of $885,302. For the six month period, the loss was almost double at $2,029,552 compared to last years net gain of $427.009. This is a significant reversal from the position Naturally Splendid was in last year, and is not a positive indicator for long term investors.

All items considered, it may just be that the quarter ending June 30, 2017 is itself an anomaly. Within the management discussion and analysis filed on August 28, 2017 in conjunction with these financials was a chart. As seen below, the chart indicates the profitability of the last eight quarters the company has had.

As can be seen, every other quarter in this eight quarter comparison has registered as a net loss. However, that fact is not very reassuring for shareholders. This may also give insight into the performance for the quarter ended September 30, 2017.

Irregardless, it looks as if the financials of Naturally Splendid have taken a turn for the worse over the last four quarters. Four quarters of declining revenue is not a good history for that of a growth company in a booming sector. Rather, it looks like an organization that is past its prime.

Closing Statements

With the financials for the quarter ended September 30, 2017 expected to be released in the next handful of days, investors appear to be bullish. This is evident based on the run up the company experienced over the previous days trading session. However, as previously stated, this may be solely due to regulatory changes as well.

There have been a few developments struck since the previous financials were released that need to be taken into consideration, including the acquisition of PROsnacks. However, this deal wasn’t transacted until the 19th of October, so the revenues from this subsidiary will not likely be included in the financials that are expected. What will be included however, is the first tranche of the private placement from the end of July. This will certainly bump up figures for the quarter, and may significantly reduce the likely loss that will be recorded.

It is assumed that markets will be reading these newest financials closely, as an indicator of how the company is performing. If the financials show little to no growth over the June 30 report, don’t be surprised by a sell off of the stock. Additionally, a further decrease in revenues would be disastrous for the company. Naturally Splendid may be currently in growth mode and focused on acquisitions, but it also needs to remain focused on increasing its financial standings. Otherwise, what was once an organization with excellent financials will quickly become the laggard of the industry.

Read the numbers. Compare the numbers. Dive Deep.

Information for this analysis was found via Sedar, and Naturally Splendid. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.