Last week WELL Health Technologies (TSX: WELL) announced their latest acquisition, a majority stake in Silicon Valley-based WISP for US$41 million. Consideration consists of $27.7 million in cash and $6.2 million in shares and a potential $7.4 million earnout based on revenue hurdles.

WISP was founded in 2018, is in 50 states, and has served 200,000 patients since its inception. The firm is a telehealth company specializing in women’s health as they offer, “discrete, timely access to treatments for ailments such as yeast infections, UTI’s, herpes, and other ailments related to sexual health.” WISP currently has a run-rate of $30 million with 100% year over year growth, gross margins of >65%, and has been adjusted EBITDA positive for “the last few quarters.”

WELL Health currently has 13 analysts covering the stock with an average 12-month price target of $11.81, or a 52% upside. 3 analysts have strong buy ratings, 9 have buy ratings and 1 analyst has a hold rating on WELL Health. Paradigm Capital has the street high of $14.25 while the lowest sits at $10.

Canaccord Genuity released a note after the news reiterating their $12 price target and speculative buy rating, saying, “We view the WISP transaction positively as a fast-growing business valued at ~2.1x revenue on upfront consideration that not only extends WELL’s primary care footprint in the US but also brings a discreet women’s health experience translatable to patients in WELL’s other care networks.”

Canaccord says that this deal brings WELL Health to a $440 million revenue run rate, which represents “quick execution” and gives a nod to management, who see potential synergies with WISP’s current expertise to serve female patients in Canada.

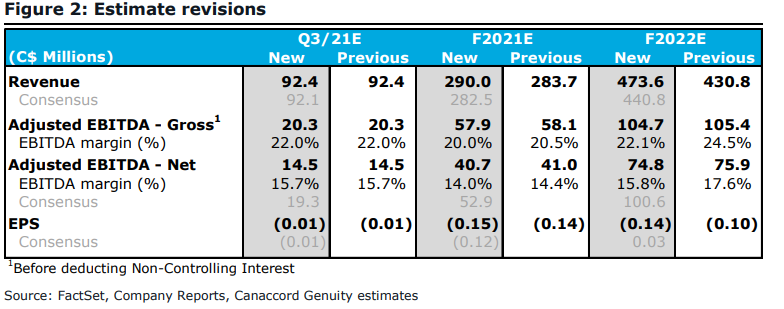

Below you can see Canaccord’s updated third quarter, 2021, and 2022 estimates, which factor in an October 31 close for WISP. They add, “we forecast near-term losses for WISP as we expect a high degree of reinvestment to support its organic growth strategy within the WELL portfolio.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.