Although coronavirus restrictions are slowly being lifted across the US, much of the corresponding financial destruction is far from over. According to CNBC, San Franciso-based Wells Fargo has decided to reduce a potential default headache by terminating its relationship with independent auto dealerships regarding auto loans.

Wells Fargo has a significant portion of its business tied to the auto industry, and provides both independent auto dealerships as well as new car dealerships with loan options for consumers. Amid the financial ruin brought on by the coronavirus pandemic, Wells Fargo has sent out hundreds of letters to its used-auto dealership partners, stating that they are no longer a customer of the bank, and as such will no longer accept loan applications.

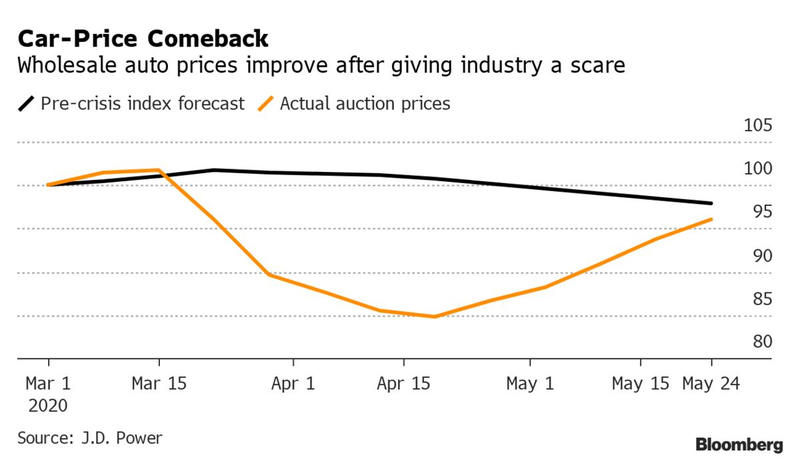

Wells Fargo will however, still maintain business relationships with its long-standing partners in the auto industry, as well as continue providing auto loans to those dealerships that solely sell new cars only. This move comes amid a slight rebound in the used vehicle market, which was previously grappled with historically low wholesale prices. With the infamous bankruptcy of Hertz Global however, the used car market is about to be flooded with an additional 500,000 used cars – causing prices to plunge once again. Thus, it makes sense why Wells Fargo wants to distance itself from the impending disaster sitting on the horizon.

Information for this briefing was found via CNBC, Bloomberg, and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.