Amid the legal battle the crypto firm is currently facing, a Securities and Exchange Commission disclosure revealed that Coinbase Global (NASDAQ: COIN) had an astronomical jump in security budget for its CEO Brian Armstrong.

Last year, the executive received $6.3 million in security perks, more than tripling the amount his security cost Coinbase the previous year.

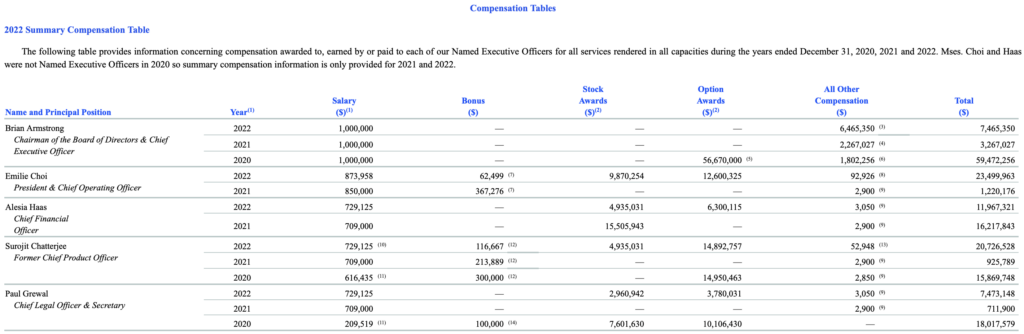

According to the document, Armstrong’s total remuneration for 2022 was $7.5 million, with a $1 million flat income and the remainder categorized as security and legal fees. The starting salary has been the same for the previous two years.

The CEO’s salary for 2022 increased by over 134% over the previous year. His colleagues, including COO Emilie Choi, CFO Alesia Haas, CPO Surojit Chatterjee, and CLO Paul Grewal, had a significant increase in their total salary for the year. In fact, the San Francisco-based exchange giant’s top five executives each made roughly $1 million in cash remuneration.

Armstrong also gained approximately $57 million in option awards in addition to profiting once Coinbase went public. He still owns 39 million shares in the corporation, which would be worth almost $2.4 billion if sold. The Coinbase CEO’s wealth is largely derived from his ownership and sale of company stock.

This comes just a week after Coinbase revealed its fifth straight quarter of losses. The company lost $79 million as its total revenue fell to $772.5 million, a 37% decrease from the $1.1 billion in revenue in Q1 2022.

The development also comes amid the ensuing legal battle between Coinbase and the SEC. The firm recently published its response to the Wells notice issued by the regulatory agency, encouraging the agency not to pursue enforcement action against the business for the sake of the SEC.

“Coinbase has never wanted to litigate with the Commission. The Commission should not want to litigate either. Litigation will put the Commission’s own actions on trial, erode public trust cultivated over decades, undermine incentives for market participants to engage with the Commission in good faith, and present significant risks to broad aspects of the Commission’s enforcement program,” the crypto exchange said.

Security for tech execs

Armstrong’s security budget for 2022 ranks among his fellow tech executives’ spending for security. Business Insider in 2020 released a list of the security spending by some of the world’s top tech moguls–topping the list was Meta CEO Mark Zuckerberg with $23 million. In an SEC filing, the firm stated that part of the rationale for Zuckerberg’s high security spending was public wrath aimed toward Facebook. That figure meanwhile has dropped to $14 million as of 2022.

“He is synonymous with Facebook, and as a result, negative sentiment regarding our company is directly associated with, and often transferred to, Mr. Zuckerberg,” Facebook said at the time.

Oracle pays the annual expenditures of protecting CTO and cofounder Larry Ellison’s “primary residence,” which is roughly estimated at $1.6 million as of 2022. Amazon’s Jeff Bezos is said to have been paying separately for his personal security but the company also shells out around $1.6 million per year.

Google paid $5.9 million on security for CEO Sundar Pichai in 2022. Pichai’s “overall security program” was authorized in July 2018, three months after Nasim Najafi Aghdam shot three people and then herself at YouTube HQ in San Bruno. Following the attack, YouTube declared an increase in security.

Apple spent $591,196 on private security for Tim Cook in 2022. Notably, the company requires Cook uses private aircraft for all business and personal travel.

Information for this briefing was found via Business Insider, Crypto Potato, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.