Donald Trump’s social media venture, Trump Media & Technology Group (NASDAQ: DJT), recently made headlines for its successful public offering, marking a significant milestone and a huge net worth jump for the former US president.

However, behind the scenes, the company’s financial journey has been anything but straightforward, with revelations emerging about emergency loans from a Russian-American businessman now under federal investigation.

In 2022, Trump Media faced dire financial straits, necessitating emergency funding to stay afloat. A portion of these crucial loans came from an entity known as ES Family Trust, connected to Anton Postolnikov, a Russian-American businessman embroiled in a federal probe involving insider trading and money laundering linked to the Trump Media merger.

Leaked documents have shed light on the opaque nature of ES Family Trust’s operations, acting as a conduit for financing Trump Media during its turbulent times. Postolnikov, who co-owns Paxum Bank, utilized the trust to provide funds when traditional avenues were unavailable, raising questions about the source and legitimacy of the money involved.

Paxum Bank’s association with the porn industry and its lack of US regulatory oversight add further complexity to the situation. It appears Postolnikov leveraged the trust to extend financial assistance to Trump Media, enabling the company, including its flagship platform Truth Social, to weather the storm.

Despite mounting scrutiny and legal threats, neither Trump nor Trump Media has been directly implicated in any wrongdoing related to these loans.

Postolnikov’s role in the ongoing federal investigation has intensified, with recent developments implicating him and his associates in potential money laundering activities alongside earlier insider trading charges. While Postolnikov remains uncharged, the increasing focus on his involvement raises concerns about the integrity of Trump Media’s financial dealings.

ES Family Trust

In late 2021, Trump Media found itself in dire financial straits when its planned merger with blank check firm Digital World Acquisition faced indefinite delays due to a Securities and Exchange Commission investigation. Will Wilkerson, a co-founder-turned-whistleblower, revealed in an interview that traditional banks were hesitant to extend financing to Trump’s social media venture following the January 6 Capitol attack.

Amid this turmoil, Trump Media turned to alternative sources for funding, including ES Family Trust, which emerged as a key lifeline. Established in May 2021, the trust’s involvement in Trump Media’s financial dealings took a curious turn when Postolnikov’s access to the account was verified by a Paxum Bank manager in November 2021. Subsequently, the trust was funded for the first time in December 2021.

ES Family Trust provided Trump Media with crucial loans totaling $8 million in December 2021 and February 2022, structured as convertible promissory notes. Despite the absence of signed documents, the trust’s investment proved substantial, with estimates suggesting its stake in Trump Media ranged between $20 million and $40 million, even amidst a decline in the company’s share price following poor earnings.

Yet, the trail of transactions raises eyebrows. Documents indicate that Postolnikov personally benefited from the trust’s activities, with $4.8 million transferred to his account. However, a significant portion of these funds, totaling $3 million, was inexplicably reversed, prompting questions about the trust’s true motives and operations.

The purpose behind ES Family Trust’s creation remains elusive. Aside from financing Trump Media, the trust’s records reveal investments in only two other entities: Eleven Ventures LLC and Wedbush Securities, totaling $11.8 million. Moreover, the current status of ES Family Trust remains shrouded in mystery, with its listed address in Hollywood, Florida, appearing to have changed hands.

Notably, the creation papers for the trust designate a successor to its original trustee, Paxum employee Angel Pacheco, as Michael Shvartsman.

Truth Social’s “bridge financing”

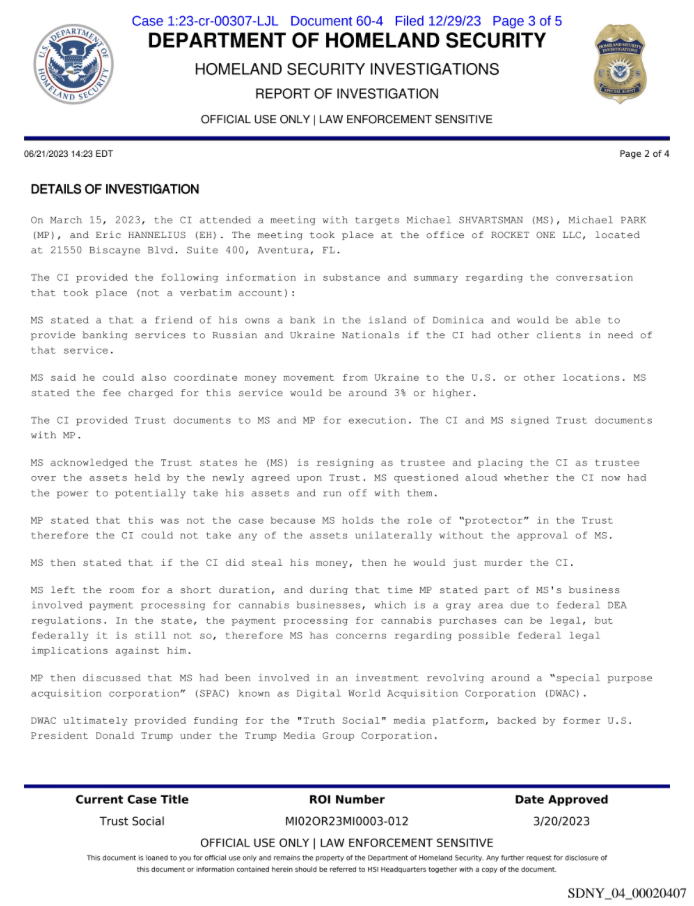

Federal prosecutors charged Shvartsman, a close associate of Postolnikov, last month with money laundering for their alleged involvement in insider trading Digital World shares. Shvartsman, along with his co-defendants, pleaded not guilty to the charges.

Court filings revealed that Shvartsman’s connection to the case extends to discussions about a friend who owns a bank in Dominica, offering bridge loans to Trump Media. While the report does not explicitly name Postolnikov as the “friend” in question, it leaves open the possibility of his involvement, raising further questions about the extent of his role in the affair.

“Michael Park (Shvartsman’s associate) told the [confidential informant] that he does not think the SEC would be able to go after [Shvartsman] for his part in the investment but mentioned that [Shvartsman] essentially provided ‘bridge financing’ for the firm behind the Truth Social media platform,” a report of Department of Homeland Security said.

Despite mounting scrutiny, Shvartsman’s lawyer declined to comment on his client’s relationship with Postolnikov. Moreover, it remains uncertain whether federal prosecutors are aware of Postolnikov’s alleged involvement in propping up Trump Media through ES Family Trust.

The probe into potential money laundering linked to the Trump Media merger has gained momentum in recent months, with the FBI and the Department of Homeland Security intensifying their efforts. This includes collaboration between the El Dorado task force and the Illicit Proceeds and Foreign Corruption group, indicating a concerted effort to uncover any illicit financial activities tied to the company.

The investigation’s origins trace back to revelations brought forward by Wilkerson’s legal team in October 2022, prompting federal authorities to expand their inquiries.

Trump sues his “Apprentices”

As this legal kerfuffle on his company’s financing is happening, Trump aims to assert his ownership of the media company after he filed a lawsuit against two of the company’s co-founders, Andy Litinsky and Wes Moss, alleging that they improperly set up the company and should not be entitled to their stake in it. Trump’s lawsuit, filed in Florida state court on March 24, seeks to eliminate Litinsky and Moss’s 8.6% stake in the company, currently valued at approximately $477 million.

Trump’s lawsuit accuses Litinsky and Moss of making reckless decisions that damaged the company, including failing to properly set up its corporate governance structure, launch the Truth Social platform, and secure an appropriate merger partner.

“Moss and Litinsky failed spectacularly at every turn,” the lawsuit said.

Litinsky and Moss, contestants on Trump’s NBC show “The Apprentice,” have denied Trump’s allegations, with their lawyers declining to comment on the lawsuit. Previously, Litinsky and Moss, through their company United Atlantic Ventures, filed their own lawsuit against Trump in Delaware Chancery Court, alleging that Trump planned to dilute their stake in the company.

The legal skirmish underscores the high stakes involved in Trump Media’s public debut, which has seen Trump’s net worth soar as a result of his majority stake in the company. Despite recent setbacks, including a $58 million loss disclosed in a securities filing and a subsequent drop in stock price, Trump Media still boasts a market capitalization of $5.5 billion.

While Trump owns 57% of the company, Litinsky and Moss’s 8.6% stake represents a significant portion of its value. The lawsuit contends that Litinsky and Moss owe their stake to Trump’s influence and that without him, the creation of Truth Social would have been impossible.

Trump Media last traded at $40.59 on the Nasdaq.

Information for this briefing was found via Bloomberg, CNN, The Guardian, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.