A majority of UK households risk energy poverty in the winter from soaring utility bills while energy suppliers are facing the threat of going out of business from being overwhelmed by bad debts, Bloomberg reports.

Power bills are set to surge 80% starting October, as the price cap goes up, right on the verge of winter when energy demand is higher. Consultancy firm Baringa Partners warns that this crisis could hurt UK households more than the 2008 financial crisis — which, people old enough would remember, was followed by the deepest recession since the Second World War.

“The impact to society will be higher than the 2008 crash in terms of the impact on households,” James Cooper, a partner at Baringa, told Bloomberg. “We’re now moving into territory where a majority of households are placed into debt or a very fragile financial position.”

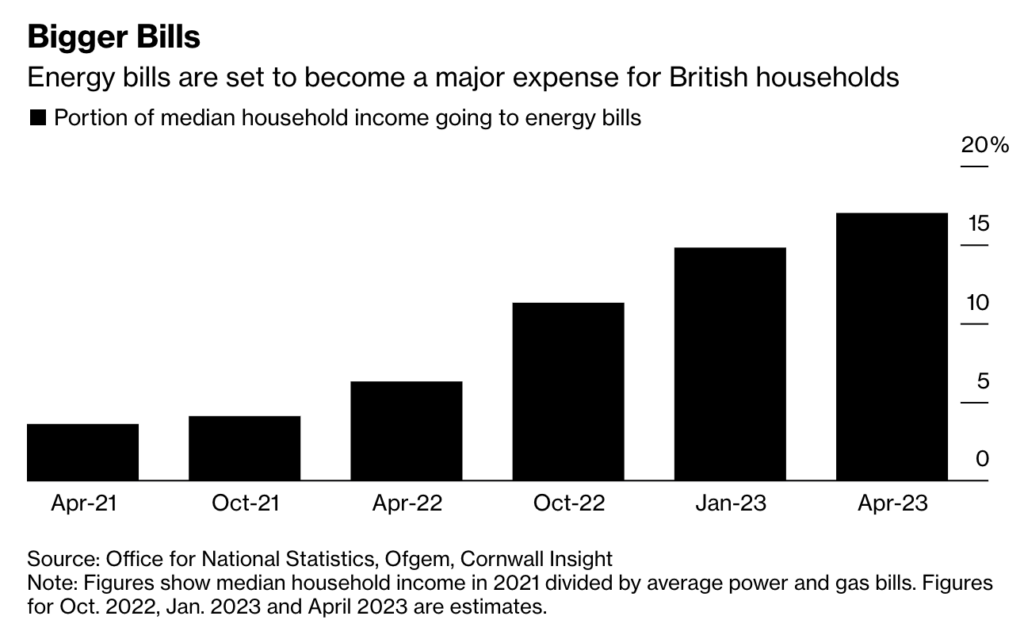

According to price-cap estimates from Cornwall Insight Ltd., energy costs could take up as much as 17% of household income beginning next year if the government doesn’t extend more help. The government had earlier pledged to give £400 support for each home, but the energy industry stresses that more help is needed as most UK households will be unable to afford price hikes on their bill.

UK’s surging inflation, which shattered a 40-year record last month, has pushed government borrowing to be much higher than forecast for July — from £200 million to almost £5 billion. With more help needed, the next prime minister will tackle the crucial challenge of helping UK households get through the cost-of-living crisis.

Information for this briefing was found via Bloomberg, Reuters, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.