A.P. Moller-Maersk A/S, which is the world’s largest container ship and vessel operator, recently issued a grim statement regarding the status of global trade amid the coronavirus pandemic.

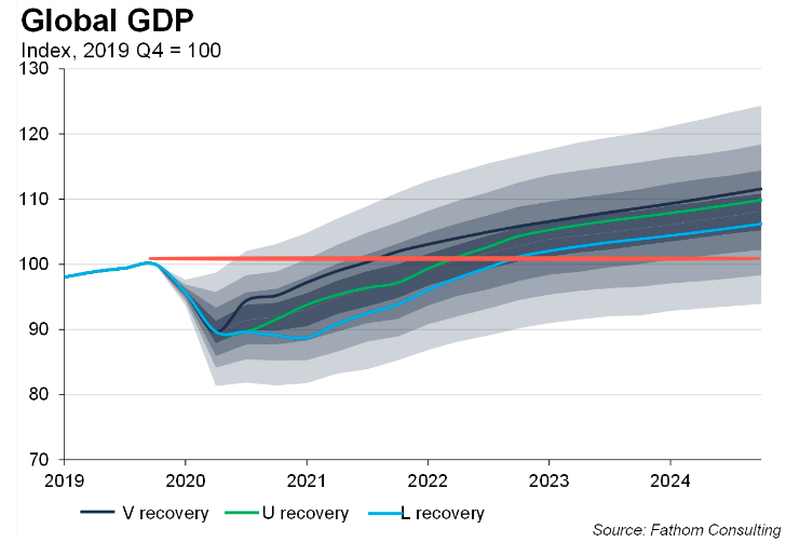

According to a Bloomberg interview, Maersk is warning that global trade volumes are going to be significantly threatened due to the increasing negative impacts of the coronavirus pandemic. The container line is casting a shadow on the hopes of a V-shaped economic recovery, and is instead predicting a U shaped recovery. Furthermore, the company’s CEO, Soren Skou, is anticipating second quarter 2020 volumes to drop anywhere between 20 to 25%.

Prior to the coronavirus pandemic chaos, Maersk was forecasting growth to be between 1% and 3% – however, all such hopes are gone, and the company has since retracted its 2020 guidance, citing a severe damage to the global economy and significant drop in demand for container trade. The container ship operator has been battling through a period of near rock-bottom, but is hopeful that by the third or fourth quarter the industry may begin to rebound.

Maersk’s rather grim prediction of a U-shaped recovery goes against the grain of the predominantly-US narrative of a V-shaped recovery. However, according to some experts, Maersk’s prediction is most likely the closest to reality. Stan Druckenmiller, who is an American investor and philanthropist, is calling a V-shaped recovery a fantasy, given the current and forthcoming grim economic impacts.

Information for this briefing was found via Bloomberg and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.