Xebec Adsorption (TSX: XBC) yesterday announced its second quarter financial results. The company announced revenues of $44.5 million, up from $40.33 million last quarter, while gross margins came in at $1.8 million, or just a 4% margin, compared to a 15% margin a year ago. The company also reported wider adjusted EBITDA and net losses for the quarter. Adjusted EBITDA came in at ($12) million, while the net loss amounted to $23.4 million.

The firm said they continue to amass a backlog of sales, growing to $270.2 million as of August 10, a jump of $9.7 million since May.

Xebec currently has 12 analysts covering the stock with an average 12-month price target of C$1.48, or an upside of about 150%. Out of the 12 analysts, two have buy ratings, nine have hold ratings, and the last analyst has a sell rating on the stock. The street high price target sits at C$3, representing an upside of 400%.

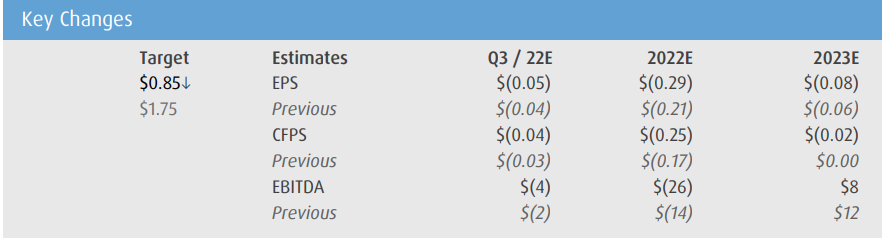

In BMO Capital Markets’ note on the results, they reiterate their market perform rating while lowering their 12-month price target from C$1.75 to C$0.85, saying that after incorporating the results, they have lowered their estimates and price.

On the results, BMO says that if you back out the one-time charge of $8.3 million, the results generally came in line with their estimates other than adjusted EBTIDA, which was expected to come in at ($3.7) million but came in at ($12) million. However, both systems and support revenues came in line with their estimates.

As a result of the quarter, BMO has now lowered their full year 2022 estimates. They now expect adjusted EBITDA to be ($26) million, worse than the ($12) million estimate prior. They also expect Xebec to see their adjusted EBITDA to grow to $8 million in 2023, down from their $12 million estimate prior.

They caution investors, saying, “We continue to take a more cautious stance until the company can

show some margin improvement.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.