The closely-watched Treasury yield curve dipped to the lowest level since the 1980s Volcker era, signalling a recession is barrelling around the corner as the Federal Reserve remains aggressively faithful to reining in the highest inflation in over 40 years.

The spread between the two-year and the 10-year yield has been situated in negative territory since July, but it wasn’t until last week when the 2-year rate surpassed the former note yield by a staggering 58.6 basis points— a phenomenon not seen since former Fed Chair Paul Volcker sunk the economy with hawkish rate hikes meant to break inflation. Although the inverted spread has since modestly widened to 52 basis points at the time of writing, a negative yield curve is nevertheless the strongest indication of an impending recession within the next 12 to 18 months.

Treasury yields have been on an unrelenting surge this year, and even more so after Powell indicated during the FOMC’s meeting last week that interest rates will continue increasing more than previously forecast as policy makers attempt to bring inflation back in the 2% target range.

“We think that the curve can keep inverting for now since the Fed is likely to keep raising rates and will tolerate some slowing in the economy,” wrote TD Securities global head of rate strategy Priya Misra in a note seen by Bloomberg. “This more aggressive than expected hiking path has an unfortunate consequence. The amount of real tightening that we expect now to happen will likely lead the economy to a recession in the second half of 2023.”

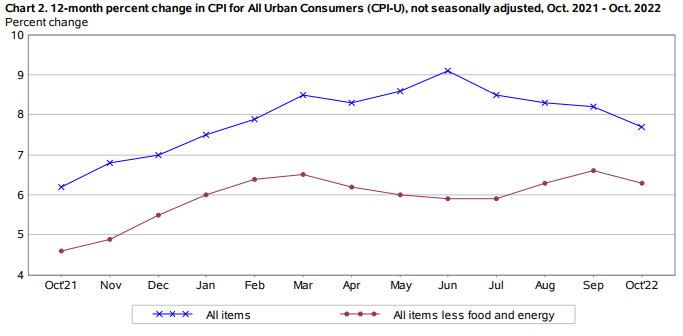

The Fed hiked the funds rate another 75 basis points at its November meeting, in light of September’s eye-popping 8.2% inflation print. The Department of Labor on Thursday posted October data, with inflation having a reading of 7.7% – nearly four times higher than the Fed’s target rate. However, the result came in slightly lower than the consensus forecast of 8%.

“Any strength in the data from here will result in higher yields and more curve inversion,” warned MUFG US macro strategy head George Goncalves.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.