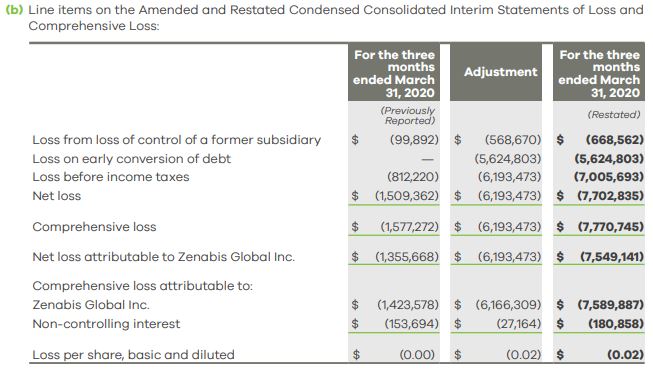

Zenabis Global (TSX: ZENA) filed amended financial statements Friday night after 10:30 PM, and issued the resulting press release this afternoon. The company had a list of approximately 12 items that were incorrectly stated within the original financials issued on May 15, with the net result being an increase of the firms quarterly net loss from that of $1.5 million to $7.7 million.

The largest impact to the quarterly net loss came from the updated accounting related to early conversion of unsecured convertible notes, which amounted to a loss of $5.6 million that was not previously reported. The resulting warrants issued in connection with the early conversion were also not recorded, having a fair value of $891,916 as an equity instrument.

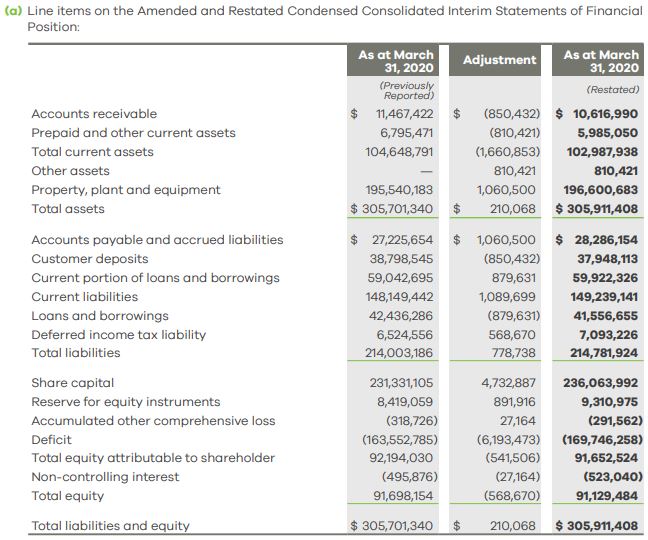

This however was not the most questionable part of accounting previously filed. For instance, one item was that a payment from a customer was incorrectly stated to be a decrease in “customer deposits” (a liability) versus that of the proper category of “accounts receivable,” (an asset) which resulting in receivables falling by $850,432. However, it gets better.

The most questionable award above all goes to the fifth bullet point identified by the company. Here, they stated, “the Company identified that $1,060,500 in payables was incorrectly classified as ‘Property, plant and equipment’ and reclassified this to ‘Accounts payable and accrued liabilities’.” How this occurred is highly questionable, and brings into question the ability of the accounting team at the company as a whole.

In terms of its cash flow statement, a total of four changes were made, including reclassifying $2.8 million in capital expenditures from 2019 within investing activities, and reclassifying $1.2 million from inventory to biological assets under non cash working capital among other items. Two corrections were also made to the condensed consolidated interim financial statements related to supplemental cash flow and share based compensation.

The net effects of these changes can be seen on the balance sheet and statement of loss, as outlined below.

Zenabis Global last traded at $0.15 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Whack a mole with these companies. Waiting to hear if Namaste brand will go to the company of the same name.