Zenabis Global (TSX: ZENA) reported dismal third quarter 2019 results this morning, posting a net revenue decline of 52% to $12.0 million. Revenue figures were bad enough that the official news release relegated the data to the “select financial data” portion, instead focusing the bulk of the release on the expansions that occurred at Zenabis facilities during the quarter.

Despite the dissapointing quarterly results, cannabis sales were only marginally down in the quarter, from $7.3 million in the second quarter to $7.1 million. The bulk of the lost sales occurred in the propagation segment of Zenabis’ operations, with sales falling from $17.4 million to $4.5 million. The deecrease in cannabis sales was blamed on packaging issues that occurred in August and September, along with a decrease in demand for bulk shipments. The propagation business’ decline was stated to be due to seasonality, growing cycles of greenhouse crops, timing of customer orders, and the varying cycles of the greenhouse vegetable industry – essentially any justification that would stick.

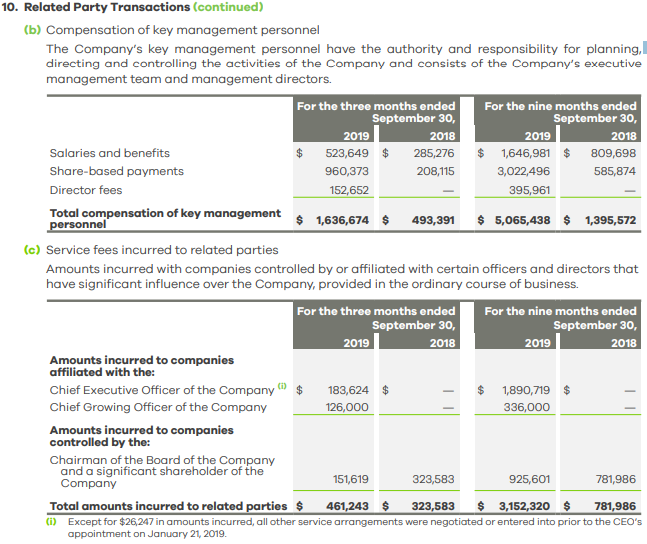

Gross margin before fair value adjustments amounted to $5.0 million during the quarter, while expenses came in at $18.9 million. The largest expense of which was salaries and benefits at $7.4 million, followed by general and administrative at $3.2 million. Related party transactions during the quarter amounted to $2.0 million. Share based compensation amounted to $2.0 during the quarter, with Zenabis posting a net loss of $5.8 million for the quarter.

Moving towards the cash flow statement, the firm utilized a total of $10.6 million for operating activities during the quarter. Meanwhile, $31.0 million was spent on property plant and equipment, which significantly impacted cash flow during the quarter. This however was offset by Zenabis generating $60.9 million in financing activities, with the firm thus having a positive cash flow quarter, increasing the cash position from $8.6 million to $27.9 million.

Inventory levels grew during the quarter for the firm to $28.3 million, thanks in part to additional production coming online. Biological assets also increased, to that of $13.8 million. Total current assets amounted to $89.9 million, an increase from $60.2 million.

Despite the significant increase current assets, the working capital position of the firm actually decrease, with current liabilities growing to $131.0 million during the quarter, up from $90.0 million. While current liabilities actually decreased to $26.0 million, this was offset by customer deposits of $37.6 million, and current loans and borrowings increasing to $49.9 million. Working capital as a result fell from ($29.8 million) to ($41.0 million).

Production costs also increased during the quarter, to $1.14 per gram from $0.78. The benefit here however is that the net revenue per gram of cannabis sold also increased during the quarter, to $4.75 per gram from $4.22 per gram. A total 5,239 kilograms of cannabis were harvested during the quarter, while the firm managed to sell 1.491 kilograms.

Zenabis Global last traded at $0.18 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.