Zenabis Global (TSX: ZENA) last night quietly filed its fourth quarter and full year 2020 financial results. The company saw fourth quarter net revenues of $15.9 million, a 16.5% decline quarter over quarter in terms of cannabis revenue, and a 33.0% decline in terms of total revenue reported by the firm in the third quarter. Notably, non-cannabis segments that were sold off in the fourth quarter were omitted from the final year end tally. Net loss for the quarter amounted to $30.1 million.

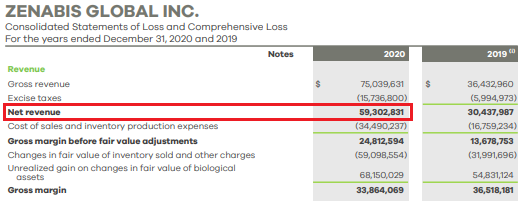

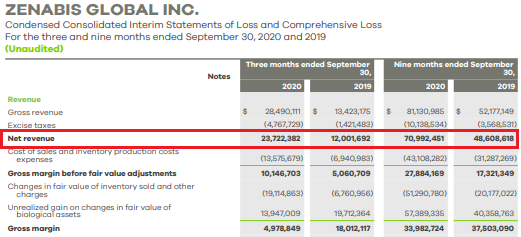

The financial results released by the company, quite simply, are a bit hairy. While the firm sold its propagation division, known as Bevo Agro, in the fourth quarter (December 31, 2020 to be precise), the company elected to remove all revenues recorded by the subsidiary throughout the fiscal year from its financial statements. The result, is full year revenues reportedly amounted to $59.3 million on a net basis – despite the third quarter filings indicating that the nine month period had revenues of $71.0 million.

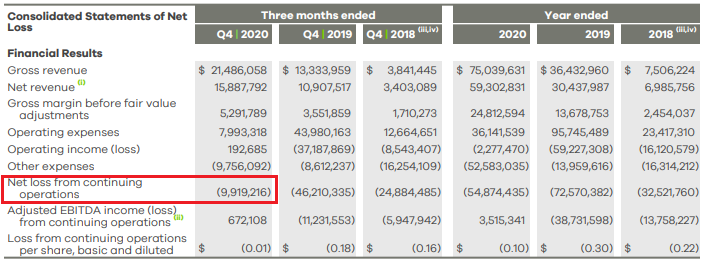

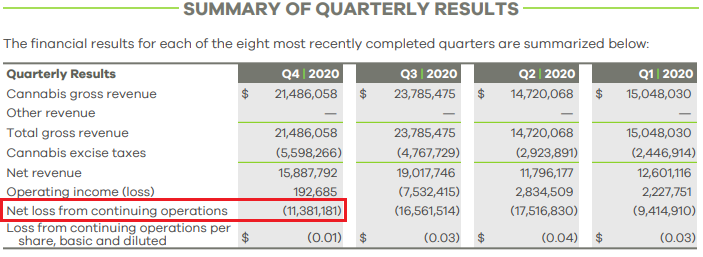

There were also inconsistencies within the firms filed MD&A in regards to the net loss from continuing operations. One section refers to this figure as being $9.9 million, while another refers to it as being $11.4 million.

Despite this, the company officially filed that it generated $59.3 million in net revenue for the fiscal year, as well as a net loss of $70.5 million. The firm also recognized adjusted EBITDA of $3.5 million for the fiscal year, once propagation revenues were backed out.

Gross margins for the full year before fair value adjustments amounted to $24.8 million for Zenabis. Operating expenses meanwhile amounted to $36.1 million, with the firm still recognizing a loss from operations of $2.3 million after fair value adjustments are added in.

Operational expenses were lead by salaries and benefits of $13.3 million for the year, followed by general and administrative expenditures of $8.7 million. Professional fees amounted to $4.2 million, which was followed by share based compensation of $3.7 million. Restructuring costs of $1.5 million were also recognized for the year.

Other expenses however is where things begin to get really ugly for the company. Interest expenses for the fiscal year amounted to a whopping $23.8 million – or 95.9% of the firms gross margin before fair value adjustments. The company also recognized a loss on early conversion of debt of $13.9 million over the course of the year, as well as a loss on modification and extinguishment of debt of $10.4 million. A further $4.7 million was lost on the remeasurement of a royalty liability. Finally, the company gained $4.9 million as a direct result of government subsidies before recognizing a total net loss of $70.5 million for the fiscal year.

Looking to the balance sheet, Zenabis saw its cash position climb marginally from $4.8 million to 5.7 million during the fourth quarter, while accounts receivable fell from $14.3 million to $8.5 million. Inventory climbed from $53.7 million to $59.3 million. Overall, total current assets fell from $102.6 million to $95.6 million.

Accounts payable and accrued liabilities meanwhile rose from $25.5 million to $32.9 million, while customer deposits fell from $35.7 million to $34.1 million. Loans and borrowings however increased substantially, rising from $13.2 million to $54.8 million, while convertible loans rose from $10.6 million to $11.3 million. Overall, total current liabilities rose from $85.2 million to $133.9 million.

Zenabis Global last traded at $0.12 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.