Zenabis Global (TSX: ZENA) this morning released its third quarter 2020 financial results, reporting revenues of $23.7 million on a net basis, along with a net loss of $17.0 million. Revenues were down 13.3% on a quarter over quarter basis, with the company being quick to highlight that it had net revenue from the cannabis segment increase 61% quarter over quarter to $19.0 million, rather than reporting its overall revenue decline.

Gross margins before fair value adjustments worked out to $10.1 million, while operating expenses were $12.8 million for the quarter. Expenses were largely comprised of general and administrative expenses of $4.7 million, along with salaries and benefits of $3.0 million. Impairments of assets held for sale also impacted operating expenses, to the tune of $1.6 million.

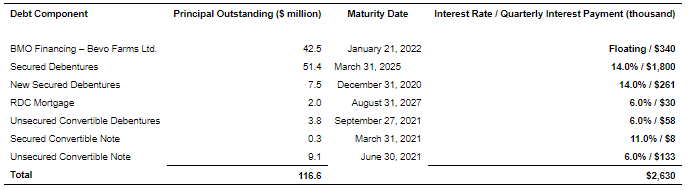

Outside of operating expenses, a number of other line items impacted the income statement, including a $5.9 million quarterly interest expenses. The bright side here, is that this figure was down from $8.0 million in the prior quarter. Also impacting the statement was a $2.1 million loss on revaluation of embedded derivative asset, along with a $3.4 million loss on remeasurement of royalty liability. The company however did benefit from $2.0 million in government subsidies within the quarter.

Moving to the balance sheet, the company saw its cash position deplete from $6.7 million to $4.8 million. This was despite raising $7.6 million in the month of September, demonstrating how expensive the firms operation is. Accounts receivable grew significantly, climbing from $8.8 million in the second quarter to $14.3 million. Inventory however declined from $56.0 million to $53.7 million, partially due to impairments of $2.1 million. Total current assets overall declined from $107.9 million to $102.0 million.

Accounts payable meanwhile increased from $23.6 million to $25.5 million, raising the question of how exactly the company intends to pay its bills with its current cash position. Customer deposits meanwhile fell from $37.2 million to $35.7 million. Loans and borrowings also fell, from $16.2 million to $13.2 million. Overall, currently liabilities dropped to $85.2 million from $88.5 million.

The company also provided a simple breakdown on the numerous maturities it faces over the next several years, with the nearest maturity being December 31, 2020, wherein the company must settled $7.5 million in new debentures. Unless it manages to push this maturity, it appears that the company will be forced to either raise funds to pay it off, or have yet another dilutionary event at a lower conversion price to settle the debt.

Finally, guidance was provided for the fourth quarter of 2020. The company is currently anticipated adjusted EBITDA of $5.0 million to $7.0 million, along with consolidated net revenue between $25 million and $29 million. The cannabis segment is expected to account for $19 million to $21 million of this figure.

Zenabis Global is currently trading at $0.065 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.