Garibaldi Resources Corp (TSXV: GGI) has had investors on a wild ride as of late. The stock has been stuck on a roller coaster ride as bulls and bears battle it out for dominance. It’s now had two bad cases of “sell the news” after excellent assay results have been reported by the company. For Garibaldi, it’s apparent that the bears like to step in on any positive results that the company can muster, which then causes short sellers to get a bad case of carpe diem.

However, through these ups and downs there has been one constant: insiders are chomping at the bit to buy. One particular insider that has been feasting unlike any other, is the owner of 2176423 Ontario Ltd., Mr. Eric Sprott. For those who are unaware, Sprott is what we call a “whale”, meaning he is someone who has significant financial assets that can enable them to own significant percentages of a company. That is certainly the case for his position in Garibaldi Resources.

Let’s follow the money invested by Mr. Sprott, and his involvement in GGI.

Who is Eric Sprott?

Right now, it is likely that many readers will likely be asking who this Eric Sprott is. For those that are unaware, Eric Sprott has been a member of the investment community for over forty years. He has owned two asset management firms: Sprott Securities, and Sprott Asset Management Inc. Eric is a billion-dollar businessman, who focuses primarily on the resource sector. He is largely focused on gold, however he also has investments in related resource companies. Sprott stepped down from his role in his latest firm in April of 2017 to enter retirement and focus on his family. However, he is still committed to finding quality investments.

In addition to this, he is also a major shareholder of Garibaldi Resources. He first came to the public’s attention as a major shareholder in the company with the closing of the first tranche of a private placement on October 2, 2017. In this placement alone, he purchased more than $2,500,000 worth of shares in the company.

It was with this financing that Sprott became a shareholder of 10% or more of the company, thus requiring him to report his purchases as an insider. From here, we can track his current positions in the company. Hint: it’s growing.

Eric Sprott’s Investment in Garibaldi Resources

Private Financing

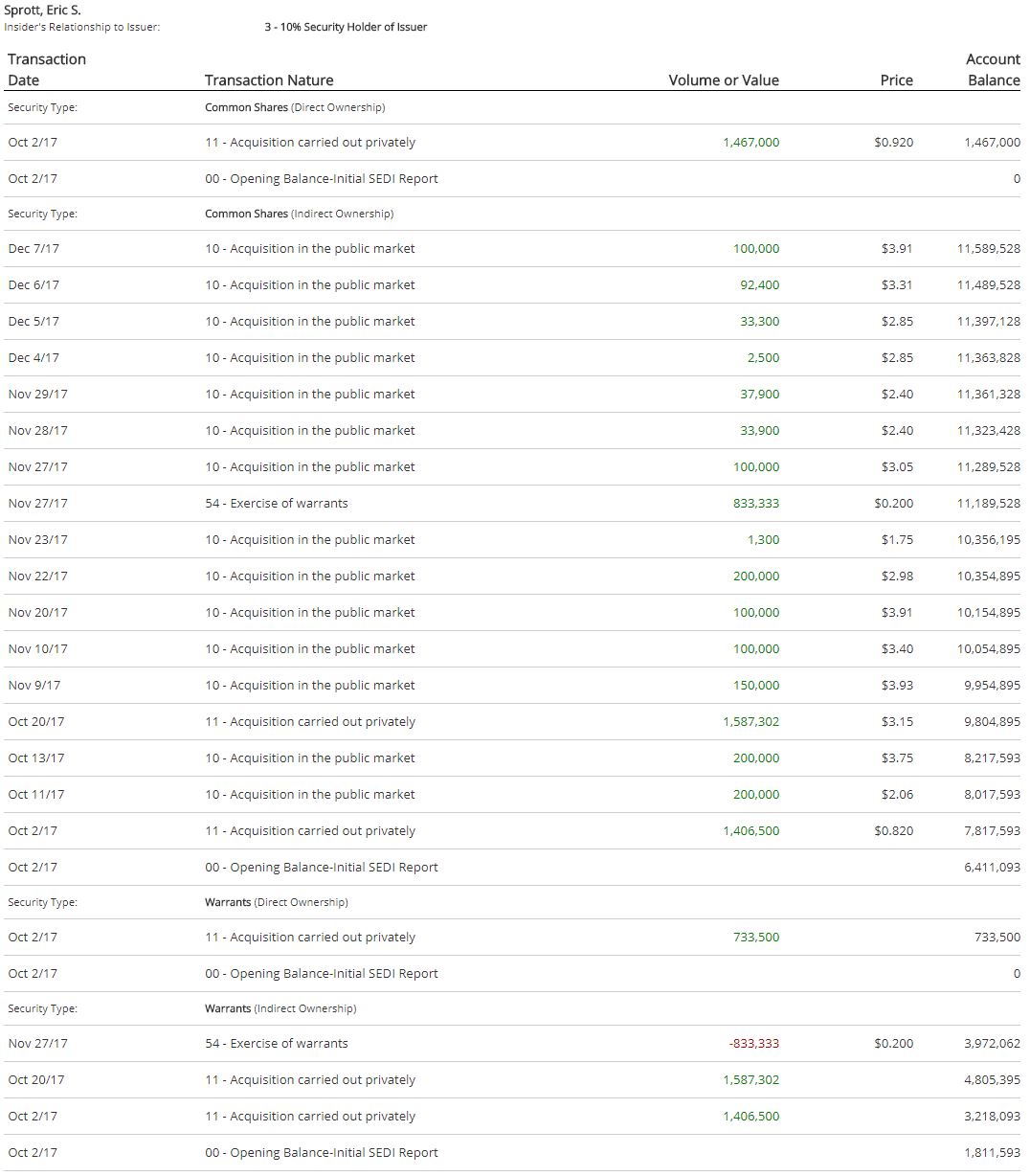

It is unclear when Sprott initially became an investor in Garibaldi Resources. What we do know, is that he became a major shareholder as of October 2, when a portion of a private placement was filled. From here, we can create a timeline of his investments within the company. This consists of both private and through the open market. We’ll split them up in our timeline to make them easier to view.

- Prior to October 2, 2017: Sprott was in control of 6,411,093 common shares and 1,811,593 purchase warrants. This equates to approximately 7.7% of the outstanding shares of the company.

- October 2, 2017: Sprott purchases the entire first tranche of a private placement for $2,502,970. This consists of 1,406,500 units priced at $0.82, with units consisting of one share and one warrant. The warrant has an exercise price of $1.05 for a period of two years. This dollar figure also consists of 1,467,000 units priced at $0.92, which consists of one share and one half purchase warrant. This warrant also has an exercise price of $1.05, and is valid for two years. Sprott now has control over 9,284,593 shares and 3,951,593 purchase warrants. This represents 10.7% of the company on a non-diluted basis.

- October 16, 2017: A $10 million financing is arranged for “strategic investors”. It consists of units priced at $3.15, which consists of one full share and one full warrant. The warrants have an exercise price of $4.50 for a period of two years.

- October 20, 2017: First tranche of this private financing is closed for a sum of $8 million. Sprott’s portion of this is $5,000,000. This resulted in him receiving 1,587,302 units at a price of $3.15 each. Sprott now controls a total of 11,271,895 common shares, and 5,538,895 purchase warrants. This represents 11.7% of the total shares outstanding for the company.

Open Market Purchases

In addition to private investments, Eric Sprott has also been purchasing shares on the open market. Again, we are uncertain when he initially began purchasing shares of the company or how they were acquired. Open market purchases are only available for viewing upon Sprott becoming a major shareholder of Garibaldi Resources. Here is a snippet outlining the purchases Mr. Sprott has made since becoming an insider.

Please note that this also lists private purchases, and is denoted as such. Additionally, “indirect ownership” refers to shares Sprott controls through his private company, 2176423 Ontario Ltd.

As can be seen, Eric Sprott has been routinely purchasing additional shares of the company, on a near daily basis for the last several weeks. This signifies he has exceptional confidence in the future performance of Garibaldi. He has gone so far as to exercise 833,333 warrants and still hold them. This was likely done to provide further funds to the companies coffers. Also of note, is that he has yet to sell a single share since becoming listed as an insider of the company.

Here’s a graph from Canadian Insider depicting all insider purchases and sales of Garibaldi Resources. It will give you a better idea of how often and when Eric Sprott has been purchasing shares in the company.

In total, as of the date of writing, Sprott is in control of 13,056,528 common shares and an additional 4,705,562 share purchase warrants. With this, it is estimated that 13.35% of the total outstanding shares are controlled by Eric Sprott.

Potential Additional Positions Taken

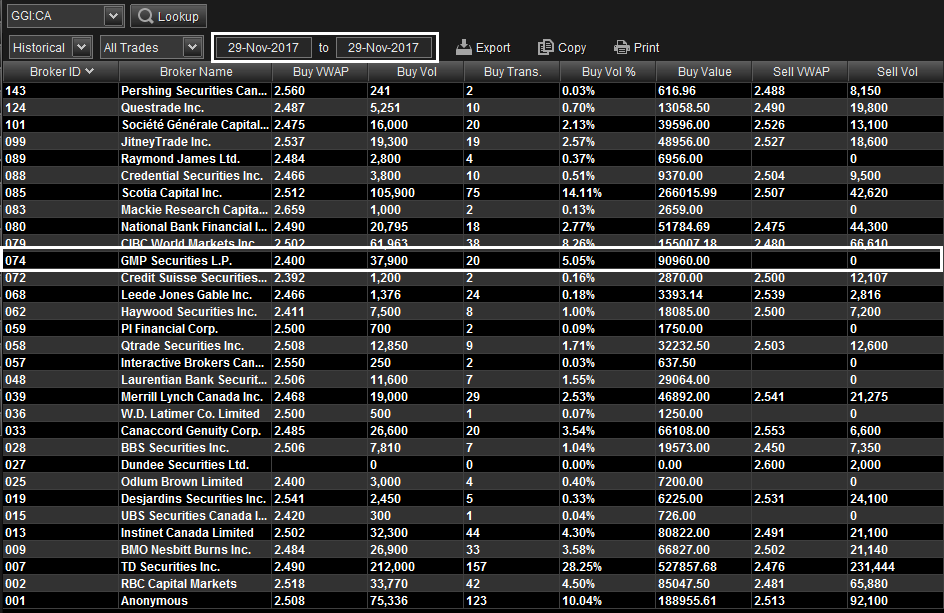

For new investors that may not be aware, data plans can be purchased through several services that denote something called “house positions”. Essentially, it tells you which brokers bought and sold an equity on a particular day. For retail traders, purchases are generally made through TD Securities Inc (Broker ID # 007), Scotia Capital (#085), CIBC World Markets (#079) or RBC Capital Markets (#002). These are the most common typically, because it is who retail traders normally bank with.

However, individuals with significant financial assets typically use more dedicated service providers for their investing. These services enable individuals to mask their moves, by routing the trade as anonymous (#001), or they can route the trade through their typical service provider and make the move more easily viewed by anyone who is looking. This data is important to investors with larger positions, as it tells more of a story on how and why a stock may be moving. When insider transactions are posted, these investors will then compare the data provided to that of what occurred under house positions.

For instance, we know from the filings posted to SEDI and Canadian Insider, that on November 29, Eric Sprott purchased 37,900 shares indirectly in Garibaldi Resources. Comparing this to the house positions taken on this date, we know that GMP Securities (#074) purchased this exact amount of shares on this date, and transacted no sales. The total value of these shares was $90,960, which equates to $2.40 per share. This again matches the transaction filed by Sprott. Purchases also line up exactly for a filed transaction dated November 23.

There are several more dates for which shares purchased by GMP Securities exceeds the figures filed by Sprott. However, there are also a handful dates that do not match up at all. It can be reasonably concluded that Sprott uses GMP Securities for his investments, while he also likely masks some transactions as Anonymous to prevent prying eyes from watching his moves too closely.

What’s the point of this data? This data is beneficial in that watchful investors can act much quicker using this information. Insider transactions are required to be posted within five days of occurring. Within this time frame, plenty can happen.

If you know where large investors trade from and the actions they are likely making, it can be used to ones advantage. For instance, as a result of this data, we know that GMP Securities between December 8 and December 11 purchased an additional 577,200 shares. This likely indicates that Sprott has continued his purchasing of stock in Garibaldi Resources. We are then able to act on this data much quicker than those who wait for the filings. The filings just provide confirmation of what we already suspected.

UPDATE 12/13/2017: Confirming our suspicions, on December 12, 2017 Eric Sprott issued a filing indicating that on December 8 he had bought 200,000 shares of Garibaldi Resources at a price of $4.12. Additionally, on December 11, he purchased a further 450,000 shares at an average price of $3.15.

Closing Remarks

Eric Sprott has made his fortune investing in resource focused companies, over a forty year career. He hasn’t done this by making poor quality stock picks, or by randomly investing in resource companies. There’s a method to the madness that is his constant share purchases, and he knows what he’s doing. When a whale such as Sprott is purchasing stock not just when the price dips, but also as it climbs, it’s likely for good reason.

It should also be mentioned that Sprott is not the only institutional investor involved with Garibaldi Resources. The financing announced on October 16, 2017, was subscribed to by just institutional investors, leaving no room for anyone else. That’s at minimum, $5,000,000 that other large investors have stashed in Garibaldi. The true figure is likely much more significant. This signifies that the experts have a large degree of confidence in the results the company has posted thus far. For long term investors, this is a critical validation of the perceived future value of this stock.

Follow the money. Learn the significance of data. Dive Deep.

Information for this analysis was found via TMXMoney, SEDAR, Canadian Insider, Mining.com, Forbes, The Globe and Mail, and Garibaldi Resources. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.