St-Georges Eco-Mining Corp (CSE: SX) has been the talk of the town for several weeks now. It seems that our Twitter feed in particular cannot seem to get enough of the company for one reason or another. Maybe its the constant news flow provided by the company, or the future potential of the company. Regardless, something draws traders in to the company.

Naturally, this piqued our interest. Where there’s enthusiasm is where we like to look for our next story. This process keeps us relevant and in touch with the flow of the market. Now, mining isn’t our typical focus. We aren’t superb at reading core samples, or understanding the intricacies of the mining sector. However, what we are good at is analyzing share structure. This is an essential starting point for any deep dive on an equity. Thus, today’s focus is the share structure of St-Georges Eco-Mining.

A Dive into the Share Structure of St-Georges Eco-Mining

Shares Outstanding, Options, & Warrants

Overall, the share structure of St-Georges is simply confusing. Within the interim and annual financial filings issued by the company, they do not break down the warrants. Rather, they give a total count of outstanding warrants, mixed in with an average exercise price. For shareholders trying to decipher key levels to be aware of, it makes things slightly difficult.

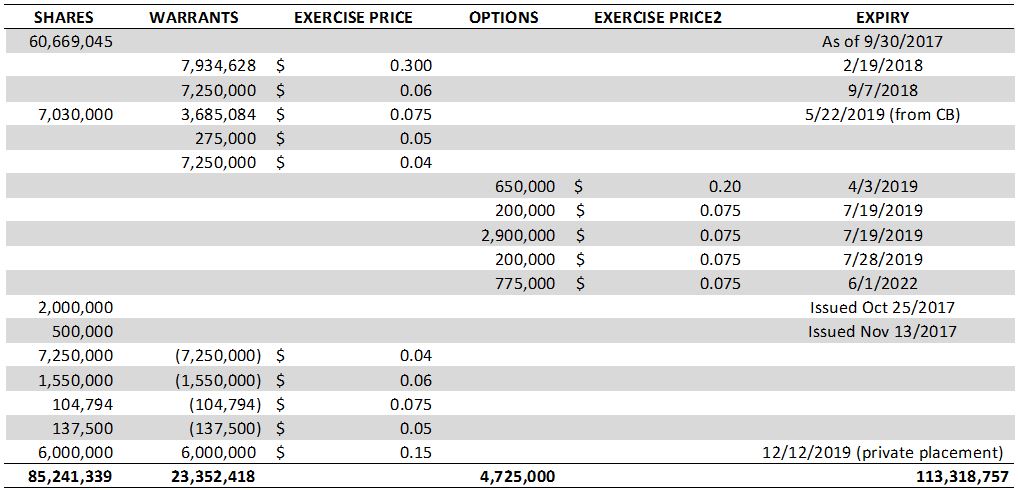

Evidently, we are not the only ones to have issue deciphering the current warrants outstanding. It seems that the company was being questioned quite frequently on the matter, based on a recent news release. On December 17, the company issued an update regarding the matter, wherein it was calculated that approximately 23 million warrants are presently outstanding. This figures includes outstanding warrants from debentures as well that have not as of yet been converted. Unfortunately, an overall figure for outstanding shares was not given. Thus, we were left to do some profanity-laced deciphering of the current share structure.

Above, you will see our best guess at an overall outstanding share count for the company. It is highly likely that this is not the exact figure, due to murkiness in several releases related to share issuance. Further to this, we also took the liberty of converting the debentures into the approximate associated share count.

As it stands based on the available information, it is estimated that there are approximately 85,241,339 shares outstanding for St-Georges. Based on the December 22, 2017 closing price of $0.395, this gives a total valuation for the company of $33.7 million. With a fully diluted estimate of 113,318,757 units, it puts the fully diluted market cap at $44.8 million.

Insider Holdings

Although the share structure might be slightly difficult to understand, one item that has been relatively clear is the amount of shares in which insiders are in control of. All but one director of the company currently has holdings in the company, which certainly is viewed positively by investors. Rather than draw it out, here is the rundown of what each insider is in control of:

- Frank Dumas, Director & CEO: 6,382,762 common shares equivalent*

- Mark Billings, Chairman: 2,512,183 shares, 2,313,462 warrants

- Herb Duerr, Director: 732,358 shares, 425,000 options, 730,051 warrants

- Wei Tek Tsai, Director: 6,028,788 shares, possibly 3.2 million warrants (data seems outdated..)

- Enrico Di Cesare, Director: 750,000 shares, 750,000 special warrants

- Vilhjalmur Thor Vilhjalmsson, Director: 6,781,888 shares

- Neha Edah Tally, Corporate Secretary: 770,894 shares, $200,000 convertible debentures, 1,257,487 warrants

- Richard Bennett, CFO: 1,000,000 shares, 250,000 options, 500,000 warrants

- Eric Salsberg, 10% holder, 5,000,000 shares, 5,000,000 warrants

In total, this equates to approximately 29,958,873 shares being under insider control. Based on our figure above for total outstanding shares, it amounts to 35.14% of St-Georges outstanding shares. This is a significant figure for the company, and should be noted as a strength by investors. Effectively, due to the holding strength these insiders have shown, it leaves approximately 55 million shares to be traded by the public.

One item that is clear, is that insiders need to be filing information in a more timely fashion. There is some data provided by SEDI that does not match to that of company news releases. We took the newest information available in these instances. Furthermore, there are some transactions that do not appear at all. This is why it is unclear whether certain insiders have as many derivatives as is listed by SEDI.

Final Remarks

Although the information was quite difficult to find, it appears that the share structure of St-Georges Eco-Mining is in relatively decent shape. Although the vast majority of shares have been obtained at very low price levels, this doesn’t currently have a huge affect on the future share price. The stock has been moving relatively steady, save for the last trading session of last week, and these cheap shares are unlikely to cause much issue at current levels. Should the price of the equity exceed $0.50 in the near term, it may be a slightly different story.

Overall, investors should have little to worry about with regards to the company’s share structure. St-Georges insiders have shown a high degree of strength and have shown almost no signs of an imminent exit. This effectively locks up a large portion of the outstanding shares, leaving less for manipulation by traders. Our only suggestion, is to be aware of the selling pressure that may exist in the future should the equity start to run hard. Otherwise, with slow and steady gains there should be little concern for St-Georges share structure.

Look at the numbers. Do the figuring. Dive Deep.

Information for this analysis was found via The CSE, SEDAR, SEDI, Canadian Insider and St-Georges Eco-Mining. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.