Golden Leaf Holdings (CSE: GLH) recently became Canada’s newest licensed producer. Their wholly owned facility Medical Marijuana Group Corporation was awarded it’s license to cultivate cannabis by Health Canada on November 24, 2017. Golden Leaf is Canada’s 75th licensed producer, out of a total of 76.

For those that may not know, Golden Leaf is primarily focused on the U.S. legal cannabis market. Presently, its operations are headquartered in Portland, Oregon where its Chalice Farms dispensaries are located. As a result of this it has had several quarters of excellent revenue, which is uncommon for many companies that current own late stage applicants in Canada.

Lets perform a brief overview of the company for those who have just been introduced.

Cannabis oil is the primary focus of Golden Leaf Holdings

Although it may have just obtained a license to cultivate cannabis in Canada, the primary focus of Golden Leaf is actually that of cannabis oil. Although it currently has the majority of equipment required for the extraction and production of cannabis oils, it currently does not have a production facility. This is the result of a recent ruling in a local county preventing the production of cannabis products within its jurisdiction.

As a direct result of this, the company has recently sold the property it acquired for this purchase. On this sale, it recorded an impairment of $1,600,000 due to the decrease in value now associated with the facility.

One implication of this ruling, is the fact that the company does not presently manufacture all of its products. Rather, some of the manufacturing is completed by a third party, with Golden Leaf then performing the task of packing the product. This practice opens up the organization to several risks – in the event the single supplier chooses to cut ties, Golden Leaf will be significantly impacted until such a time that it can either find a replacement or manufacture its own products.

The cannabis products are primarily distributed through its main subsidiary, Greenpoint Oregon. These products are then distributed to over half of the dispensaries that serve Oregon. This includes the five dispensaries owned by Golden Leaf – four under the Chalice Farms brand, and one under the Left Coast Connections brand. Company documents state that their products are in approximately 260 dispensaries across the state.

The company recently elected to restructure its Oregon operations so that all processes occur at its new Chalice Farms facility in Portland. This facility is approximately 15,000 square feet in size and includes an indoor cultivation portion. It is not clear when this restructuring will be competed.

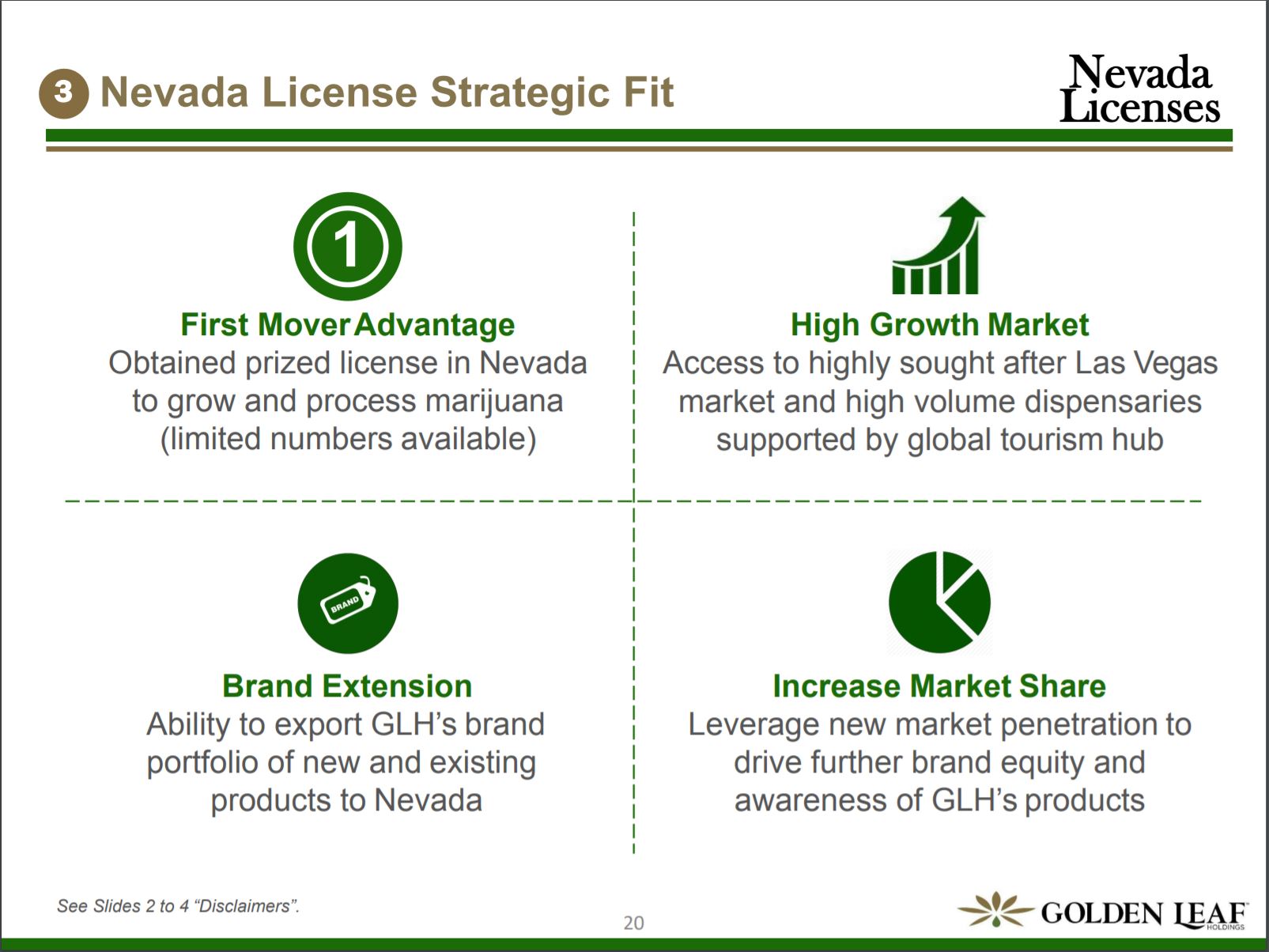

Golden Leaf’s operations in Nevada

Earlier this year, Golden Leaf expanded its operations to that of Nevada. This was completed through the acquisition of NevWa LLC under a subsidiary of the company. At the time of purchase, NevWa possessed both an extraction license as well as a cultivation license for cannabis. This enables Golden Leaf to quickly and efficiently introduce its current product lines to dispensaries in Nevada, a state which just recently legalized cannabis for recreational purposes.

Under the terms of the agreement, a total of $2,237,000 was spent in the acquisition of NevWa. With the acquisition the company obtained the licenses required to cultivate, extract, and distribute products related to cannabis across the state of Nevada. This is significant for the company, as they highlight the markets of Las Vegas and Reno as key growth opportunities.

On October 31 the company obtained the necessary business license to sell product within the city of Las Vegas. Additionally, it previously announced such licenses for the cities of Henderson, Sparks, and Washoe County. With recreation cannabis having been legalized in July 2017 within the state, this gives Golden Leaf significant first mover advantage. In turn, this will enable a high degree of brand growth in a relatively short amount of time.

Medical Marijuana Group Corporation

As we briefly discussed at the start of the article, Golden Leaf Holdings recently acquired Medical Marijuana Group Corporation (MMGC). This move was done as a method of diversifying its portfolio across North America. Through this acquisition of what was a late stage applicant, it also opened up the company to the Canadian market. The company originally intended to introduce its branded products to the Canada market in the third quarter of 2017.

The initial binding letter of intent for the transaction was released to the public on March 14, 2017.

Under the terms of the initial agreement, the total purchase price would be $15,000,000, paid in the form of common shares. Of this, $10,000,000 would be the initial payment in consideration of the company. The remainder would be based on sales targets being met for Golden Leaf’s branded products in the Canadian market. Golden Leaf would also be responsible for all costs associated with the build out of the facility as well as operating costs. The transaction was originally slated to close within five days of the facility receiving its Health Canada license.

These terms were then reaffirmed in the definitive agreement signed on June 27. Additionally, shares were also assigned a value of $0.28 per share. This in turn results in a maximum of 53.5 million shares being issued for the acquisition.

The acquisition was closed early, on November 2, 2017. The facility received its license to cultivate on November 24, 2017.

With respect to the details on the facility itself, little information has been provided. Within news releases, the only figures issued are that it can expand up to a size of 50,000 square feet. The investor presentation deck provided by the company indicates the current facility is 6,000 square feet in size.

Golden Leaf Holdings Extreme Dilution

Not everything is currently rosy for Golden Leaf. Although we outlined some excellent handiwork conducted by the company above, we need to address the dilution. Plain and simple, its ridiculous. As a result of the companies latest financials being released in two days time, this is going to be a rough and tough comparison.

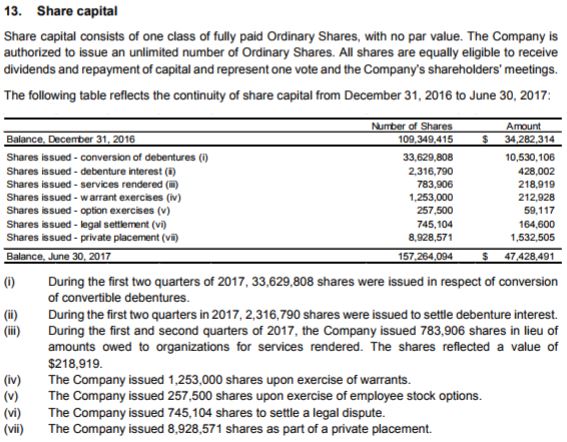

At the time of the latest interim financials, June 30, 2017, Golden Leaf Holdings had approximately 157 million shares outstanding. With a closing price on this date of $0.29, this gave the company a valuation of approximately $45 million. With quarterly revenues of approximately $2 million, plus the acquisition deals it had in the works, this could arguably be considered a fair valuation.

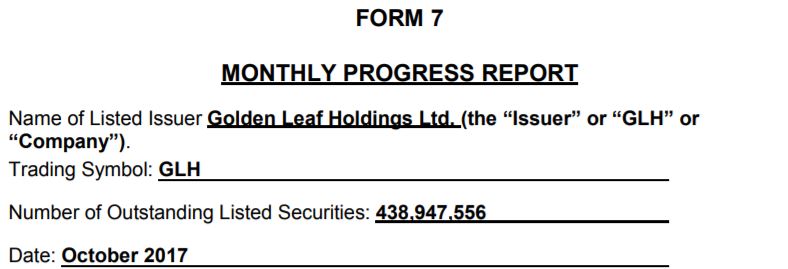

Then, the company did several rounds of financing. Take a look at the form 7 filed with the Canadian Securities Exchange for the month of October 2017:

As of the date of this latest filing, the company had 438,947,556 shares outstanding. Based on November 27’s closing price of $0.30, it gives the company a valuation of $131 million. This is why investors need to be aware of any financing or dilution that occurs. This figure does not include outstanding warrants or options. If you are currently holding shares from June, those shares represent 1/3 of the power they previously had, even though your “up” a penny. Share count is important.

Final Comments

We’ve taken flack in the past for our insistent focus on a companies dilution. However, a companies market cap, by way of dilution, is absolutely crucial to place a proper valuation on a company. Too many new invests focus on the price of an equity, when in fact they should be focusing on the market cap of a company.

Two companies priced at $0.25 per share are not equally valued unless they have the same outstanding shares count.

This is perhaps an extreme example of dilution occurring. Typically, moves like this do not occur on Canadian junior markets. Furthermore, we are not invalidating the success Golden Leaf Holdings has had. They certainly have strong aspects within their operations. Rather, we are elaborating on the effect dilution can have on the value of an equity.

We’ve said it before, read the reports. Process the info. Dive deep.

Information for this analysis was found via Sedar, The CSE, and Golden Leaf Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.