Much of the focus of cannabis investors has been centered on Canada, and California. This makes sense given that they are the two largest recreational (or soon to be) cannabis markets in the world. However, one publicly-traded company with US-centric cannabis operations has taken a different approach.

iAnthus Capital (CSE: IAN) is listed in Canada on the CSE, but is headquartered in New York and incorporated in Delaware. And unlike other Canadian-listed cannabis companies, most of whom are aiming to get in on the highly competitive green-rush in California and Canada, iAnthus has set its sights on becoming the dominant player on America’s east coast. Join us as we take a Deep Dive into iAnthus Capital.

iAnthus Capital: A Burgeoning Empire on the US East Coast

iAnthus’ strategy centers around building a portfolio of vertically integrated cannabis assets in markets that have significant barriers to entry, i.e., a limited number of licenses. While the Canadian and California markets are both larger than any other single state market in the US, they have low barriers to entry, and as a result have a significantly higher ratio of growers and operators to consumers.

This, combined with the fact that California and Canada are both renowned for their cannabis growing expertise, has led to fears of an ultra-competitive environment where most profits will be competed away as companies fight for market share. The east coast markets where iAnthus’ core assets are located on the other hand have a limited number of competitors, and when combined add up to a population size significantly larger than either California or Canada.

The company currently has a presence in 6 states and is eyeing further expansion. Originally they intended to be strictly an investment firm that would operate under a royalty model, but came to the conclusion that better returns could be had by purchasing strategically located assets outright in markets with limited competition. iAnthus’ portfolio consists of strategic partnerships and minority-ownership investments, in addition to their core assets that they either own 100% of or own a majority of with the option to acquire the remaining equity. The majority of value lies within the core assets on the east coast, but they have made some noteworthy investments in Colorado and New Mexico as well.

The Assets: Core Operations

Grow Healthy – Florida

In January of this year, iAnthus acquired 100% of Grow Healthy Holdings, LLC including fully-owned subsidiaries McCrory’s Sunny Hill Nursery and GHIAA Management. The transaction was for $17.5 million USD in cash, and $30.5 million in iAnthus shares at a valuation of $2.52/share, for a total purchase price of $48 million.

Grow Healthy holds one of just 13 licenses in the entire state of Florida, giving them access to a major US market of 21 million people with very limited competition. The Grow Healthy assets included a 200,000 square foot cultivation and processing center in Lake Wells on a 33 acre campus, which will be capable of producing 18,000 kgs/yr upon completion of the build-out. They currently have at least 4,000 square feet of plant production in operation, and a 15,000 sq. ft. extraction lab and commercial kitchen. Also included is the right to open up to 25 dispensaries across the state, and offer delivery of medical cannabis statewide.

They are currently preparing to open their flagship dispensary in West Palm Beach, and another in Tampa, with another one in Orlando planned to open in Q4. They are already delivering cannabis to Florida patients via delivery service, with 3 vehicles in operation and plan to have 8 delivery vehicles operating around the state by year end.

In addition to gaining control of excellent physical assets and licenses, the Grow Healthy acquisition also came with excellent management. From their investor deck:

Citiva – New York

In February of this year, iAnthus acquired 100% of Citiva for $18 million USD, paid for with $3.6 million in cash, and the remaining $14.4 million in iAnthus shares valued at $2.57/share. Citiva holds one of only 10 licenses in New York State, and includes a cultivation and processing facility, and four dispensaries.

New York is home to approximately 20 million people, and Brooklyn, home of the Citiva flagship dispensary slated to open by year-end, alone is home to 2.6M residents, where Citiva will have only one other competitor. They are also scheduled to open another dispensary in Staten Island by Q4, and will be the only licensed dispensary for the island’s 500,000 residents. In addition, early next year they will be opening two more dispensaries in Dutchess (Population: 300,000) and Chemung (Population: 70,000) counties. Furthermore, they plan to launch home delivery by Q4 of this year.

iAnthus anticipates the closing of its acquisition of 8.2 acres in Orange County New York to be imminent, and will immediately begin construction of its cultivation facility. They expect phase one of the buildout to be completed by February of 2019, which is expected to yield approximately 1,470 kgs/yr. Further to this the entire facility is estimated to be complete by Q1 2021, which will be capable of producing up to 22,000 kgs/yr. In the meantime, they are negotiating wholesale supply agreements with other producers to be able to meet demand in the dispensaries set to open in Q4.

Again, as with the Florida acquisition, iAnthus was impressed by Citiva’s management. Citiva’s management has experience growing and operating multi-million dollar businesses.

Mayflower Medicinals – Massachusetts

In January, iAnthus completed its acquisition of 80% of Pilgrim Rock Management, LLC, the management company that oversees operations at Mayflower Medicinals. Pilgrim Rock owns all of the IP, real estate, and equipment , which it acquired for $11.7 million USD. (Often in the US, dispensaries and cultivators must be non-profits, so there will generally be a for-profit management company that oversees operations and essentially captures the profits). They also have the option to acquire the remaining 20% upon Mayflower applying for one or more additional cannabis licenses.

Mayflower Medicinals operates a soon to be open medical dispensary in a prime Boston neighborhood, and is one of only 3 licensed dispensaries in the entire city of 670,000 residents and 150,000 college students, and one of approximately 35 licenses in the state. They are preparing to launch 2 additional dispensaries, and like in NY and Florida, home delivery is allowed.

Mayflower has a 36,000 sq. ft. cultivation center already in operation, with the first crop expected to be harvested in April. iAnthus expects Mayflower to produce around 500 pounds per month, or about 2,720 kgs/yr. However, perhaps the most attractive aspect of this core asset is that Massachusetts has passed a recreational cannabis law, and is expecting rec sales to launch in Q3 of this year and reach $1.2 billion in sales annually by 2020. Mayflower is also in discussions with other operators to obtain wholesale cannabis to accelerate their launch.

Grassroots – Vermont

As in the other states, iAnthus owns 100% of the for-profit management company that oversees operations for Grassroots Vermont, a non-profit cannabis company. They also provide credit facilities to Grassroots. Grassroots owns and operates a boutique dispensary, and 6,900 sq. ft. craft grow in Brandon, Vermont. They also provide home delivery.

The Vermont market is much smaller than the other markets that iAnthus has operations in and is currently only allowing medical cannabis to be dispensed from retail locations. However, Grassroots grew sales by 48% year over year, is undergoing a $200,000 upgrade to their facilities, and the Vermont legislature recently passed a recreational cannabis law. Unfortunately that bill does not allow for adult use retail sales, but iAnthus anticipates that this will change in the future, given that the state legislature has been studying the potential tax revenue that would be generated from recreational sales.

The Assets: Strategic Partnerships

Reynold Greenleaf & Associates

Reynold Greenleaf & Associates manages three LNPPs (Licensed Non-Profit Producers) across New Mexico, as well as a processing facility. They generate revenue through management contracts, financing, consulting, and real estate and equipment leasing. iAnthus owns 24% of the company, and through their partnership with them manages four licenses that include six dispensaries with two more on the way, a manufacturing/processing facility, and three cultivation facilities.

Organix

Organix is a dispensary in Breckenridge, Colorado. They also operate a 12,000 square foot cultivation center in Denver. iAnthus owns all non-cannabis assets of the company, including all real estate, equipment, and IP.

The Green Solution

TGS is one of the top dispensary operators in Colorado and winner of over 50 cannabis industry awards. They currently operate 13 dispensaries and are planning to open two more. iAnthus has entered into a strategic partnership with them and has provided them with a $7.5 million loan facility for one year.

iAnthus Management – A Source of Strength

iAnthus Capital has been building a strong portfolio of cannabis assets in markets with desirable demographics and limited competition. While most publicly-traded cannabis companies with US operations focused on the western United States, iAnthus saw a potentially far more lucrative opportunity on the other side of the country.

This strategic vision comes from its management who come from backgrounds in finance, real estate, health care, government, and technology. By seeking out best-in-class assets in strategically located markets for investment, and combining that with the expertise and experience of its management, iAnthus is building what it hopes to be a significant competitive advantage over its peers. A quick rundown on some key executives shows the wide breadth of experience they bring to the table.

From the firm’s bios:

Hadley Ford – CEO and Director

Hadley Ford is an investment banking and healthcare veteran with over 20 years of experience in the business world. After spending 14 years on Wall St. with prestigious firms such as Goldman Sachs and Bank of America, he co-founded ProCure Treatment Centers, a chain of cancer treatment facilities. As CEO, he built it into a $100 million+ annual revenue business with 0ver 300 employees.

Randy Maslow – President and Director

Randy Maslow has more than 25 years’ experience as an attorney, investor, and executive in the technology sector. He has co-founded and managed multiple successful startups, and is the founder of Electric Ventures, a technology startup angle investor network.

Julius Kalcevich – CFO and Director

Julius Kalcevich brings more corporate consulting and investment banking experience to the team. Formerly Director of Investment Banking with CBIC World Markets and Oppenheimer, most recently, he was partner at BG Partners Corp., where he oversaw the firm’s cannabis investments.

Carlos Perea – COO

Carlos Perea is another technology and investment veteran with a wide range of experience. He has overseen Intel’s Semiconductor unit, been Managing Director at Entrada Venture Partners, President of Qynergy Corporation, CEO of MIOX, and most recently, President of Nutiva Corporation.

John Henderson – Chief Development Officer

Rounding out the management team is John Henderson, another healthcare, real estate, and technology veteran. Prior to serving with CEO Hadley Ford as COO and CDO at ProCure, Mr. Henderson was President of George B.H. Macomber Company, a construction services firm for healthcare organizations where he managed the development of millions of square feet of healthcare and technology space while growing the company 600%.

What it All Means for iAnthus

The Full Picture

Now that we have a snapshot of the iAnthus team and operations, we can dive into what this means for the business and its investors. iAnthus has licensed operations in the six states mentioned, Colorado, New Mexico, Massachusetts, New York, Vermont, and Florida.

This grants them the ability to operate 8 cultivation facilities, 5 processing / value add facilities, and up to 41 dispensaries. They are also in active discussions for potential partnerships and acquisitions in Oregon, Nevada, Illinois, Ohio, Arizona, and Delaware. Again, from the presentation:

What this all means for investors is that iAnthus Capital has full vertical integration across multiple states and is still growing, aggressively. It is difficult to forecast what this will look like in terms of revenue down the road, but the company expects to be able to generate between $10-12 million in revenue per dispensary annually, as long as they are strategic about site selection.

Assuming that iAnthus opens every dispensary that they are legally entitled to, they could be generating between $400-500 million a year, or perhaps considerably more, within the next few years.

This figure is in line with what is estimated based on their expected production. There was not an estimate available for Grassroots’ annual production. If we assume 500 kilograms in annual production based on the size of their facility, and add that with the 18,000 KG, 22,000 KG, and 2,720 KG that the other facilities are expected to produce, assuming average revenue of $10/gram US we arrive at a total expected revenue of $432,200,000. Furthermore, they are still actively expanding their multi-

state presence, and will likely continue to do so for the foreseeable future, so this figure could grow considerably.

In addition, the fact that they are vertically integrated means that they are able to capture the cultivation margin, the value-add margin (Derivative products, edibles, concentrates, etc.), and most attractively, the retail margin. This, combined with the fact that they are operating in regions with limited competition, should translate into an overall operating margin that is significantly better than most of their publicly-traded peers, both in the US and Canada.

If we factor in a conservative margin of 15%, this translates into earnings of $64,830,000. If iAnthus was to trade at a multiple of 15, which could be way to low considering the multiples investors pay for growth companies, it would give it a market cap of $972,450,000 USD. This is over 5X the current market cap.

Obviously, reality could differ substantially from this projection, it is only meant to be an example. There is no way to be certain of what percentage of product will be transformed into higher margin products, what their average selling price per gram will be, or what sort of retail profits they will gain from selling other manufacturer’s products in addition to their own.

However, while there is no doubt that eventually more licenses will be granted in these jurisdictions, and the landscape will continue to become more competitive, they do not face the immediate concerns of over-supply and fierce competition that will soon be pressuring their Californian and Canadian counterparts. This should allow iAnthus to have excellent margins over the next few years and give them time and cash to continue to expand their presence, resulting in becoming a significantly larger business than they are today.

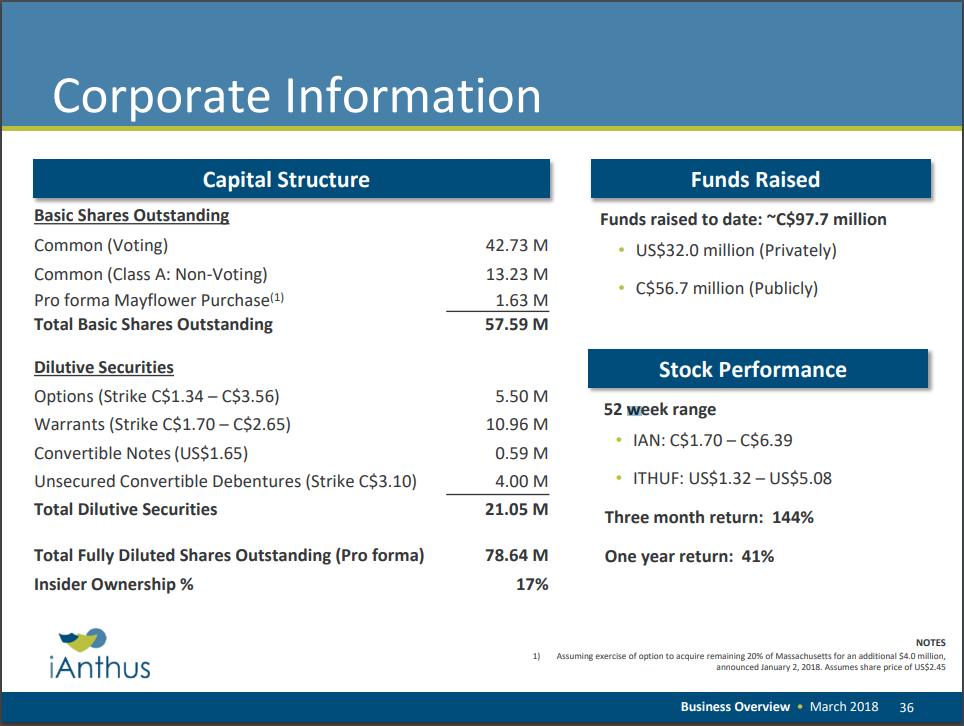

iAnthus’ Valuation

All of this considered, their current valuation looks pretty compelling, at least relative to their peers given their portfolio of assets. As of the time of writing, iAnthus is trading at $2.41 in the US (OTCQB: ITHUF), and $3.0 in Canada (CSE: IAN). Their fully diluted shares stand at 78.64 million. Here is a look at their share structure, as of March 2018.

One of the largest concerns with publicly traded cannabis companies, and a topic that has been covered here at The Deep Dive, is that of incessant dilution. There seems to be a never ending series of bought deals in the sector, and firms don’t always seem to be putting the cash to great use. You could make the argument that some management teams in the sector are overly focused on raising cash and issuing press releases, instead of focusing on creating genuine shareholder value by strategically positioning their businesses to have a real competitive advantage.

So far, iAnthus has been a good steward of investors’ money, and has been only making acquisitions that are truly accretive. The fact that they have a fully diluted market cap of $189,522,400 US, and $243,784,000 CAD would seem to suggest that they are significantly undervalued, again, at least compared to their peers. There are a lot of companies in the sector that have far larger market caps despite the fact that they will likely never have margins or addressable markets that are comparable to what we should see from iAnthus’ east coast operations.

This is where there appears to be great value in having investment bankers at the helm. iAnthus is, after all, not a cannabis producer, in and of themselves. They are more like an investment firm or holding company that makes acquisitions which will deliver shareholder value. Often times, it seems that cannabis companies are raising money and making acquisitions just to avoid falling behind the curve and to appear to be doing something.

This does not seem to be the case with iAnthus, who seems to be far more thoughtful about raising cash and only putting it to use when excellent opportunities arise. That being said, if they are to continue to grow and fund operations they will be taking on additional debt, and issuing more equity. However, thus far they have been able to create a very large presence on the US east coast without diluting equity to the tune of hundreds of millions of shares or drowning the firm in debt.

Going forward, there are a number of catalysts over the next two years that could boost iAnthus’ share price. They will be opening several dispensaries in NY, Florida, and Mass, starting and completing construction of their facilities, harvesting their first crops, and adding more vehicles to their delivery fleet. Furthermore, the upcoming summer launch of recreational sales in Massachusetts will likely give investors something to be excited about. Not to mention, should either Florida or NY, let alone both, decide to legalize recreational cannabis in the not too distant future, the benefit for iAnthus would be massive.

Risks and Concerns

Considering all of the above information, iAnthus Capital looks cheap. So what gives? Well, first and foremost, they operate in the US where cannabis – medical or otherwise – is illegal at the federal level. iAnthus, and indeed the entire sector, was on a tear earlier this year until US Attorney General Jeff Sessions threw cold water on the fire. He rescinded the Cole memorandum, an Obama-era guideline that prevented federal prosecutors from targeting cannabis businesses as long as they were in compliance with their state laws.

This introduced a great amount of fear and uncertainty into the sector, and started an immediate correction. Though admittedly, the sector was looking very pricey and was probably due for a pullback anyway. Here we are a few months later, and the US Congress has once again attached protections for medical marijuana businesses to the budget. However, it does not protect recreational businesses.

At this point, a federal crackdown seems very unlikely as Sessions has made no move against the industry, and has given no indication that one is imminent. And according to many political pundits, Sessions could be the next Trump cabinet member to be fired – which would be another excellent catalyst for the sector. Nevertheless, this is a real risk that investors must be aware of and it appears to be reflected in share prices across the sector for firms with US assets. Even if there is no legal action coming, the mere uncertainty could continue to hang over the sector like a dark cloud, keeping many investors on the sidelines.

Were cannabis legal in the US or at least fully protected from federal intrusion, iAnthus would likely be trading much higher than it currently is. At the same time, were it legal at the federal level, the increased competition from other producers and investors chasing deals would potentially be an issue for the iAnthus business model.

Another concern that investors should be aware of, is that despite the fact that iAnthus doesn’t have a ton of debt and dilution yet (at least relative to much of the sector), it will require much more cash to continue its expansion plans, let alone any new deals that arise. There is a risk across the sector that firms will spend massive amounts of cash building infrastructure, diluting equity and taking on debt in the process, only to see the profits be competed away. iAnthus has positioned their business in a way that allows them to lay a strong foundation before the market becomes flooded.

Despite the strong strategic position they have created by entering markets with barriers to competition the day is coming when these markets will have a much higher level of competition than they have currently. If and when Florida and New York adopt recreational cannabis laws (a question more of when than if, in my opinion), they will most likely allow many new entrants to the market. That being said, having a thriving medical cannabis presence and well located dispensaries should give them a first mover advantage to some extent. They may want to consider continuing to add further capacity in those states ahead of any anticipated change in the laws, so that they are better able to take advantage of the market expansion in an accelerated manner before the rush of new entrants.

Conclusion

All in all, iAnthus Capital has done an excellent job at building a strategic multi-state presence that could potentially translate into a competitive advantage. Their acquisitions have been smart, and they have managed to execute them without giving away the farm so to speak. They have excellent management, great assets, and a strong business model. The full vertical integration that they enjoy in their markets allows them to weather the eventual storm of competition that will put pressure on margins better than most.

The combination of great entrepreneurs with investment bankers at the helm is compelling, and provides a certain measure of confidence in the business. However, the fact that they operate in the US adds an extra layer of risk and uncertainty. That being said, they trade at a significant discount to many of their peers in the sector, and will likely not stay this cheap for very long provided there is no federal crackdown. For investors with the risk tolerance for US cannabis assets, iAnthus Capital is worth a look.

Disclosure: The author of this article has a long position in iAnthus Capital. This is not a recommendation to buy or sell any security, and merely represent the opinions of the author. Do your own research before making any investment decisions.

All information within this report comes from publicly-available information gathered from the iAnthus Capital website, their investor presentations, their financial filings on Sedar, NASDAQ Globenewswire, and NASDAQ Market Wired.