Although the peak of the coronavirus pandemic is supposedly beginning to subside given that states are starting to ease restrictions and stay-at-home orders, the recovery of the US economy still has a long way to go. Despite the increasing prospects of a V-shaped or U-shaped economic recovery- depending on how pessimistic or optimistic one is, the permanent economic damage often gets overlooked.

According to a recent report by Coresight Research, by the end of 2020, up to 25,000 mall-based retailers could cease to exist for good. After the US economy was battered down with months of lockdowns, unemployment, and dwindling consumerism, many US retailers can no longer remain viable even after an economic recovery. Many businesses became delinquent on rent payments, which quickly amassed to large sums, given that some commercial landlords remained unforgiving even during times of crisis.

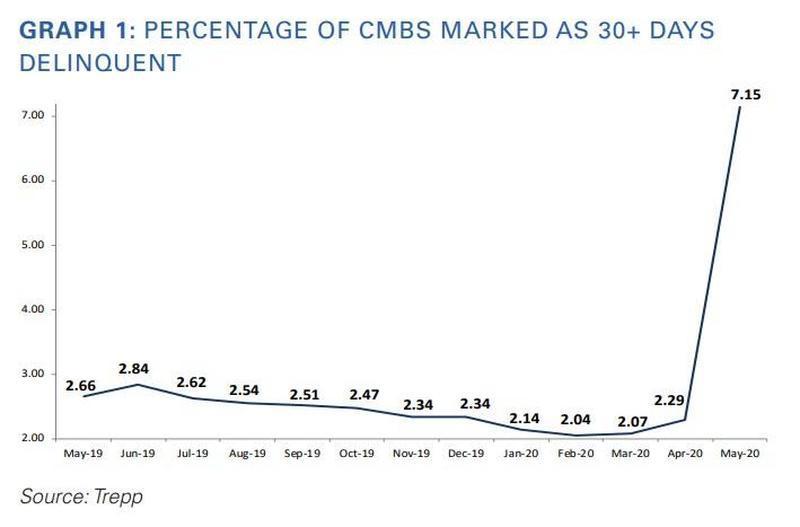

However, landlords also have good reason to worry about their financial situation as well. As a result of increasing store closures, commercial real estate in the US has been deteriorating. According to remittance data compiled by Trepp, there has been a significant increase in delinquent commercial mortgage-backed securities (CMBS). Back in April, the delinquency rate was at 2.29% – however, by May the rate skyrocketed to 7.15%.

However, unpaid rent is not the only variable causing for a demise in retailers. Consumer preferences have also shifted towards online-based shopping, which became even more prominent during pandemic stay-at-home orders. Nonetheless, the damage is already becoming evident, as US retailers have already planned for 4,000 permanent store closures, including Neiman Marcus, JC Penny, Pier 1 Imports, Stage Stores, L Brands, and Tuesday Morning.

Information for this briefing was found via Coresight Research and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.