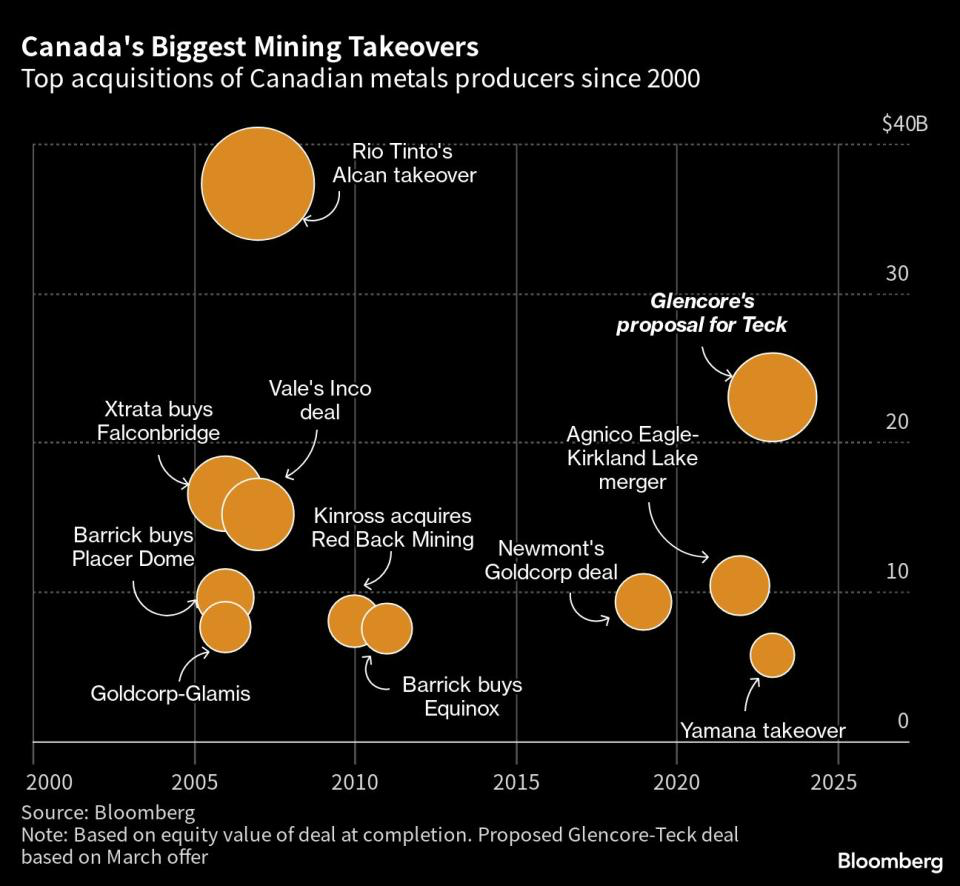

The mining M&A space has been rustled recently with the news that Glencore extended an unsolicited proposal to acquire Teck Resources Limited (NYSE: TECK) in an ambitious $23 billion bid.

The Swiss miner’s offer was an all-share acquisition of Teck, representing a 20% premium on the offer date. But it also indicates a desire to proceed with the simultaneous (or near simultaneous) demerger of the merging firm’s combined thermal and metallurgical coal activities as well as its ferro-alloy operations into a new publicly traded business.

While a spinoff of its coal business is aligned with Teck’s move to evaluate alternatives for its steelmaking coal operation, the Canadian miner rejected the “opportunistically timed” bid.

“The Glencore proposal would expose Teck shareholders to a large thermal coal business, an oil trading business and significant jurisdictional risk, all of which would negatively impact the value potential of Teck’s business, is contrary to our ESG commitments and would transfer significant value to Glencore at the expense of Teck shareholders,” said CEO Jonathan Price.

Instead of the rejected proposal, the Teck board is recommending shareholders vote in favor of its own separation plan, dividing the firm into Teck Metals and Elk Valley Resources. The vote is scheduled for April 26.

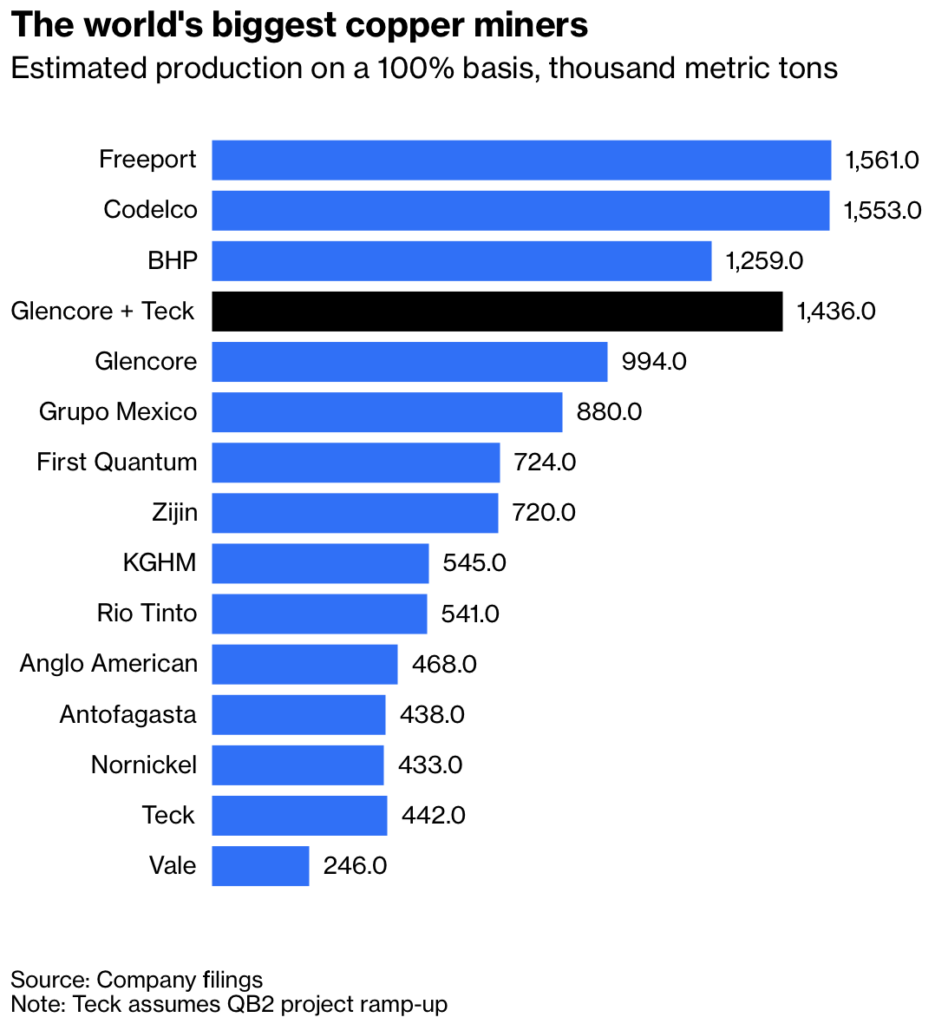

Glencore’s move, as characterized by Teck, is seen as a rally for the potential of the copper business. And if the Swiss mining giant decides to continue its plan to acquire the Canadian miner, it has less than three weeks to convince shareholders to vote down the Teck board’s proposed separation plan. Because of Teck’s dual class of shares, if the split goes through, Glencore’s takeover attempt would be practically dead.

If it goes through, it will be the second-largest mining acquisition in Canada, where some of the industry’s most significant transactions have occurred in the last two decades. So far, Rio Tinto Group’s 2007 purchase of aluminum-maker Alcan Inc. is still the largest takeover of a metals producer in Canada.

But by suggesting Teck to spinout its coal business, Bloomberg’s Javier Blas said that Glencore is inadvertently also putting a “for sale” sign above its company. And only one firm currently has the potential interest and means to acquire them: BHP Group Ltd.

“If a Glencore-Teck tieup is the most logical deal today in global mining, a BHP-Glencore merger is perhaps the second – and most transformative – one,” wrote Blas.

COLUMN: Unwittingly or not, Glencore has put the "for sale" sign above the company — a placard visible to the only company that has the potential interest and means to acquire them: BHP Group | $GLEN $TECK $BHP https://t.co/ZG2uw8GhzM

— Javier Blas (@JavierBlas) April 6, 2023

BHP purchased Australian copper miner OZ Minerals Ltd for more than $6 billion in November, paying a premium of 49% above the share price of OZ Minerals before the takeover talks began.

Glencore, according to Blas, has been hesitant to break away with its enormously profitable coal sector. Nevertheless, by offering to integrate it with Teck’s and subsequently spin it off, he has supplied BHP with a roadmap.

“Once you spin off coal, and divest agriculture and energy trading, all that’s left is mining and, crucially, metals trading – the perfect fit for BHP,” he added.

If ever it happens, BHP’s acquisition of Glencore would be one of the biggest moves in the mining industry as of late.

Meanwhile, Copper futures rose above $4 per pound, rebounding from a two-week low of $3.98 on April 4th amid continued supply concerns.

Experts have long warned that copper stocks are running dangerously low. And now with a rebound in Chinese demand and the metal’s crucial role in the move toward decarbonization, the world is running the risk of depleting copper stockpiles very soon.

According to Goldman Sachs, Chinese copper demand grew 13% last month compared to the year before. If this trend continues, the world could run out of visible copper inventories by the third quarter of this year.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.