Last week, Alamos Gold Inc. (TSX: AGI) reported its fourth quarter and full-year production results, as well as their 2022 to 2024 production estimates.

For the fourth quarter, Alamos Gold produced 112,500 ounces of gold, bringing the full year 2021 production to 457,200 ounces, which was the lower range of guidance. Costs have not yet been finalized but the company says that it is expected to be consistent with their guidance.

The company also provided 2022 guidance, which included expected gold production of 440,000 to 480,000 ounces. Cash costs are expected to be between $875 to $925 per ounce and all-in sustaining costs are to be between $1,190 to $1,240 per ounce. Total capital expenditures will be between $305 and $345 million, while exploration is expected to cost $27 million for 2022.

For the longer run, the company expects these numbers to grow to 460,000 to 500,000 ounces of gold in 2024, with cash costs of $650 to $750 per ounce and $950 to $1,050 of all-in sustaining costs per ounce.

Currently Alamos Gold currently has 13 analysts covering the stock with an average 12-month price target of C$12.46, or a 36% upside to the current stock price. Out of the 13 analysts, 1 has a strong buy rating, 6 have buy ratings, 5 have holds and 1 analyst has a sell rating. The street high sits at C$17.50 or a 91% upside to the current stock. While the lowest price target sits at C$9.98.

In Haywood Capital Markets’ note, they reiterate their buy rating but lower their 12-month price target from C$15 to C$12.75, saying, “lower production and higher costs for 2022,” and that inflation is finally starting to impact the production costs.

For the fourth quarter and full-year production numbers, they came in line with Haywood’s estimates although they note that the full-year production numbers came in the lower half of guidance.

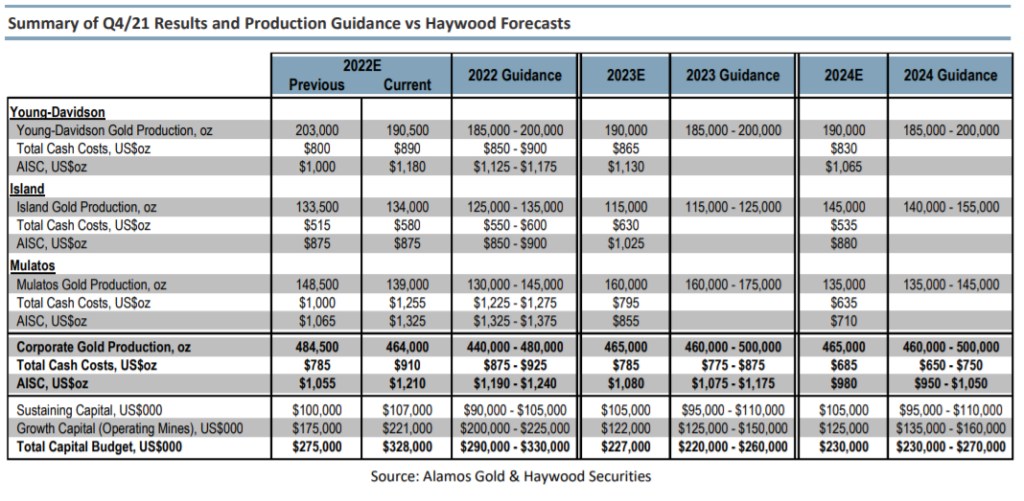

For the companies three-year guidance, Haywood expected 2022 production to be 485,000 ounces, below their high-end figure. While cash costs were expected to be $785 per ounce, lower than their guided number. This is the same for all-in sustaining costs as Haywood expected it to be $1,055 per ounce. Haywood says that this cost increase in 2022, “is due to industry-wide cost inflation as well as temporary higher costs at Mulatos.”

Below you can see Haywood’s estimates versus the company’s guidance.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.