Last Week, Equinox Gold Corp (TSX: EQX) announced the acquisition of Premier Gold Mines (TSX: PG). Each Premier shareholder will receive 0.1967 shares of Equinox Gold for each share held of Premier, which is the weighted 10-day volume-weighted average closing price. Premier will also spin off its US-focused gold production and development company i-80 Gold Corp as part of the transaction.

Equinox Gold currently has ten analysts covering the company with a weighted 12-month price target of C$22.60. One analyst has a strong buy rating. The majority, seven analysts, have buy ratings, and two analysts have hold ratings.

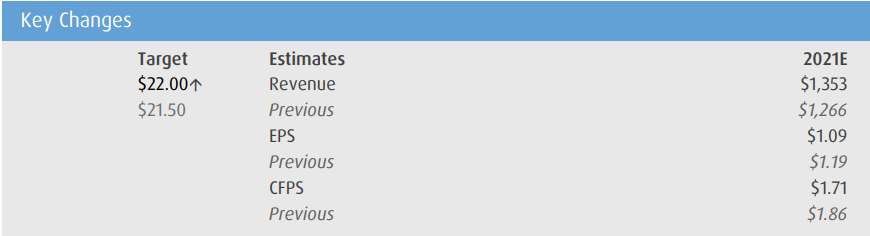

BMO Capital Markets analyst Ryan Thompson this morning raised their 12-month price target to C$22 on the equity, up from C$21.50, and reiterated their outperform rating on Equinox. Thompson headlines, “If You Want Growth (You’ve Got It)” and says that long term investors should like this deal, and he is not surprised that this deal is dilutive near term as the Mercedes mine is smaller.

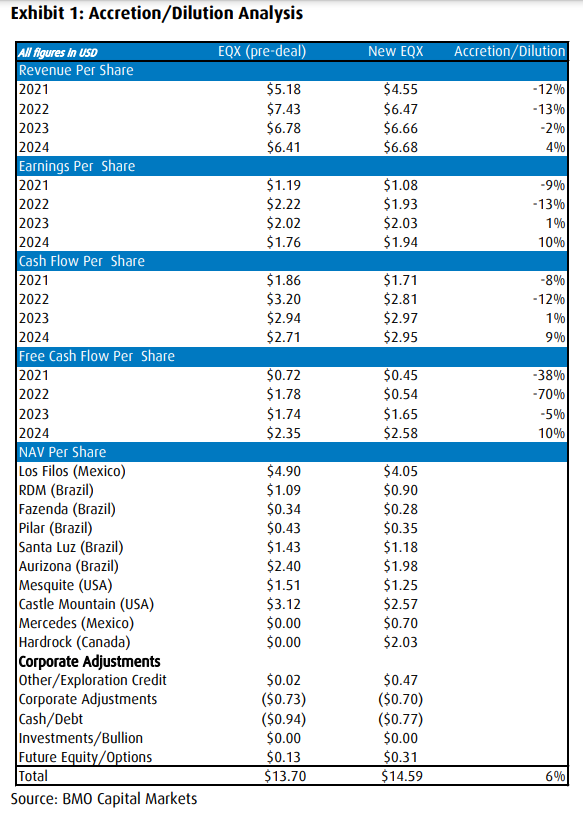

The real value comes from the development project Hardrock, which won’t go into production until 2023 based on BMO’s model, which then the deal will become EPS/CFPS accretive. He says that after integrating the Premier assets into their model, they see the purchase being 6% accretive to their Net Asset Value to share price. Thompson adds, “dilutive on 2021/2022 EPS/CFPS, but accretive on 2023/2024 EPS/CFPS.”

The next thing Thompson comments on is that the “Growth pipeline goes from full to fuller.” Before this deal, Equinox was already restarting its Santa Luz project, which is expected to grow to 350,000 ounces per year in 2020. This is on top of Castle Mountain Phase 2, which is scheduled to be completed in 2024, which will bring production up from 40,000 ounces per year to 200,000 ounces per year. Then there is also Harrock, which would grow production further by another 200,000 ounce per year. Thompson comments, ” we see a scenario where EQX could get to ~1Moz/yr in 2022 (pre-Hardrock) and nearing 1.2Moz by 2023/2024.”

Thomspon says they believe that Equinox can fund all this growth. BMO models roughly $1.1 billion of growth CAPEX between 2021-2023, plus an additional $315 million in sustaining CAPEX for a total CAPEX of approximately $1.4 billion. BMO’s current forecasts show Equinox will have $2.2 billion of cash from operations during that time. Thompson writes, “We think the breakeven gold price is ~$1,400/ oz, offering a large margin of safety from current prices. Further, we would not be entirely surprised if EQX looks to divest some of its smaller assets.” Thompson says specifically Solaris and i-80 could be other sources of liquidity if needed.

Below you can find BMO’s key estimate changes to reflect Premier’s assets.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.