FULL DISCLOSURE: This is sponsored content for Alaska Energy Metals.

Alaska Energy Metals (TSXV: AEMC) has closed off a small side car financing as part of its ongoing financing, raising proceeds of $341,250. The closing follows the firm raising $3.3 million in the first tranche of an upsized financing amid several corporate changes that are set to occur at the board level.

The side car financing saw 2.275 million units of the company sold at $0.15 per unit, with each unit containing one common share and one purchase warrant. Each warrant is valid for a period of three years at an exercise price of $0.20 per share.

The side car offering has similar terms to the larger special warrant offering, which will see special warrants convert to units that contain the same terms. That larger offering saw the first tranche close this week, raising proceeds of $3.3 million, while upsizing the overall placement size to $3.5 million.

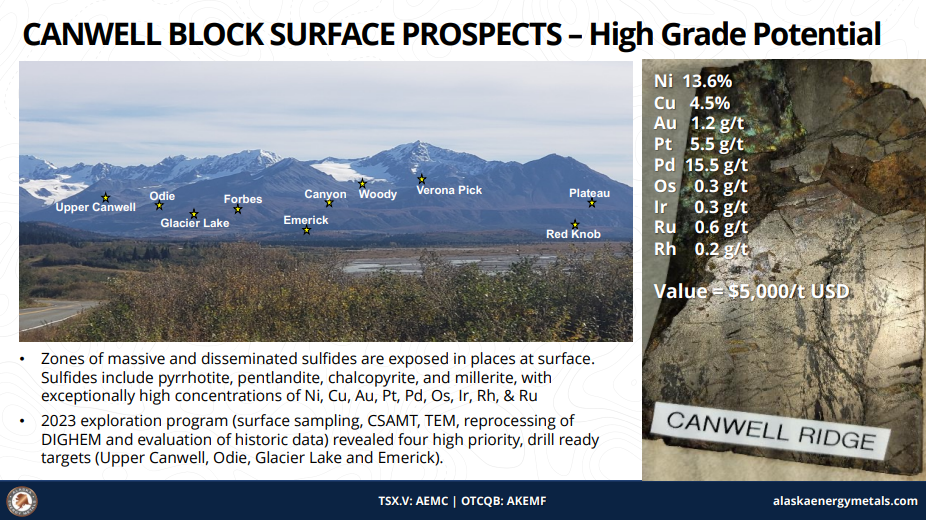

Proceeds from the financings are to be used for drill testing the Canwell prospect at the firms Nikolai Nickel project in Alaska, as well as for conducting metallurgical studies, working capital, and marketing.

A total of three holes are set to drill test the prospect, which is found near to the Eureka deposit and is prospective for copper, cobalt, chrome, iron and precious metals. The drill program is said to total 1,200 metres in aggregate.

The fundraising follows the firm announcing that it will be revamping its board of directors, with the company nominating several executives associated with K92 Mining, including former CEO Ian Stalker. Stalker, currently executive chairman of Bradda Head Lithium, has been involved in raising over US$750 million in capital markets for mining projects.

Additional nominations for the board include Mario Vetro, a successful financier in the resource industry and a co-founder of K-92 Mining, with transactions under his belt ranging from $100 million to $1.5 billion in size, as well as Tyron Breytenbach, a former top metals analyst and geologist focused on magmatic nickel deposits. Paul Matysek, a mine developer and known serial entrepreneur that has developed and sold six mining companies, meanwhile is set to join the firms advisory board.

Alaska Energy Metals last traded at $0.145 on the TSX Venture.

FULL DISCLOSURE: Alaska Energy Metals is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Alaska Energy Metals. The author has been compensated to cover Alaska Energy Metals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.