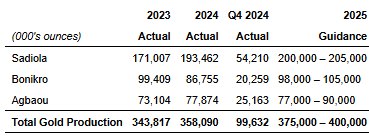

Allied Gold (TSX: AAUC) has released its guidance for 2025, calling for production of 375,000 to 400,000 ounces of gold for the year. The figure represents growth of 8% on a midpoint basis from 2024’s production level of 358,091 ounces.

The guidance is said to be based on Allied’s fourth quarter performance, which saw the production of 99,632 ounces of gold following the Sadiola Mine seeing a full quarter of production from oxide ore. The majority of production in 2025 is expected to come from Sadiola, which on a standalone basis is expected to produce 200,000 to 205,000 ounces of gold this year.

Production in 2025 is said to be back-half weighted, similar to 2024, as a result of mine sequencing.

On a costing basis, mine-site level all in sustaining costs are forecasted to be between $1,690 to $1,790 an ounce. In terms of capital costs, $352 million in expected to be spent on expansionary projects, the bulk of which ($280 million) will be spent at Kurmuk, while $100 million has been allocated to sustaining capital and $20 million has been earmarked for exploration.

Costing is based on a gold price of $2,500 per ounce, with every $100 increase in the realized price of gold contributing $15 to all in sustaining costs as a result of current royalties in place.

In terms of mineral reserves and resources, as of December 31, Allied Gold has reserves of 10.8 million gold ounces at a grade of 1.42 g/t, along with measured and indicated resources of 15.7 million ounces at a grade of 1.49 g/t. Inferred resources currently sit at 1.4 million ounces at 1.33 g/t.

Allied Gold last traded at $4.35 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.