On February 10, 2022, Altus Midstream Company (NASDAQ: ALTM) shareholders voted to approve its business combination with the private company BCP Raptor Holdco LP. The merger should close by the end of the month following this approval.

Altus is a high-yielding (9.0% dividend yield) energy company which owns minority stakes in a total of four natural gas, one natural gas liquids and oil pipelines — two of which are located in the U.S. Permian Basin and are underpinned by very attractive, long-term take-or-pay contracts — as well as a midstream gas business. BCP Raptor has a similar set of assets.

According to the transaction with BCP Raptor, Altus will issue 50 million shares to the private company in exchange for its midstream assets and pipeline ownership stakes, bringing total shares outstanding for the pro forma company to about 66.5 million, and its expected enterprise value (EV) to around US$8 billion. The combined company should generate aggregate free cash flow (or distributable cash flow) of perhaps US$10 per Altus share.

Given the company’s free cash generation potential, Altus’ 50 million share issuance, and the consequent significant increase in its liquidity, could be key to value creation for shareholders. Investors seem unlikely to require a now-liquid stock with a safe US$6.00 annual dividend to maintain a 9% dividend yield. If the market were to eventually require Altus to carry a smaller 8% yield, its resultant share price would be US$75.00 (versus US$69.28 currently).

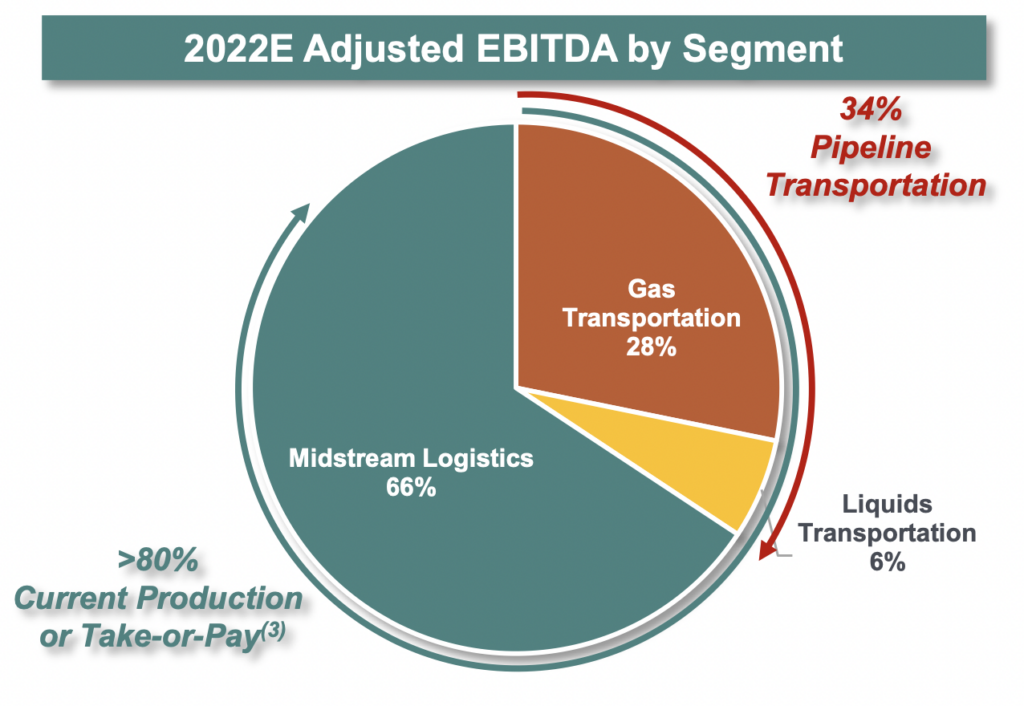

In more detail, Altus’ management estimates that pro forma 2022 adjusted EBITDA will be around US$800-US$850 million, more than 80% of which stems from pipeline take-or-pay contracts and current midstream production levels. In addition, capital expenditure requirements are fairly minimal. All this seems to imply that the resulting 10x EV/EBITDA valuation is reasonable. Perhaps more importantly, management is committed to maintaining the US$6.00 annual dividend through 2023 and to target annual dividend increases of 5% or more thereafter.

Two developments in the U.S. energy industry since Altus/BCP Raptor’s October 2021 merger announcement seem to further bolster the resultant company’s valuation case. First, most analysts now believe that given soaring natural gas prices and regulators’ increasingly frowning on drillers’ flaring of natural gas into the atmosphere, additional gas transmission capacity will be needed in the Permian Basin by late 2023 or early 2024. This need to build new capacity likely only makes Altus’ pro forma 53% and 16% stakes in the currently operating 2.1 billion cubic feet-per-day (Bcf/d) Permian Highway and 2.0 Bcf/d Gulf Coast Express Pipelines, respectively, even more valuable.

Second, in early January 2022, Enterprise Products Partners L.P. (NYSE: EPD), one of the U.S.’s largest providers of midstream energy services, acquired Navitas Midstream Partners, LLC for US$3.25 billion, equivalent to about nine times Navitas’ EBITDA. Navitas provides midstream services in the Midland region of the Permian Basin. Pro forma Altus’ midstream business is currently valued at only about an 8x EV-to-EBITDA multiple.

Little-known Altus could represent an interesting candidate for a yield-oriented portfolio. The upcoming closing of the Altus-BCP Raptor merger could be a catalyst for the stock, as could its near-term ex-term dividend date (late February 2022).

Altus Midstream Company last traded at US$69.28 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.