Amazon.com Inc (NASDAQ: AMZN) announced that it will be reporting its third quarter results on October 28th with their call set for 4:30. The consensus revenue estimate between 42 analysts is $111.571 billion, which is near the high end of the $106 – $112 billion guidance provided by Amazon. Analysts expect gross margins to be 42%, and a net income of $4.577 billion.

Amazon currently has 56 analysts covering the stock with an average 12-month price target of $4,140.64, or a 21% upside. Out of the 56 analysts, 20 have strong buy ratings, 34 have buy ratings and 2 analysts have hold ratings. The street high on Amazon sits at $5,000 from Susquehanna Financial while the lowest comes in at $3,775.

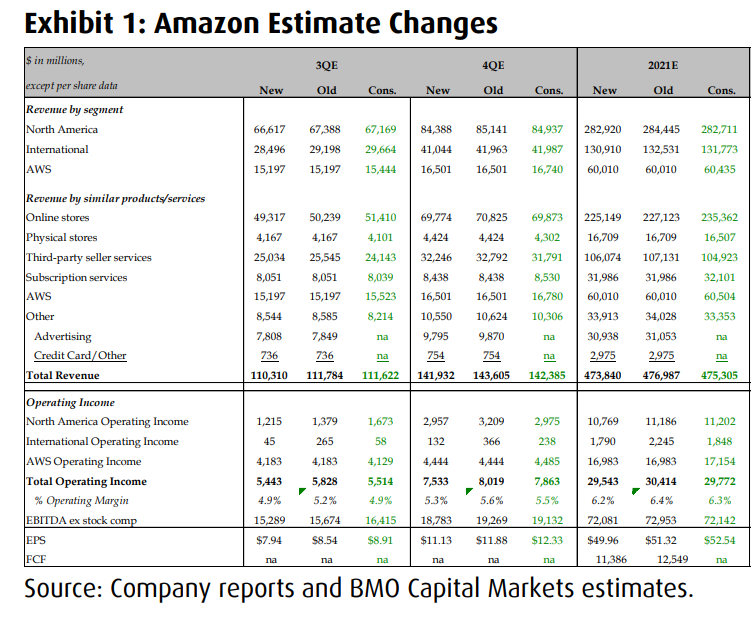

BMO Capital Markets reiterated their $4,100 12-month price target and Outperform rating in a note which outlines their third-quarter preview, saying that they remain focused on how Amazon talks about their supply chain situation and what BMO calls “tough comps.” Because of this, they have lowered some near-term estimates but believe that Amazon’s AWS will see strong demand and advertising will “move to a new level.”

The three major changes to BMO’s model start with the lowering of online stores and third-party sellers revenue for the second half of 2021, primarily due to ongoing supply constraints. To somewhat counteract that, they have increased advertising revenue for the fourth quarter due to Amazon having exclusive streaming rights for Thursday Night Football. Lastly, they are estimating lower margins for the second half of 2021, “to better reflect heightened seasonal hiring trends.”

Below you can see BMO’s updated third and fourth quarter as well as full year 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.