As internet sleuthing continues, it’s slowly becoming clear exactly as to why AMC Entertainment (NYSE: AMC) this morning revealed a $27.9 million investment into an entirely unrelated mining operation known as Hycroft Mining (NASDAQ: HYMC).

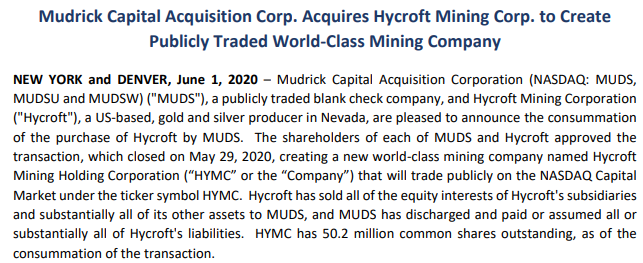

As it turns out, back in mid-2020, Hycroft Mining was acquired by Mudrick Capital Acquisition Corporation, a blank check company, also known as a SPAC. The transaction saw the firm go public with a $110.0 million senior secured credit facility provided by Sprott Private Resource Lending, as well as a $30.0 million 1.5% NSR. Share purchases meanwhile included $25.0 million in forward purchases from the SPAC itself, while $75.96 million came from shareholders of Hycroft, among which was Jason Mudrick, CEO of the SPAC.

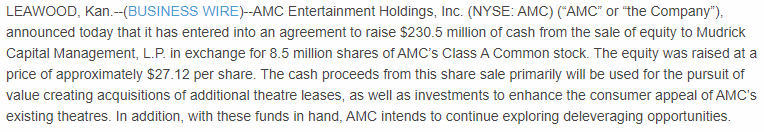

Long term shareholders of AMC Entertainment here likely already note the connection. Jason Mudrick, as well as Mudrick Capital, are part of the reason that AMC as a whole exists today. In June of last year, Mudrick invested $230.5 million into the company, acquiring 8.5 million shares of the firm at $27.12 per Class A share.

At the time, AMC CEO Adam Aron commented that “With this agreement with Mudrick Capital, we have raised funds that will allow us to be aggressive in going after the most valuable theatre assets, as well as to make other strategic investments in our business and to pursue deleveraging opportunities.”

Mudrick then subsequently unloaded the shares on day traders for quick gains, indicating to Bloomberg the same day that it had already sold out of the position, commenting that the company was “overvalued.”

AMC is playing on offense again with a bold diversification move. We just purchased 22% of Hycroft Mining (NASDAQ: HYMC) of northern Nevada. It has 15 million ounces of gold resources! And 600 million ounces of silver resources! Our expertise to help them bolster their liquidity. pic.twitter.com/LihqZguwnd

— Adam Aron (@CEOAdam) March 15, 2022

With this mornings announcement that AMC Entertainment would be acquiring 23.4 million units of Hycroft at just $1.193 per unit for $27.9 million, it appears that the entire investment is simply a “I’ll scratch your back if you scratch mine,” scenario. The investment saw the theatre chain acquire 21.8% of the gold and silver producer, which enabled Hycroft to extend its debt from 2025 to 2027.

Mudrick Capital notably remains a large shareholder of Hycroft, with 24.4 million shares held, which amounted to a 40% stake in the firm prior to this mornings announcement.

Evidently, the two firms are not so “unrelated” after all. It appears unclear what “expertise” AMC intends to provide to the firm.

Starting to make a bit more sense. Mudrick bails out $AMC, Aron bails out Mudrick’s busted SPAC. pic.twitter.com/lOTrIeScdO

— Keubiko🇺🇦 (@Keubiko) March 15, 2022

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.