Advanced Micro Devices (NASDAQ: AMD) opened 3% higher but ultimately closed down 1.4% the day after the firm released its first-quarter results this week, which generally beat analyst expectations. The company announced first-quarter revenue of $3.44 billion, a gross margin of 46.1%. Net Income for the first quarter was $555 million, or a 16.1% net margin, and earnings per share of $0.45.

A number of analysts changed their price targets off the back of AMD’s earnings, bringing their average 12-month price target slightly higher from $102.50 to $104.44 from a total of 39 analysts who cover the name.

Below are the most recent analyst changes as of the time writing:

- UBS raises target price to $100 from $95

- JP Morgan raises target price to $105 from $100

- Summit Insights group cuts to hold rating

- Susquehanna raises target price to $125 from $115

- Mizuho raises target price to $107 from $105

- Truist Securities raises target price to $102 from $101

- Raymond James raises target price to $110 from $100

- Northland Capital raises target price to $116

- BOFA Global Research raises price objective to $110 from $100

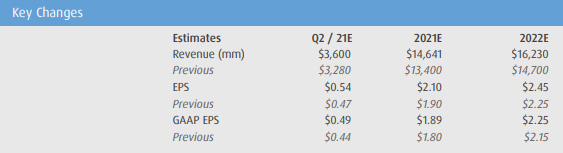

In BMO’s earnings note, their analyst, Ambrish Srivastava, reiterated BMO’s underperform rating and $75 12-month price target. He said that the company posted a solid set of results and higher forward guidance. As a result, BMO has raised their second quarter, 2021, and 2022 estimates to be in line with this quarter’s beat and updated guidance.

PC/GPU drove most of the revenue beat this quarter, with the segment accounting for $2.1 billion, up 46% year over year. While revenues from server/console leveraged businesses were $1.35 billion, up 286% year over year. Srivastava writes, “We believe that server units grew sequentially, leading to further share gains for AMD. The company expects data center revenue to grow significantly through the year with ramps from cloud, enterprise, and HPC customers. AMD also expects data center GPUs to contribute to data center growth as the year progresses.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.