On August 30, Alimentation Couche-Tard Inc. (TSX: ATD.B) announced its fiscal first quarter financial results for the period ending July 17, 2022. The company announced that revenues came in at $18.66 billion, up roughly 38% year over year. Though merchandise and service gross profits remained flat on a year-over-year basis, coming in at $1.4 billion.

The company saw a jump of almost 25% in its road transportation segment, rising to $1.44 billion. This brought the company’s overall gross profit to $2.88 billion, or an increase of 11% year over year. Net income for the quarter was $872.4 million, or earnings per share of $0.85 compared to the $764.4 million and $0.71 the company reported last year.

Alimentation Couche-Tard saw its margins for its merchandise and service segments remain steady year over year at 34.4%, while it saw a boost in its road transportation fuel margin, growing between 19% and 33.3%.

Alimentation Couche-Tard currently has 17 analysts covering the stock with an average 12-month price target of C$65.51, or an upside of 16%. Out of the 17 analysts, four have strong buy ratings, ten have buy ratings, and the last three analysts have hold ratings. The street high price target sits at C$69.00 and represents an upside of almost 40%.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and $70.00 12-month price target on the stock, saying that the company saw a beat thanks to high fuel margins while also seeing a smaller uptick in operating expenses.

On the results, BMO says that the reported earnings per share of $0.85 were ahead of their $0.69 estimate as “Couche-Tard realized fuel margins well above our expectations.” While the company’s operating costs, “inflated at a much lower level than we projected.”

BMO was expecting, based on OPIS data, that Alimentation Couche-Tard would have reported an average full margin of 41 cents per gallon, with the U.S fuel margin sitting at 45 cents per gallon. The company actually reported a fuel margin of 49 cents per gallon.

The company saw its operating expenses, excluding “certain items that are not considered indicative of future trends,” increase by 7.3%. This is lower than the 12% BMO was expecting and much lower than the growth during the previous two months. As a result, BMO believes this shift showcases that the rapid rise in labor, energy, and rent expenses “may be subsiding.”

BMO notes that their thesis on the stock is that even during periods of oil price declines, Couche-Tard’s retail fuel margins are typically higher than the industry average and is slow to bring down the price at the pump. They write, “Couche-Tard has proven itself to be a resilient business in the face of the many COVID related challenges of the last two years.”

Lastly, BMO says that their fiscal 2023 estimates would mean that the company is trading at a 9.3x EBITDA, while historically, the company trades between 10x and 12x forward EBITDA.

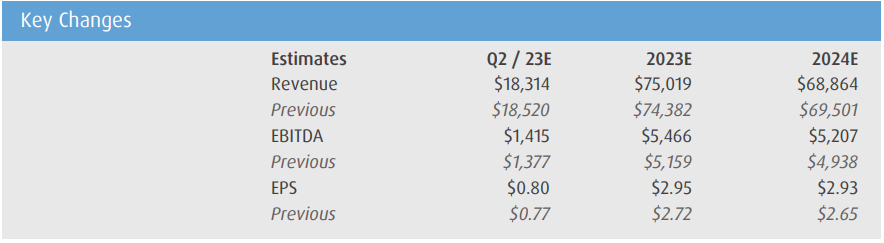

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.