For those focused on the cannabis sector, you’re likely aware of a drama that has been brewing in the background related to that of Medmen Enterprises (CSE: MMEN). With multiple sources indicating that suppliers have not been paid, and that the company is currently renegotiating with vendors to decrease payables, social media has been bustling to get to the bottom of things. And it appears that The Green Market Report is the one who takes the cake, with the firm publishing a Q&A with that of Medmen CEO Adam Bierman related to the rumours.

The problem with the Q&A however, is that Bierman makes several claims within the interview that run counter to public filings, as well as with what has been indicated in leaked emails with that of suppliers.

First and foremost, it appears that the emails, which Bierman confirmed, are the result of Medmen contracting out certain restructuring processes to that of FTI Consulting. The stopped and delayed payments to venders were referred to as being “commonplace in the restructuring of a retailer.” The restructuring process, as per Bierman, is “30 days away from being out the other end.” This comment was then followed by the CEO claiming that the firms cash position is very healthy, and that the firms balance sheet is strong.

Lets look at this first.

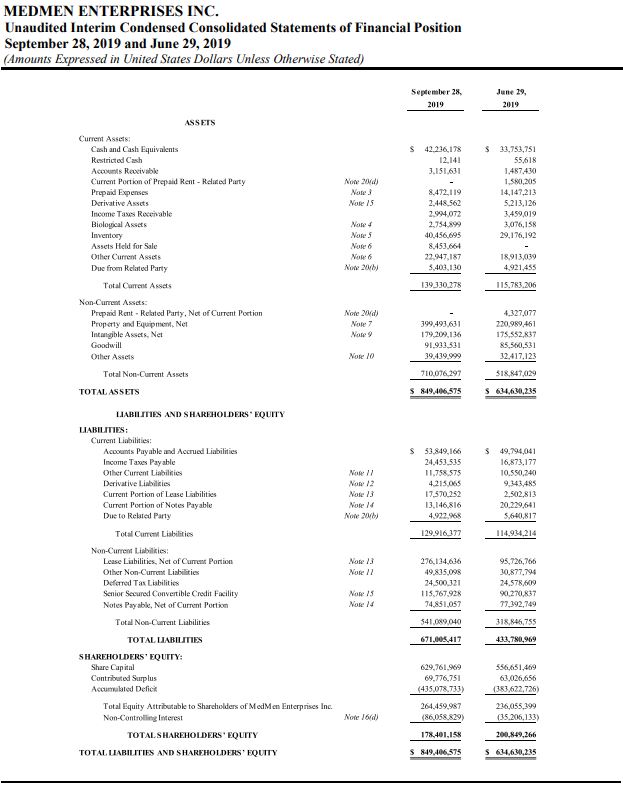

First, Bierman claims that Medmen’s balance sheet is quite strong. At first glance, this claim is questionable based on the latest filings. As of September 28, the firm had $42.2 million in cash on hand, as you can see above – and $53.8 million in accounts payable. Here is where current shareholders will point out the positive working capital experienced by the firm – thus, there shouldn’t be an issue.

However, lets look at that a bit more in depth. First, inventory rose from $29.1 million to that of $40.4 million over the quarter, while revenues for the quarter are sitting at $43.9 million. This means there’s effectively more than an entire quarters worth of inventory sitting in Medmen’s vaults right now – thus, it doesn’t translate to cash overly quick. Second, receivables are growing, as are funds due from related parties – timing of receiving these is questionable at best, and won’t do much good in a short term liquidity crunch.

Let us also consider that Medmen had negative operational cash flow of just under $44.0 million last quarter – which is a figure larger than the current cash position as per filings. While subsequent funds have come in to company coffers since the last reporting period – our estimates based on filings indicate approximately $64.3 million, which doesn’t include the announced $54 million asset sale due to no final definitive filings indicating cash transfer – given that the firm burns approximately $14.65 million per month on operations, this does not give Medmen much breathing room.

Given the date of last filing, its estimated that the company has burnt approximately $58.6 million in operational cash flow in the time since. Combined with the confirmed closing of $64.3 million via subsequent asset sales as well as equity raises, the firm is likely sitting at a cash balance of sub $50 million at the time of writing – or a little over three months of OpEx – not something that we would classify as being a healthy cash position, or a strong balance sheet. At least, not until the additional $54 million in asset sales finally close, which still won’t provide a whole lot of breathing room for the firm.

While some will be quick to point out that Medmen seriously reduced its staff over the last few months – see here and here – any operational savings right now will have been offset by required severance payments to those let go. A break even in this regard would be a positive for the company.

Email shows $mmen $mmnff can’t pay its bills on time, but more importantly trying to give people free trading stock to settle debt. Shareholders would be diluted every day because mgmt was fiscally irresponsible, that is if they could clear it… @ScottW_Grizzle @WallandBroad pic.twitter.com/byuFZrLSAS

— Jason Spatafora (@WolfOfWeedST) January 23, 2020

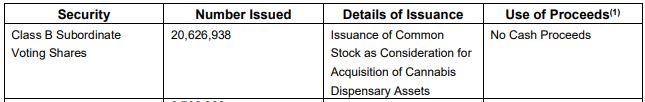

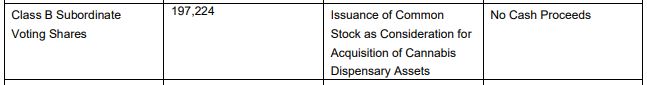

With regards to the restructuring being completed within the next 30 days, consider this leaked email that was posted to twitter by Jason Spatafora. The email identifies that the company is actually willing to settle vendor debt in Class B subordinate shares in the company, diluting shareholders significantly. Further, it also identifies two other optional payment plans – one which will see payments made for $0.50 on the $1.00 within 4-6 weeks, or the optional full repayment of monies owed in a time frame of roughly March or April, with no hard consensus on when specifically suppliers would be paid. The email is then signed by Ben Schultz, a senior director at the firm.

It appears however, that at least some vendors are taking the equity option. While its unclear what specific amount of these shares were attributable to paying off vendor debts, note that Medmen has issued 20.8 million common shares over the months of November and December for “cannabis dispensary assets.” At least half of the portion attributable to November issuances is believed to be for an earn-out related to a December 2018 dispensary purchase. Its unclear what the remainder was specifically paying for.

However, the icing on the cake in reference to Bierman’s interview comes at the end of the discussion. After the Green Market Report comments that its in the lenders best interest to see Medmen succeed so they get paid back their debts, Bierman responds, “Yes, yes. 100%, which is why some of these rumors are just so silly. But MedMen has an NAV of over $1 billion dollars, right? And MedMen has a market cap right now of $350 million dollars.”

For those unaware, NAV, or net asset value, as per Investopedia, refers to “the total value of the entity’s assets minus the total value of its liabilities.” It’s often calculated on a per share basis for mutual funds and exchange traded funds (ETF’s). However, in the context of Bierman’s comment, he’s simply referring to the overall value of the firms assets when you subtract liabilities from the firms assets, or simply, Medmen’s net assets.

And what do you get when you do this math? Well, you get the shareholders equity in the company – a figure that Bierman would have signed off on as being accurate – which comes out to a whopping $178 million, or approximately 17.8% of the figure Bierman claimed in today’s interview. The reality is that Medmen doesn’t even have a billion dollars worth of assets on the balance sheet, before liabilities are taken into consideration, and certain assets have since been sold which will likely reduce the overall value of the firms assets.

However, based on the firms latest filing indicating that the company has 300,593,702 Class B shares outstanding, and an equity price of $0.61 per share, Medmen’s market capitalization is approximately C$183.3 million, showing that math might not be Bierman’s strong suit.

Lastly, net asset value, in its true form for Medmen, works out to approximately US$0.59 per share based on the above outstanding share count. Note however that this does not include the fully diluted share count or the conversion of Class A shares into that of Class B.

Medmen Enterprises last traded at $0.61 on the CSE.

Information for this briefing was found via Sedar and MedMen Enterprises. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.