It’s long been known by cannabis industry followers that MedMen Enterprises (CSE: MMEN) has a cash problem. Relentless general and administrative costs have plagued the company since its go public transaction last year, which has been coupled with numerous acquisitions and out of line management compensation which has further fueled cash burn.

However, it appears that the end of the line is drawing near for the US multi state operator as sources of funding are quickly drying up while its share price continues to tumble. Confusingly, this lack of funding seems to have little bearing on how management continues to operate, with two recent acquisitions being announced in the last week alone in addition to another California license being awarded.

MedMen recently reported its third quarter earnings on May 29, and little had changed in terms of cash burn. Many industry followers, The Deep Dive included, were hopeful that spending habits would change this quarter.

[stock_market_chart symbol=”MMEN.CN” range=”1y” settings='{“primaryChartType”:”smoothedLine”,”width”:”100%”,”height”:”350px”,”marginTop”:0,”marginBottom”:0,”marginLeft”:10,”marginRight”:10,”primaryPanelTitle”:”Price”,”secondaryPanelTitle”:”Volume”,”fontSize”:13,”color”:”#383838″,”primaryLineColor”:”#000″,”primaryLineColorAlpha”:0.15,”secondaryLineColor”:”#000″,”secondaryLineColorAlpha”:0.15,”backgroundColor”:”#fff”,”gridColor”:”#e0e0e0″,”gridAlpha”:0.8,”cursorColor”:”#ba0000″,”cursorAlpha”:0.8,”scrollbarBackgroundColor”:”#fff”,”scrollbarSelectedBackgroundColor”:”#000″,”scrollbarGraphFillColor”:”#000″,”scrollbarSelectedGraphFillColor”:”#000″,”primaryLineThickness”:0,”secondaryLineThickness”:0,”gridThickness”:0,”precision”:2,”thousandsSeparator”:”,”,”decimalSeparator”:”.”,”usePrefixes”:false,”mouseWheelZoomEnabled”:false,”cursorEnabled”:false,”exportEnabled”:false,”scrollbarEnabled”:false,”legendEnabled”:false,”periods”:”1W,1M,6M,YTD,1Y,ALL”,”defaultPeriod”:”1y”}’]

Largely this thesis was built on Michael Kramer, the newly appointed Chief Financial Officer, finally having a full quarter to reign in spending habits of the management team. The belief was that the experienced executive would act as an adult in the room of sorts and drastically reduce excessive G&A costs that MedMen has displayed over the last year. This was not the case.

Over the thirteen week period ending March 30, 2019, MedMen collected gross revenues of US$36.6 million, from which gross profit before fair value adjustments came in at $15.53 million. These gross profits equated to an astounding 25% of General and Administrative expenses during the same thirteen week period – providing virtually no path to profitability. Total expenses came in at $72.9 million, or just shy of double total revenues over the same time period.

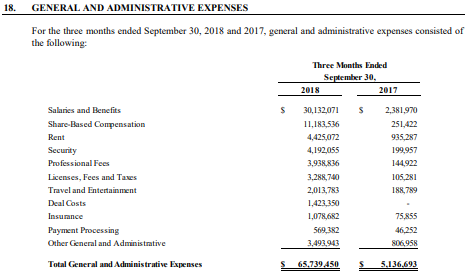

Despite the relentless G&A costs, MedMen has stopped reporting what is included in this expense line. This is largely a result of shareholder push back following first quarter results wherein it was identified that costing was absurd relative to any other industry comparables, with travel and entertainment costs exceeding two million dollars over a three month period, and security charges being more than double that.

G&A costs have remained relatively flat since the first quarter, suggesting that minimal effort has been placed on reducing these out of line expenses despite management stating otherwise.

Over the most recent period, MedMen Enterprises has burned through $56,322,726 in cash, leaving just $21.90 million in the bank. This equates to roughly $18.77 million per month – evidently, far too much for the firm to eek by the current quarter without performing a raise in some form.

MedMen’s At-The-Market Funding

Desperate for cash, MedMen scrambled for two forms of funding to keep the operation going for the time being. The first of which was entered into on April 10, 2019, with Canaccord Genuity Corp. The funding consists of an “At-The-Market” equity financing program, also referred to as an “ATM”. Essentially, MedMen will be selling Class B subordinate voting shares from the treasury into the open market at market prices. The funding is for up to CAD$60 million, with no defined deadline for when these sales must be completed by.

“The Company intends to use the net proceeds from the sale of Subordinate Voting Shares under the ATM program principally for general and administrative expenses, working capital needs and other general corporate purposes.”

Thanks to Canadian Securities Exchange reporting requirements, we know from MedMen’s Form 7 filing for the month of April that 2,864,200 shares were sold under this program. In May, an additional 2,310,700 shares were also issued for further funding.

For the period April 10, 2019, to May 31, 2019, Canaccord Genuity Corp has sold 5,404,848 shares of MedMen enterprises, at an average price of $3.56 per share. With 5,174,900 of these being directly from MedMen’s treasury, it can be assumed that the firm has raised roughly CAD$18.42 million from its at the market equity program.

Further selling has occurred from Canaccord in June, however we’ll have to wait for the Form 7 to confirm it was directly from the firms treasury.

All told, it’s believed that US$13.86 million has been dumped into company coffers through the ATM program.

MedMen’s Gotham Green Credit Facility

Recognizing that the Canaccord Genuity funding wouldn’t provide enough funds to even cover their G&A costs through to the next quarter, MedMen went looking for even more additional cash. On April 23, they found what they were after when they signed an agreement with Jason Adler’s Gotham Green Partners for a credit facility worth up to US$250 million, which is set to be drawn upon in a series of tranches.

An initial tranche of US$20 million was drawn upon at the time of closing, with following cash infusions to be available as follows.

- (a) Tranche 1-B: An aggregate amount of US$80,000,000 will be available to the Company (without meeting any share price threshold, as described below) no later than 30 days following the closing date of Tranche 1-A (the “Closing Date”).

- (b) Tranche 2: An aggregate amount of US$75,000,000 will be available to the Company, of which

- (i) an aggregate amount of US$25,000,000 may be requested by the Company (without meeting any share price threshold, as described below) (“Optional Tranche 2”), and will be available beginning 75 days after the Closing Date; and

- (ii) an aggregate amount of US$75,000,000 may be requested by the Company if Optional Tranche 2 is not funded and an aggregate amount of US$50,000,000 may be requested by the Company if Optional Tranche 2 is funded (“Required Tranche 2”), and which will be available beginning on the six-month anniversary of the closing date of Tranche 1-B.

- (c) Tranche 3: An aggregate amount of US$75,000,000 will be available to the Company beginning on the six-month anniversary of the closing date of Required Tranche 2.

Upon issuance, the investment is to be treated as a convertible security with an interest rate of LIBOR + 6.0%. Each note will have a maturity date of 36 months from the time of issuance. Before the date of maturity, Gotham Green may elect to convert the debt into shares at predetermined pricing. MedMen may also force the conversion of 75% of the debt should the 20 day volume weighted average price (VWAP) of the equity be above US$8.00. Finally, a predetermined amount of warrants are to be issued with each facility draw down.

It should also be noted that both “Required Tranche 2” and Tranche 3 have minimum pricing requirements before they can be drawn on. For the former, the 20 day VWAP for subordinate voting shares must be at least US$3.75 (~$5.00 CAD at time of writing), and for the latter it must be at least US$4.50 (~$6.00 CAD at time of writing).

The last time MedMen closed above $5.00 on the CSE was November 16.

As of the time of writing, MedMen has drawn a total of US$100 million from Gotham Green Partners. After the initial $20 million draw down, Tranche 1-B was drawn down on May 22, 2019 for an addition $80 million.

The next credit facility, which at a minimum is $25 million, will not be available until July 7 as per the terms of the facility. Should the company not elect to draw on this tranche, $75 million will become available on November 22, 2019, provided the 20 day VWAP of the equity is above US$3.75. If the $25 million is drawn on, then only $50 million will be available on this date.

The final $75 million will be available upon the six month anniversary of Required Tranche 2 being drawn upon, provided pricing conditions are met.

But is it enough?

Cumulatively, MedMen Enterprises has found funding to the tune of an estimated US$113.86 million since the last reporting period. Lets also not forget the $21.89 million that was in the bank at the end of the last reporting period. However, there is little else that can be sourced should the firm need additional funds for operations.

With total cash of $135.75 million, and a burn rate of $18.77 million, it gives the company roughly 7 months to find a path to profitability in a best-case scenario. This excludes promissory notes that are due between now and the end of September that are to the tune of $7.25 million, and $9.8 million in promissory notes that were due between April 30 and May 13, which the company indicated it “intends to refinance”.

This also doesn’t reflect the M&A nature of MedMen, which still continues to acquire additional assets despite its need to find profitability. Over the last reporting period, the company acquired an additional five entities, at questionable valuations given the net assets each firm maintains. Total consideration for acquisitions during the quarter totaled $66.41 million, while intangibles and goodwill accounted for $60.13 million, or 90.54%.

MedMen’s acquisitions have gotten so out of hand, that in one instance they paid $9,000,000 for a dispensary license in San Diego which has had $0 in revenues, yet they managed to book $1,030,000 of the purchase price to “customer relationships” under intangible assets.

There’s also the fact that the firm is running behind on its accounts payable, with monies owing jumping from $26.20 million to $36.88 million over the course of the last thirteen weeks. At some point, these vendors will need to be paid or they will simply stop providing goods and services to MedMen.

The PharmaCann Angle

All things considered, this doesn’t even factor in the purchase of PharmaCann, which is also bleeding cash in a similar nature. MedMen quietly filed financials for the entity on Friday, for which it recorded $15.49 million in revenues, of which $5.18 million was gross profit.

However, PharmaCann also recorded $13.74 million in overall expenses during the same period, signifying it too is a long way from being a profitable company. The firm burned through $15.13 million in the last quarter, of which $5 million was a line of credit from MedMen themselves.

An additional $5 million was loaned from MedMen to PharmaCann in April 2019 to help the company keep the company afloat, signifying it’s barely keeping its doors open as a result of it’s cash burn issue as well.

Collectively, between the Canaccord Genuity ATM program, and the Gotham Green funding coming available on July 7, MedMen can access an additional US$56.29mm between now and the end of November 2019. This will provide the firm with some additional funding.

However, short of a significant run in the equities price, this will remain to be all that the firm can raise unless investors are willing to throw further good money at the cash burning machine.

MedMen Enterprises closed yesterdays session at $3.06, up $0.18 or 6.25%.

Information for this briefing was found via Sedar and MedMen Enterprises. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

FULL DISCLOSURE: The author of this article is foolishly long MedMen Enterprises warrants.