US consumers have likely felt significant pressure on their pocketbooks over the past several months, and their concerns are certainly warranted. Indeed, every metric used to measure price pressures in the US has been running red-hot, all while Fed chairman Jerome Powell appears to have fallen asleep atop the shiny “buy” button, as purchases of $120 billion worth of bonds continue each month.

The latest headline Personal Consumption Index print, which the Federal Reserve uses for its inflation target, significantly outpaced consensus estimates, and jumped by a whooping 3.6% from year-ago levels. In the meantime, the core PCE index, which excludes food and energy price volatility, surged 3.1% from April 2020 — the sharpest increase since July 1992.

In separate economic news, the Chicago PMI — which measures business conditions in the Chicago region, soared to 75.2 in May, marking the highest reading since November 1973.

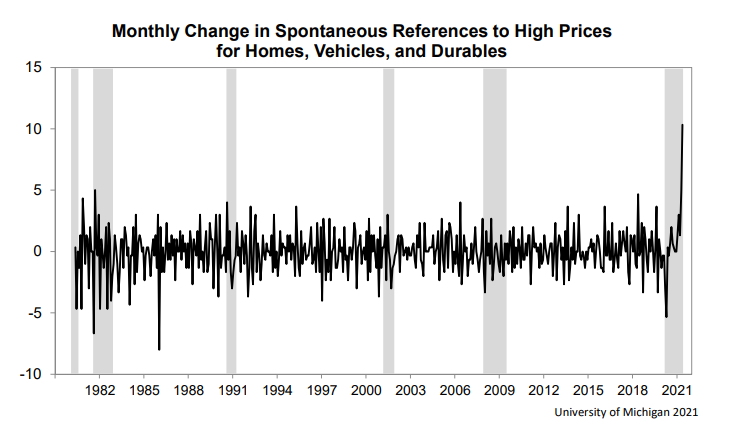

Similarly, the University of Michigan consumer confidence reading fell to 82.9 in May, as an increasing number of Americans anticipate inflation to run hot over the next twelve months.

Despite all the signs pointing to surging inflation, policy makers, particularly at the Federal Reserve, remain reluctant to shift policy. Indeed, the central bank is currently on a buying spree of $120 billion bonds per month, all meanwhile maintaining interest rates anchored near-zero.

Would someone please wake Jerome Powell up from his slumber?

Information for this briefing was found via the BLS, the Institute for Supply Management, and the University of Michigan. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.