On July 9, Apollo Gold & Silver Corp. (TSXV: APGO) closed its acquisition of the private company Stronghold Silver Corp. Under the terms of the takeover agreement, Apollo issued 40 million new shares, currently worth $45.2 million, to Stronghold shareholders.

Stronghold held the rights to three large-scale U.S.-based silver projects — Waterloo and Langtry in California; and the Silver District in Arizona, the latter of which appears to be the project with the best near-term potential. The Arizona Silver District Project has three near-surface vein structures with a cumulative strike length of 13 kilometers. Previous drilling programs on the property reached a maximum depth of only about 45 meters, so deeper drilling could lead to additional discoveries.

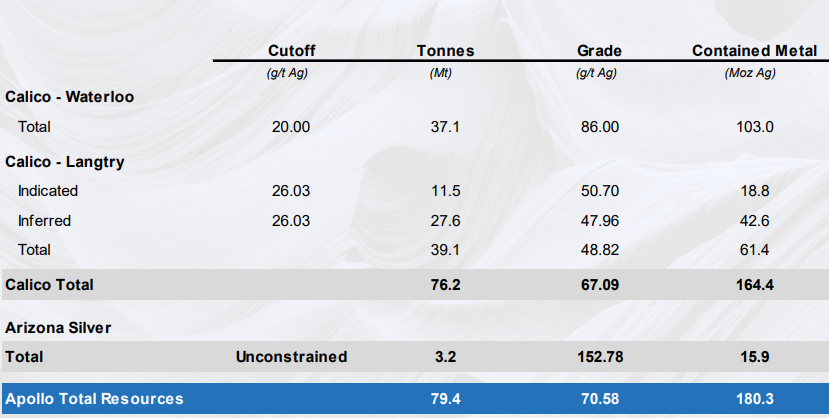

The three acquired projects contain more than 100 million ounces of silver, expressed on a historic basis (e.g., prior to the implementation of the NI 43-101 resource estimation standards). Notably, the company was recently forced to clarify its current historical resources by the British Columbia Securities Commission, with the company having to go so far as to pull its current investor presentation as a result of unclear comments.

Purchase/Option Agreements on the Acquired Rights to Properties

Waterloo: Until July 12, 2021, Apollo has the right to purchase Waterloo from Pan American Silver Corp. (TSX: PAAS) for US$25 million, of which US$5.25 million had already been paid by Stronghold Silver.

Langtry: Apollo now has the option to acquire 100% of lands that form part of the Langtry Project from Athena Silver Corporation for US$1 million until December 21, 2025. The balance of the land can be purchased from an individual for the greater of US$5.2 million or 220,000 ounces of silver through December 24, 2025.

Arizona Silver District Project: Apollo has the right to buy 100% of the Arizona project from Gulf + Western Industries for US$1.97 million through January 22, 2026. Based on certain milestones, Apollo could be required to make additional cash payment and stock issuances totaling US$4 million.

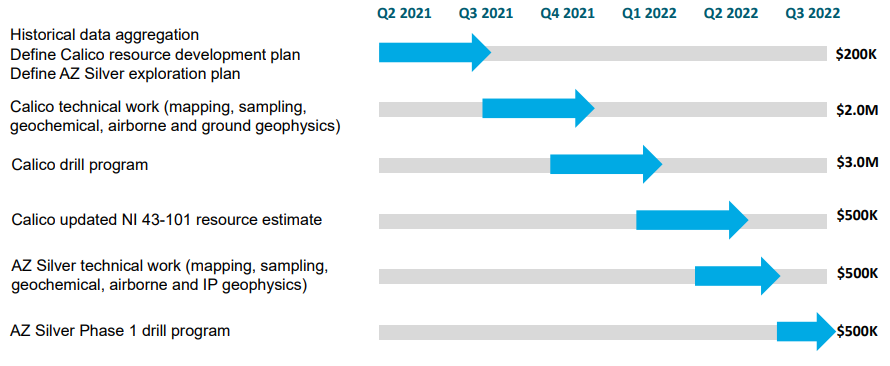

Project Timelines for the Properties

Apollo hopes to publish a Mineral Resource Estimate for Waterloo and Langtry (collectively termed the Calico Project) in 2Q 2022. A drilling program on the Arizona Silver District Project could commence in early 3Q 2022.

Equity Raise Bolsters Balance Sheet

On July 7, Apollo closed a $52.9 million equity raise. With this equity issuance, the company at merger close should have around $45 million of cash on its balance sheet, sufficient to fund the purchase and option payments described above. Its shares outstanding now are approximately 144 million.

| (in thousands of Canadian dollars, except for shares outstanding) | 1Q FY21 | 4Q FY20 | 3Q FY20 | 2Q FY20 | 1Q FY20 |

| Operating Income | ($226) | ($471) | ($319) | ($791) | ($36) |

| Operating Cash Flow | ($226) | ($515) | ($457) | ($106) | ($2) |

| Cash | $6,016 | $6,126 | $5,829 | $2,113 | $9 |

| Debt – Period End | $0 | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 51.2 | 50.8 | 50.7 | 40.7 | 13.5 |

Like any pre-revenue, exploration-stage mining company, Apollo is dependent on constructive drilling results to advance its projects. If the Arizona project’s drilling program next year were to yield disappointing assay results, the company’s stock could suffer.

Apollo now has the rights to what appear to be three promising properties, particularly the Arizona project, and sufficient cash to implement its plans for the properties over the next twelve months. If drilling results in Arizona confirm its historical estimates, the stock could be rerated higher.

Apollo Gold & Silver Corp. last traded at $0.90 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.