As the economy comes to a halt, consumers become more cautious with their wallets. Analysts have started to note demand changes in a number of consumer staples by watching and checking the wait time on several items. In a Canaccord Genuity Capital Markets note, they take aim at Apple, Inc (Nasdaq: AAPL), slashing their price target to US$170 from US$200 while reiterating their buy rating on the stock.

Unsurprisingly, they say that the demand for the higher priced iPhone 14 Pro and 14 Pro Max has been somewhat disappointing. However, they believe that some of the demand lost during December sales will just be getting replaced in March. As of their recent channel checks, the iPhone Pro and 14 Pro Max’s waitlist, which used to be over four weeks in November, is now in stock at most carrier stores.

They admit that Apple continues to have a strong sell-through for their iPhones; they believe that overall consumer demand for smartphones has been slowing, and as a result, they have continued to be less optimistic about iPhone sales for Q1 and full year 2023. They forecast first-quarter iPhone sales of $68.3 billion and full-year estimates of $199.6 billion. Both are below the consensus estimate of $69.3 billion and $205 billion, respectively.

Though Apple’s iPhones continue to see demand, Canaccord believes that the other hardware is at risk of seeing a meaningful decline in demand. Though it’s to no fault of the company, just a bad macro backdrop and tougher year-over-year comps, Canaccord says. They specifically point towards Apple’s new Mac’s range in price from $1,999 to $2,499. With the higher prices than previous Macs, Canaccord says that they do not know consumers’ “willingness to invest in more expensive products,” given the macro backdrop.

Canaccord meanwhile applauds Apple’s ecosystem of over 1.8 billion devices and over 1 billion iPhone users, they say this ecosystem will help Apple generate strong reoccurring service revenue long term. As service revenues carry a higher gross margin, they believe this revenue segment will grow faster than Apple’s total growth and drive margin expansion.

With all tech stocks having a turbulent 2022, Apple could not escape that, as seen in their stock price, which is down almost 17% over the last twelve months. With the recent rise in Apple’s stock price being attributed to China reopening, Canaccord believes the stock has likely priced in a slower start to the year.

The analysts at Canaccord also note Apple’s $49 billion in net cash and eagerness to continue to buy back stock “given the attractive valuation.” They ultimately believe Apple is in a fine position.

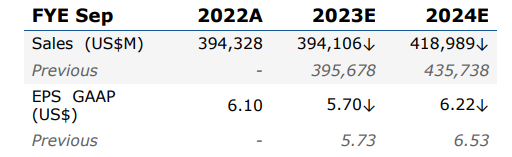

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.