A number of Binance customers have been sharing their experiences on Reddit of Automated Clearing House (ACH) withdrawals missing and not reflecting in their bank accounts.

“Has anyone had any luck as of yet with their ticket for missing ACH payments sent to bank account?” asked Reddit user Anduril7star86. “It’s been over a week and still no help or explanation as to what happened or any response to my questions.”

🚨 #BinanceUS ALERT 🚨

— Parrot Capital 🦜 (@ParrotCapital) March 28, 2023

BANK TRANSFERS ARE FAILING AT BINANCE US, AND SUPPORT STAFF ARE REFUSING TO GIVE A STRAIGHT ANSWER, JUST AS CZ HAS BEEN HIT WITH A HOST OF LEGAL CHARGES.

IF YOU STILL HAVE ASSETS THERE, TRANSFERRING OUT ON-CHAIN AND SELLING ELSEWHERE IS A BETTER OPTION. https://t.co/n2ayLdv26O

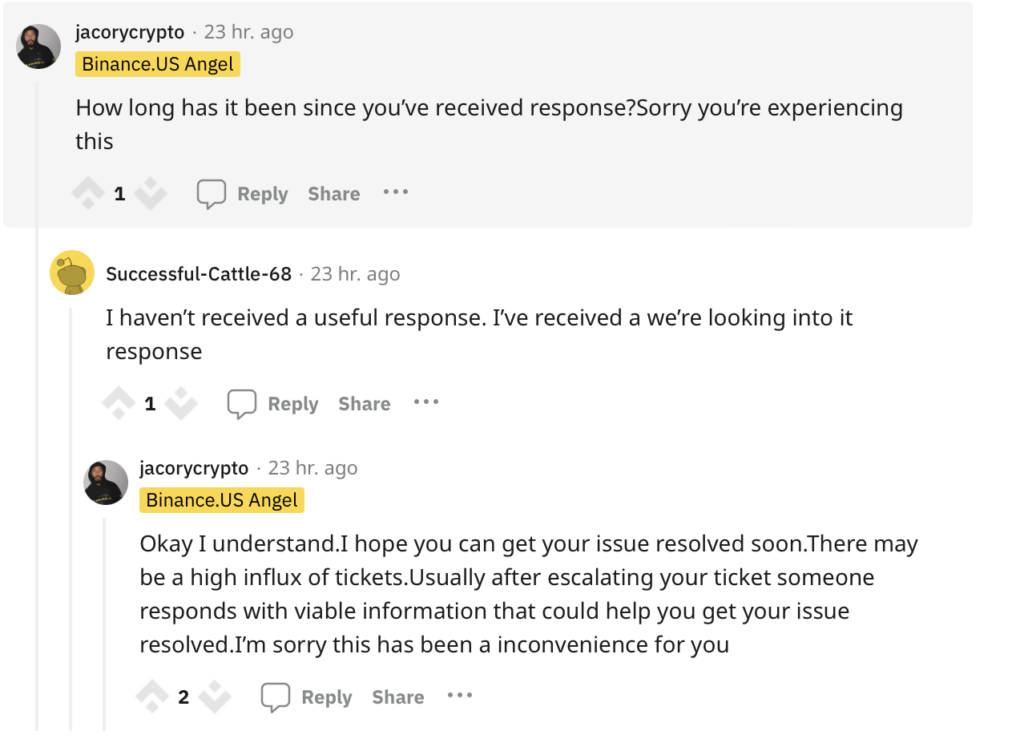

The original post generated a thread with other users sharing the same experience, highlighting the seemingly inadequate customer service efforts.

“Nothing. [I just] get generic responses. [The] ticket has been escalated with 0 actual helpful communication,” said one user.

User Fickle-Light9543 shared the latest response they got from customer service: “We are aware of this withdraw issue and we are working diligently with our payment processor to resolve this issue. We are waiting for them to provide us a resolution for this issue. I will now place this ticket on hold. Once we have more details someone from our team will reach out and provide you a resolution.”

“So they are going to make me wait. Like how long am I supposed to wait? It has been 10 days,” they added.

A Reddit user labeled “Binance.US Angel”, jacorycrypto, presumably working for Binance, has responded to some comments. They point the complainants to the live chat on Binance and also explained that “there may be a high influx of tickets.”

Another commenter, dadoc99, relayed that they regularly withdraw from Binance.US and it seems the delay in reflecting the withdrawal is related to the crypto exchange changing its processor Prime Trust to Plaid.

“Normally in the past 3 business days max the ACH has shown up and it has been nearly 7 days,” they added.

Another user shared the same concern: “Never had an issue with Prime, except small limits. First with Plaid, big issues.”

On its website, the only transaction halts reported are the scheduled upgrades for XTZ network on Wednesday, BSC (BNB Chain) network on Thursday, and ETH Shapella on April 12.

$2 billion outflow

Concerns encountered in transacting within the Binance ecosystem are intensified as its CEO Changing Zhao faces mounting legal hurdles. The Commodity Futures Trading Commission recently filed a complaint against Binance and Zhao claiming they routinely flouted American derivatives rules as the company grew into the world’s largest trading platform.

A federal judge on Monday also temporarily barred bankrupt Voyager Digital from completing a proposed $1.3 billion sale to Binance.US, causing a major blow to the world’s largest crypto exchange.

According to crypto data source Nansen, as of Monday evening, Binance had suffered net outflows of $2.1 billion on the Ethereum blockchain in seven days.

“The pace of withdrawals is heightened compared to normal activity and did pick up after the CFTC announcement,” Andrew Thurman, an analyst at Nansen said on Monday.

According to CryptoCompare, the exchange’s spot market share fell to 30% on March 24 from 57% at the start of the month. Kaiko, a digital-assets statistics firm, reported that the majority of transaction volume on Binance was zero-fee until it added back the fees.

Binance stated last week that it would resume charging fees on spot bitcoin trading after lowering them to zero last summer. It also had to halt spot trading for many hours while it rectified a technical glitch.

The decision to bring back trading fees likely contributed to a decline in its spot market share, analysts say.

Despite this, according to CryptoCompare, Binance retained a 66% market share in the crypto derivatives market as of March 24.

Information for this briefing was found via The Wall Street Journal and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.