Yesterday, Aurora Cannabis (TSX: ACB) (NYSE: ACB) reported their first quarter 2021 results. Aurora reported total revenue of $68.7 million, basically flat quarter over quarter. The adjusted gross margin was 48%, and Adjusted EBITDA was $57.9 million.

A number of analysts changed their price targets in connection with the results, including the following:

- ATB Capital Markets cuts to underperform from sector perform; raises price target to C$10.50 from C$10.25

- Cowen and Company raises target price to C$16 from C$10

- CIBC raises price target to C$15.00 from C$12.00

- Canaccord Genuity raises price target to C$11 from C$8.50

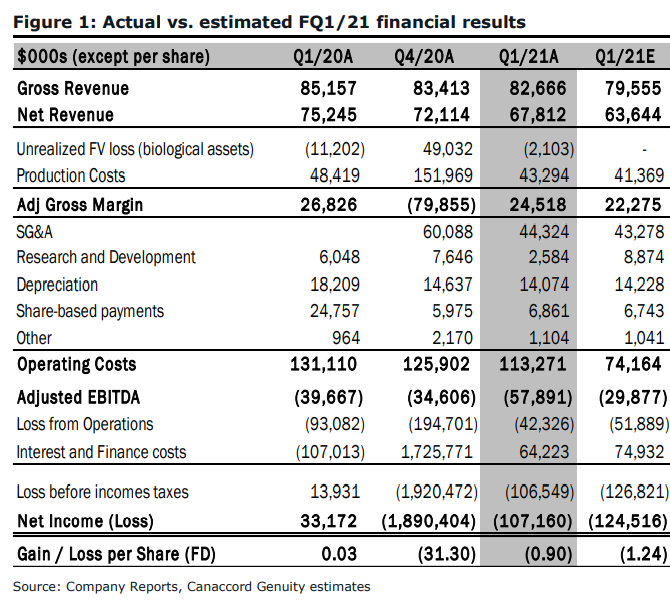

As above, Matt Bottomley, Cannaccord’s cannabis analyst, raised their 12-month price target on Aurora from C$8.50 to C$11.00 while reiterating their hold rating on the company. He headlines, “FQ1/21 review: A stalled top line but ACB still hopes to reach positive adj. EBITDA next quarter.”

He first talks about the revenue being ahead of Aurora’s guidance of $60-$64 million, but a 1.3% decline quarter over quarter, while adjusted EBITDA losses “took a step back compared to FQ4/20 levels.”

Bottomley cites that the primary reason for the decline in revenue was due to lower consumer cannabis revenues. Aurora’s adult-use dried bud segment was down ~16% quarter over quarter as Aurora dipped its hand into the premium market. Although the sizeable drop in bud, Aurora’s extract segment was up 49% quarter over quarter, this comes off the back of Reliva CBD, which has #1 market share among CBD products sold in B&M.

Onto Aurora’s medical sales, Aurora saw strong growth in its international segment, being up 41% quarter over quarter but offset by Canadian medical sales being down 2% quarter over quarter. Bottomley adds, “the company still maintains the #1 medical market share among its Canadian LP peers.”

Next, Bottomley talks about Aurora’s balance sheet. He says that the cash balance of C$250 million is large. The primary way Aurora has raised cash is through its heavy use of its at-the-market programs. A few weeks ago, Aurora announced a new U$500 million base shelf prospectus. Bottomley believes that the facility is “sufficient to fund the company’s interim funding gap” but adds, “however, the servicing/compliance/re-financing of what is ~C$137M of debt due within 12 months should now be a top priority for the company.”

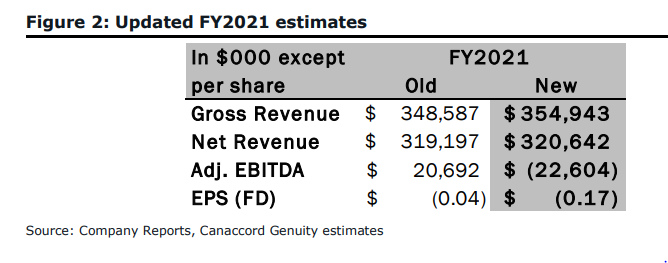

Matt Bottomley has slightly lifted their 2021 estimates, which you can see below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.